Get the free Individual Application for a Health Savings Account (HSA)

Show details

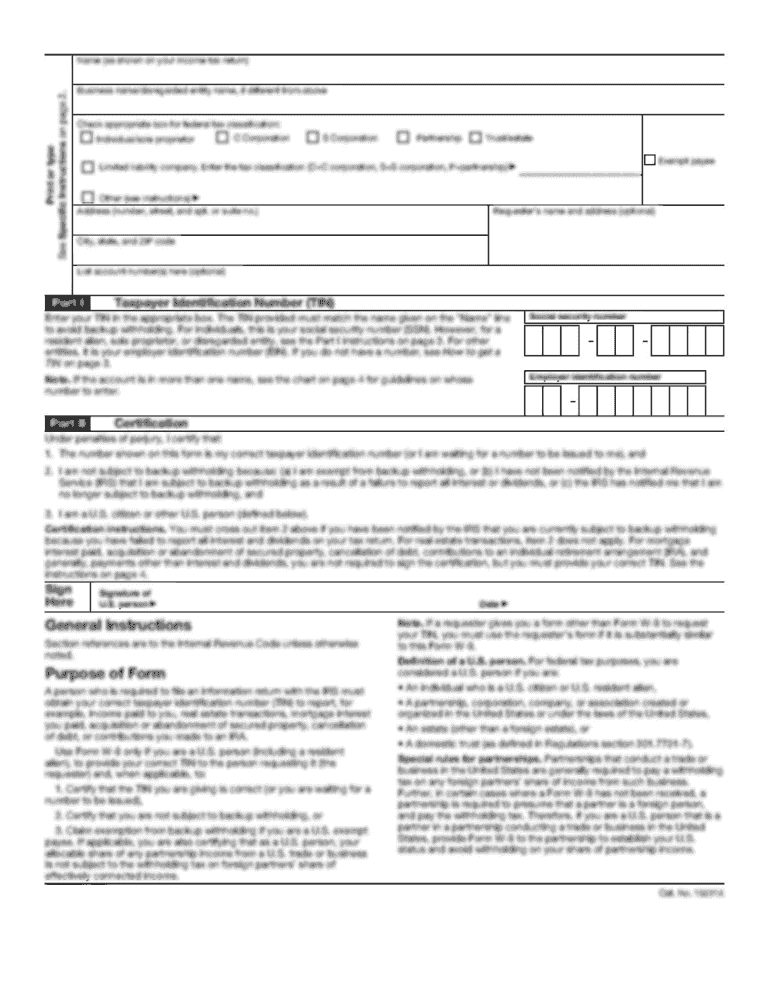

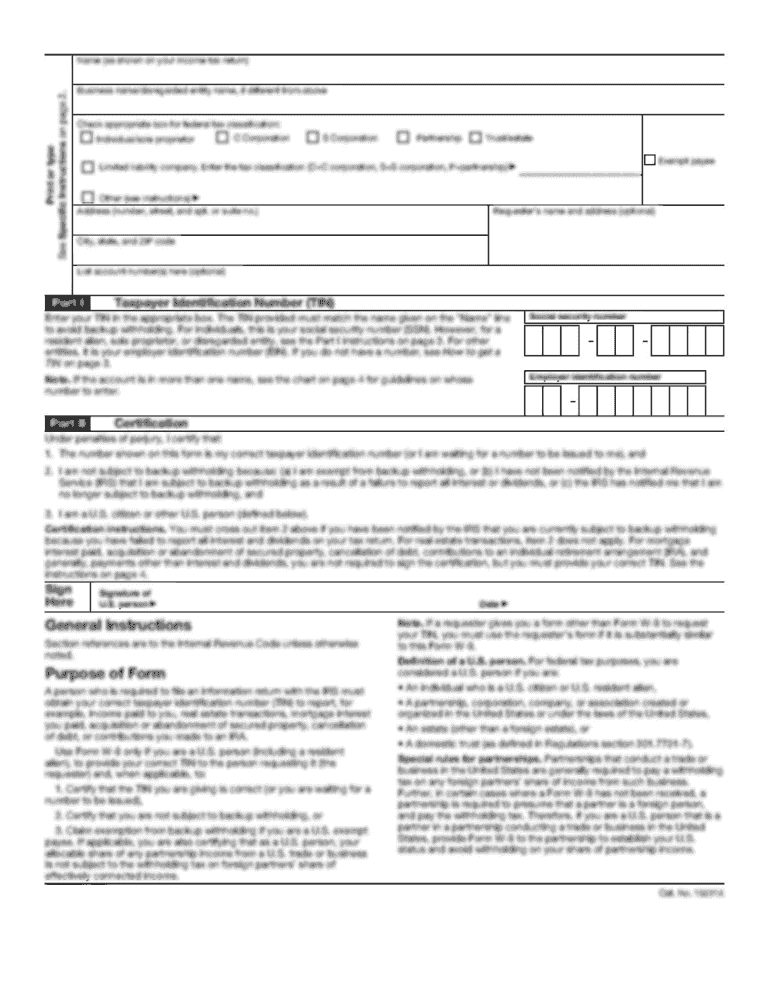

Individual Application for a Health Savings Account HSA Important notes - You will be assessed a 10 fee for submitting this paper application and the fee will be deducted from your HSA once it has been opened* Please ensure that you have completed both pages before you sign and date the form* Did you know There is no application fee if you apply online at wellsfargo. Com/hsa* Personal Information required field First Name Middle Name Last Name Street Address required may not be a P. O. Box...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual application for a

Edit your individual application for a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual application for a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual application for a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual application for a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual application for a

How to fill out Individual Application for a Health Savings Account (HSA)

01

Gather necessary personal information, such as your name, address, and Social Security number.

02

Confirm your eligibility for a Health Savings Account (HSA) by ensuring you have a qualified high-deductible health plan (HDHP).

03

Complete the personal information section of the application form.

04

Provide information about your employer, if applicable, including their name and address.

05

Indicate the type of HSA you wish to open (individual, family, etc.).

06

Choose your contribution preference, specifying if you want to contribute the maximum allowed or a different amount.

07

Review and sign the application, agreeing to the terms and conditions.

08

Submit the completed application form to the HSA provider, either online or via mail.

Who needs Individual Application for a Health Savings Account (HSA)?

01

Individuals who have a qualified high-deductible health plan (HDHP).

02

People looking to save for qualified medical expenses while enjoying tax benefits.

03

Those who want to reduce their taxable income through HSA contributions.

04

Individuals planning for future healthcare expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside of having an HSA?

If you have a severe illness or medical emergency, you could drain what you added to your HSA and still pay high excess out-of-pocket costs if you haven't met your deductible.

Do I ever lose my HSA money?

Myth #2: If I don't spend all my funds this year, I lose it. Reality: HSA funds never expire. When it comes to the HSA, there's no use-it-or-lose-it rule. Unlike Flexible Spending Account (FSA) funds, you keep your HSA dollars forever, even if you change employers, health plans, or retire.

What are the negatives of HSA?

Drawbacks of HSAs include tax penalties for nonmedical expenses before age 65, and contributions made to the HSA within six months of applying for Social Security benefits may be subject to penalties. HSAs have fewer limitations and more tax advantages than flexible spending accounts (FSAs).

What is the best bank to open an HSA account?

The best HSA accounts in 2024 Best for accessibility: Lively. Best for investment options: Fidelity Investments. Best for short-term spending: HealthEquity. Best for reimbursement of out-of-pocket expenses: HSA Bank. Best HSA offered by a traditional bank: .

How do I get an individual HSA account?

How to find an HSA financial institution Research HSA providers online. Check with your health insurance company to see if they partner with HSA financial institutions. Ask your bank if they offer an HSA option that meets your needs.

What disqualifies you from having an HSA?

You're no longer covered by an HDHP. You have any other health coverage, including coverage from your spouse, Medicare, or a flexible spending arrangement (FSA). Someone else can claim you as a dependent on their tax return.

Is it better to have an HSA or not?

It is absolutely worth it to have an HSA. Don't think of an HSA as a healthcare account, it's a retirement account. It's triple tax advantaged (pre-tax contributions, growth is not taxed, and tax free withdrawals after retirement). If you're able to, contribute to the max.

Who shouldn't get an HSA?

HSAs might not make sense if you have some type of chronic medical condition. In that case, you're probably better served by traditional health plans. HSAs might also not be a good idea if you know you will be needing expensive medical care in the near future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Application for a Health Savings Account (HSA)?

The Individual Application for a Health Savings Account (HSA) is a form that individuals complete to establish their HSA, which is a tax-advantaged savings account specifically for medical expenses.

Who is required to file Individual Application for a Health Savings Account (HSA)?

Individuals who are eligible for a Health Savings Account, typically those enrolled in a high-deductible health plan (HDHP), are required to file this application.

How to fill out Individual Application for a Health Savings Account (HSA)?

To fill out the application, individuals must provide personal information, details about their qualifying health plan, and any required signatures, following the instructions provided in the application.

What is the purpose of Individual Application for a Health Savings Account (HSA)?

The purpose of the application is to officially establish the HSA, allowing individuals to contribute funds to the account for qualified medical expenses while enjoying tax benefits.

What information must be reported on Individual Application for a Health Savings Account (HSA)?

The application must report personal identifying information, information about the individual's health insurance plan, and consent to the terms and conditions of the HSA.

Fill out your individual application for a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Application For A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.