Get the free International Public Sector Accounting Standards (IPSAS) Workshop

Show details

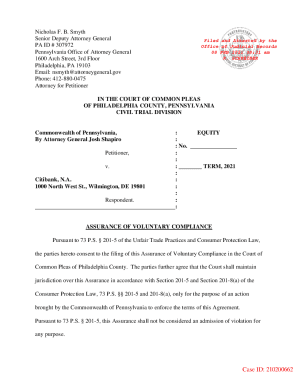

International Public Sector Accounting Standards (IPSA) Workshop P RO GRA MME OF ER VIEW There has been increasing pressure for governments around the world to be more accountable for their public

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international public sector accounting

Edit your international public sector accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international public sector accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international public sector accounting online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit international public sector accounting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

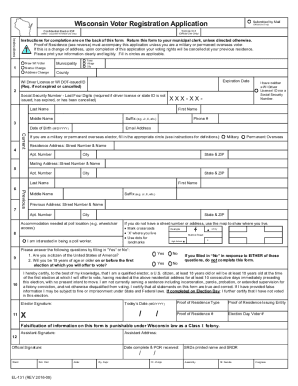

How to fill out international public sector accounting

How to fill out international public sector accounting:

01

Understand the basics: Start by familiarizing yourself with the basic concepts of international public sector accounting. This includes understanding the different accounting standards, principles, and guidelines specific to the public sector.

02

Gather relevant information: Collect all the necessary information required to complete the accounting process. This may include financial statements, budget reports, invoices, receipts, and any other relevant documents.

03

Analyze and categorize transactions: Examine each transaction carefully and categorize them accordingly. This involves classifying transactions into appropriate accounts such as revenue, expenses, assets, and liabilities.

04

Apply accounting principles: Use the appropriate accounting principles and standards specific to the public sector to ensure accurate and transparent accounting. This may include adhering to frameworks like the International Public Sector Accounting Standards (IPSAS).

05

Record transactions: Enter the transactions into the accounting system, ensuring accuracy and completeness. This involves recording the date, amount, description, and any other pertinent details of each transaction.

06

Prepare financial statements: Compile the necessary financial statements based on the recorded transactions. This typically includes an income statement, balance sheet, and cash flow statement. These statements provide an overview of the organization's financial position and performance.

07

Review and reconcile accounts: Regularly review and reconcile accounts to ensure accuracy and identify any discrepancies. This involves comparing recorded balances with supporting documents and addressing any errors or inconsistencies.

Who needs international public sector accounting?

01

Government entities: International public sector accounting is essential for government entities at various levels, including central, state, and local governments. It allows them to effectively manage public funds, track expenditures, and report financial information to stakeholders.

02

Non-profit organizations: Non-profit organizations that receive public funding or operate in the public sector also need international public sector accounting. It helps ensure transparency in their financial reporting and strengthens public trust in their operations.

03

International organizations: Multilateral organizations, such as the United Nations and World Bank, often deal with public funds and operate in multiple countries. They require international public sector accounting to maintain consistent financial reporting standards across their various projects and operations.

In conclusion, filling out international public sector accounting requires understanding the basics, gathering relevant information, analyzing and categorizing transactions, applying accounting principles, recording transactions, preparing financial statements, and reviewing and reconciling accounts. Various entities including government entities, non-profit organizations, and international organizations need international public sector accounting to manage funds, maintain transparency, and report financial information accurately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is international public sector accounting?

International public sector accounting is a set of accounting standards and guidelines designed for use by governmental entities and organizations in the public sector.

Who is required to file international public sector accounting?

Governmental entities and organizations in the public sector are required to file international public sector accounting.

How to fill out international public sector accounting?

International public sector accounting can be filled out by following the guidelines and standards set by the International Public Sector Accounting Standards Board (IPSASB).

What is the purpose of international public sector accounting?

The purpose of international public sector accounting is to improve the quality, consistency, and transparency of financial reporting in the public sector.

What information must be reported on international public sector accounting?

International public sector accounting requires reporting of financial data, performance indicators, budget information, and other relevant information.

Where do I find international public sector accounting?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific international public sector accounting and other forms. Find the template you need and change it using powerful tools.

How do I execute international public sector accounting online?

pdfFiller has made filling out and eSigning international public sector accounting easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the international public sector accounting in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your international public sector accounting right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your international public sector accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Public Sector Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.