Get the free ibts report example

Show details

This document is used to order publications related to manufactured home standards and regulations, including pricing and shipping information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ibts report form

Edit your what is ibts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is an ibts report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ibts form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ibts order form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ibts website form

How to Fill Out Computer Coded Items Guidelines:

01

Familiarize yourself with the guidelines: Start by reading through the computer coded items guidelines to gain a clear understanding of what is expected. Take note of any specific instructions or requirements mentioned in the document.

02

Understand the purpose: It is essential to grasp the reason behind the computer coded items guidelines. This understanding will help you comply with the guidelines effectively and ensure accurate coding.

03

Gather necessary information: Before filling out the guidelines, gather all the necessary information, such as coding manuals, reference documents, or any supplementary materials that may be required to complete the task.

04

Follow the format: Pay attention to the specified format for filling out the guidelines. It can include sections, tables, or specific fields that need to be completed. Carefully follow the provided structure to ensure consistency and ease of understanding.

05

Provide accurate code assignments: When selecting codes, refer to the designated coding system (such as ICD-10 for medical diagnosis codes) and apply the appropriate codes based on the given information. Double-check for accuracy to minimize errors.

06

Document your decision-making process: If the guidelines require you to provide a rationale or justification for your code choices, ensure you document your decision-making process clearly and concisely. This will help in case of any future audits or inquiries.

07

Seek clarification if needed: If you come across any ambiguous instructions or encounter difficulties while filling out the guidelines, don't hesitate to seek clarification from relevant authorities or experts who can provide guidance.

08

Review and proofread: Once you have completed filling out the guidelines, thoroughly review your work for any mistakes, omissions, or inconsistencies. Proofread the document to ensure it is error-free and meets all the specified requirements.

09

Submit or share as required: Depending on the purpose of the guidelines, submit or share the filled-out document with the relevant individuals or departments responsible for reviewing or implementing the coded items.

Who Needs Computer Coded Items Guidelines?

01

Medical Coders: Medical coders require computer coded items guidelines to accurately assign codes to medical diagnoses, procedures, and treatments. Compliance with these guidelines ensures consistency and accuracy in medical record keeping and billing processes.

02

Software Developers: Software developers may need computer coded items guidelines when creating applications or systems that involve coding. These guidelines help ensure standardized coding practices, making the software more efficient and compatible with other systems.

03

Researchers or Data Analysts: Individuals involved in research or data analysis may use computer coded items guidelines to classify and categorize data using specific codes. Adhering to these guidelines allows for easy comparison and analysis of data sets.

04

Regulatory Agencies: Government agencies or regulatory bodies often rely on computer coded items guidelines to ensure compliance and accurate reporting in various industries. These guidelines help maintain consistency and facilitate data analysis across different entities.

05

Educators or Trainers: Teachers and trainers who educate others in coding or coding-related fields may refer to computer coded items guidelines to teach students or professionals how to correctly assign codes and follow industry standards.

06

Insurance Companies: Insurance companies use computer coded items guidelines for accurate and consistent claim processing. Following these guidelines ensures that claims are properly coded, reducing errors and facilitating appropriate reimbursement.

Overall, computer coded items guidelines are essential for anyone involved in coding-related tasks, as they provide clear instructions, standardization, and accuracy in various industries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ibts report example form online?

With pdfFiller, you may easily complete and sign ibts report example form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in ibts report example form?

The editing procedure is simple with pdfFiller. Open your ibts report example form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my ibts report example form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ibts report example form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

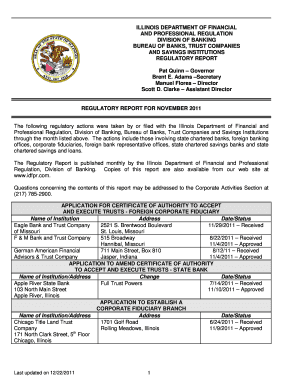

What is ibts report example?

An IBTS report example is a template or model report that outlines the necessary information required for the Income Based Tax System (IBTS) filings. It typically includes sections for reporting earnings, deductions, and tax calculations according to tax regulations.

Who is required to file ibts report example?

Individuals and businesses who earn income subject to taxation under the Income Based Tax System are required to file an IBTS report. This includes self-employed persons, freelancers, and any entity that generates taxable revenue.

How to fill out ibts report example?

To fill out an IBTS report, begin by gathering all necessary financial documents. Enter your income, deductions, and any applicable tax credits into the appropriate sections of the template. Follow the instructions provided with the form carefully to ensure compliance with tax regulations.

What is the purpose of ibts report example?

The purpose of an IBTS report example is to provide a standardized method for reporting income and taxes owed, helping taxpayers comply with tax laws while ensuring that the financial data is organized and easily interpretable.

What information must be reported on ibts report example?

The information that must be reported on an IBTS report includes total income, various sources of revenue, applicable deductions, tax credits, and the calculated tax liabilities. It is essential to provide accurate and complete financial data to avoid penalties.

Fill out your ibts report example form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ibts Report Example Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.