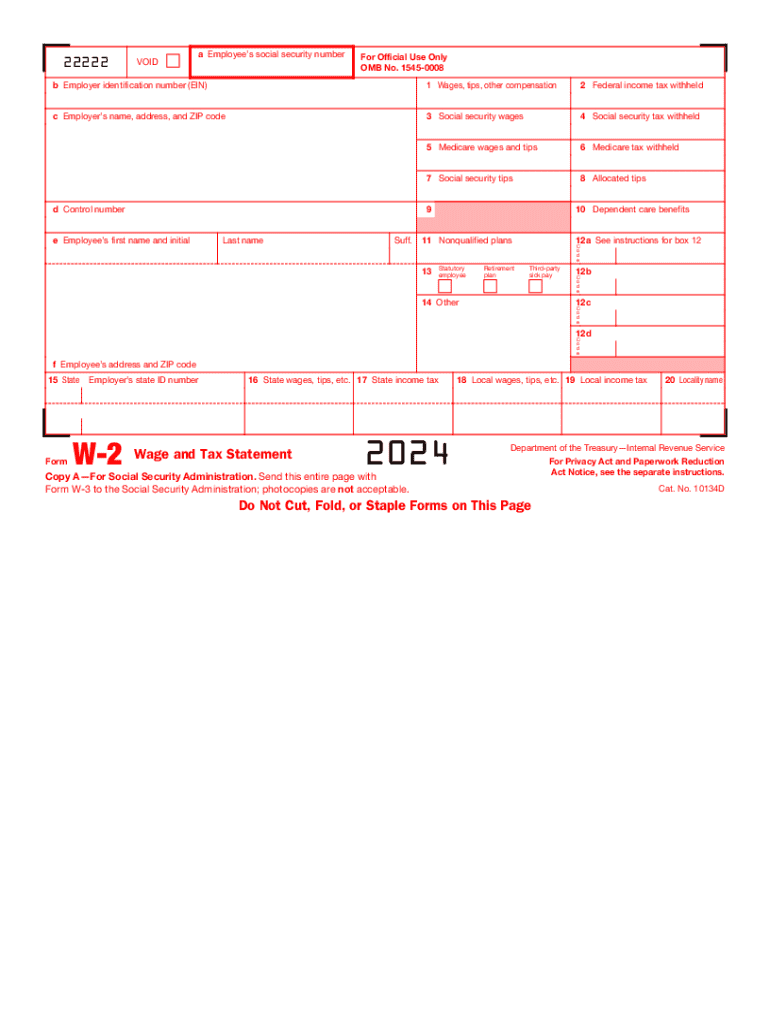

Get the free w2 form 2024

Instructions and Help about w2

How to edit w2

How to fill out w2

Latest updates to w2

All You Need to Know About w2

What is w2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

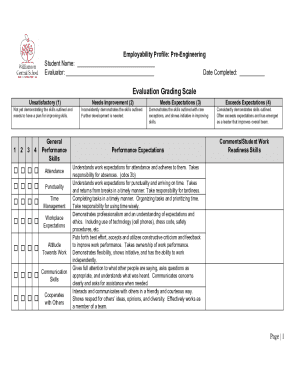

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about w2 form 2024

What should I do if I realize I've made a mistake on my W-2 after filing?

If you notice an error on your W-2 after filing, you need to request a corrected form from your employer. This process generally involves your employer issuing a corrected W-2, often referred to as a W-2c. Keep in mind that the corrected W-2 should be filed with the IRS and any state tax authority as necessary, to avoid complications with your tax return.

How can I track the status of my W-2 submission?

To verify the receipt and processing of your W-2 submission, you can use the IRS's online tools or contact their customer service. Tracking is crucial as it helps ensure that your tax return is processed smoothly. Be aware of common e-file rejection codes that can hinder this process and familiarize yourself with their resolutions.

What are some common errors to avoid when filing W-2 forms?

Common errors when filing W-2 forms include mismatched SSN, incorrect employer identification numbers, and misspelled names. To avoid these pitfalls, double-check all information against official documents. Additionally, ensure that the amounts reported are accurate, as discrepancies can lead to delays or audits.

Can I e-file my W-2, and what should I know about this process?

Yes, you can e-file your W-2, which offers a faster and more efficient way to submit your form. When e-filing, ensure that your software is compatible with IRS requirements and verify that all fields are properly filled. Be mindful of any service fees associated with e-filing and know what to do if your submission gets rejected.

What steps should I take if I receive a notice or letter from the IRS regarding my W-2?

If you receive a notice from the IRS concerning your W-2, carefully review the letter to understand the issue. Prepare any necessary documentation that supports your case. Respond promptly to the notice, as failure to address it can lead to penalties or further inquiries. It may also be useful to consult with a tax professional for guidance.

See what our users say