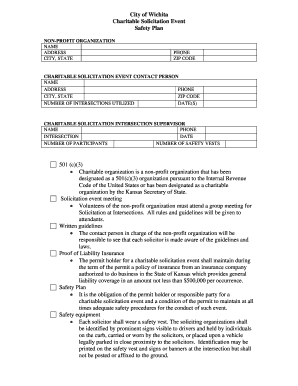

PA ET-1 - Pittsburgh 2024 free printable template

Show details

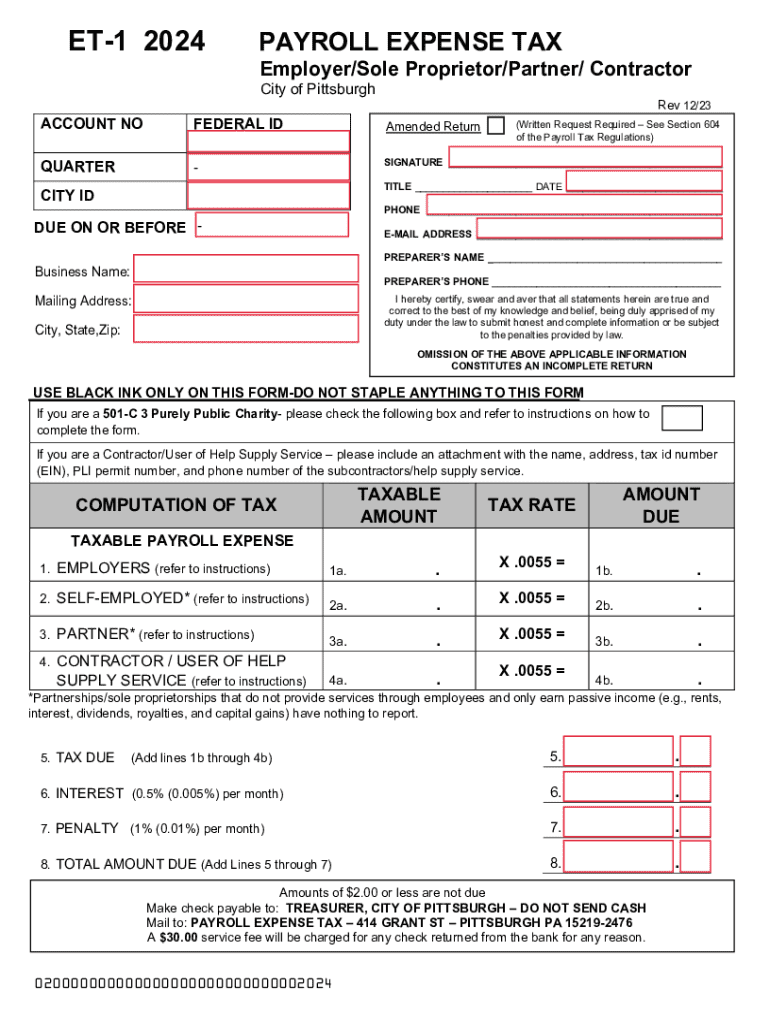

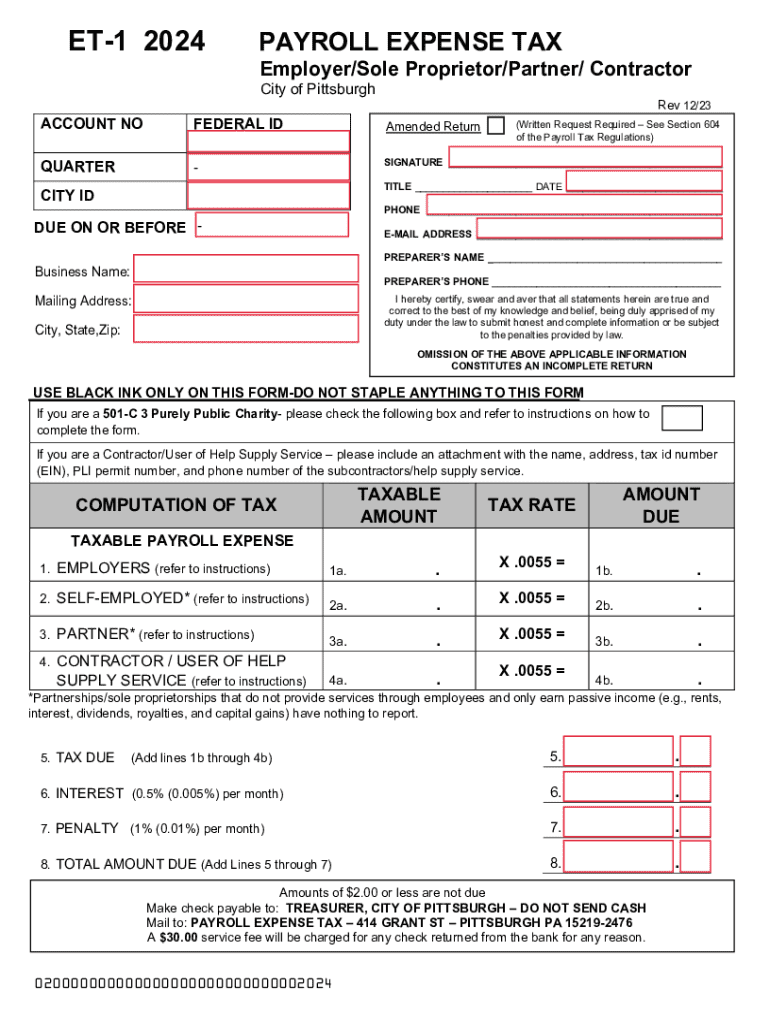

00 service fee will be charged for any check returned from the bank for any reason. 020000000000000000000000000002024 CITY OF PITTSBURGH PAYROLL EXPENSE TAX CITY CODE TITLE TWO CHAPTER 258 INSTRUCTIONS WHO MUST FILE Every employer conducting business in the City of Pittsburgh is required to file a Payroll Tax on their payroll expense and on their own net earnings distributions to each partner sole proprietor or individual performing services within the City of Pittsburgh. ET-1 2024 PAYROLL...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign et 1 pittsburgh form

Edit your pittsburgh 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pittsburgh payroll expense tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax et 1 payroll online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit city of pittsburgh et 1 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA ET-1 - Pittsburgh Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out et 1 form

How to fill out PA ET-1 - Pittsburgh

01

Gather necessary information, including tax identification number and business details.

02

Access the PA ET-1 form from the Pennsylvania Department of Revenue website.

03

Fill in the basic information at the top of the form, including the entity type and contact details.

04

Provide additional details regarding the business activities in Pittsburgh.

05

Calculate the estimated earnings tax based on the projected income.

06

Review all entered information for accuracy.

07

Submit the completed PA ET-1 form along with any required payment, if applicable.

Who needs PA ET-1 - Pittsburgh?

01

Businesses operating within the city limits of Pittsburgh that expect to owe an earnings tax.

02

Self-employed individuals who work in Pittsburgh and earn income that is taxable.

03

Partnerships, corporations, and other entities that engage in business activities in Pittsburgh.

Video instructions and help with filling out and completing city pittsburgh

Instructions and Help about pittsburgh ls 1

Pittsburgh is one of the best cities for jobs wallet hub looked at more than 180 cities and compared them based on the job market socioeconomic Pittsburgh ranked 15th on the list because of things like income commute times housing affordability they also took into account job satisfaction and job opportunities scottsdale-arizona is first on the list

Fill

pittsburgh payroll expense tax form

: Try Risk Free

People Also Ask about payroll expense tax pittsburgh

How much tax is deducted from a paycheck in Pittsburgh PA?

Pennsylvania has a flat state income tax rate of 3.07%.

What is not taxed in Pennsylvania?

Sales Tax Exemptions in Pennsylvania Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

Does everyone have to file local taxes?

Only localities in states with state income tax impose a local income tax. As an employer, you must pay careful attention to the local taxes where your employees work. If the tax is a withholding tax, local tax laws require you to withhold the tax from employee wages and remit it.

Who is subject to PA Local tax?

The EIT is separate from the Pennsylvania personal income tax (your state income tax). 2. Who must pay this tax? Any resident of a municipality and/or school district who was employed during the calendar year, and/or received taxable income during the calendar year is subject to the tax.

Is Pittsburgh tax free?

What is the sales tax rate in Pittsburgh, Pennsylvania? The minimum combined 2022 sales tax rate for Pittsburgh, Pennsylvania is 7%. This is the total of state, county and city sales tax rates. The Pennsylvania sales tax rate is currently 6%.

How does EIT work in PA?

The EIT tax is assessed by the city, township, or borough (political subdivision) where the employee's residence is located (for PA resident employees) and withheld and paid by the employer to the employee's designated residence tax collector quarterly (“resident municipality”).

Is there sales tax in Pittsburgh PA?

The Pennsylvania sales tax rate is 6 percent. By law, a 1 percent local tax is added to purchases made in Allegheny County, and 2 percent local tax is added to purchases made in Philadelphia.

Who must file a Pittsburgh return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

What does EIT rate stand for?

RESIDENT EIT RATE – The resident EIT rate is the earned income tax rate imposed on an Employee by the municipality and/or school district where he or she lives. Under Act 32, an Employer is generally required to withhold at the higher of the Employee's resident or non-resident rate.

Do minors have to file local taxes in PA?

Any resident or a non-resident with PA source income over $33 is required to file a PA state income tax return. She would also be required to file a local earned income tax return with the municipality that she lives in.

What is Pittsburgh EIT?

WHAT IS TAXED? Under Pennsylvania Earned Income Tax law, all residents of the City of Pittsburgh must have three (3%) percent of their wages withheld from their pay as Earned Income Tax.

Who is exempt from filing local taxes in PA?

If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits are exempt from the tax.

Who must file PA local tax return?

12. When To File: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18, 2022. Even if you have employer withholding or are not expecting a refund, you must still file a return.

What is PA local EIT?

What is the Earned Income Tax? The local Earned Income Tax (EIT) was enacted in 1965 under Act 511, the state law that gives municipalities and school districts the legal authority to levy a tax on individual gross earned income/compensation and net profits.

What is the payroll expense tax?

The total due every pay period is 15.3% of an individual's wages – half of which is paid by the employee and the other half by the employer. This means that each party pays 6.2% for Social Security up to a wage base limit of $147,000 and 1.45% for Medicare with no limit.

What is the Pittsburgh payroll expense tax?

The City of Pittsburgh levies a 0.55% tax on payroll amounts generated as a result of an employer conducting business activity within the city. The business activity must be directly attributable to activity within the city.

What is the state tax in Pittsburgh?

The minimum combined 2022 sales tax rate for Pittsburg, California is 9.25%. This is the total of state, county and city sales tax rates. The California sales tax rate is currently 6%.

What is the payroll tax rate in PA?

The withholding rate for 2022 remains at 3.07%.

Do I have to file a local tax return?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

What is EIT taxes in PA?

EIT – Earned Income Tax: Employees working in Pennsylvania will pay a local Earned Income Tax (EIT). The tax rate is determined by where the employee lives and works. The employee will be taxed by the higher of the two rates.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out pittsburgh payroll expense tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign pittsburgh form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit city pittsburgh form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share city of pittsburgh et 1 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit pittsburgh et 1 on an Android device?

You can edit, sign, and distribute pgh et 1 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is PA ET-1 - Pittsburgh?

PA ET-1 is the Employer's Quarterly Earnings Tax Return form used for reporting and paying the Employer's Earnings Tax in the City of Pittsburgh.

Who is required to file PA ET-1 - Pittsburgh?

Employers who pay wages to employees working within the City of Pittsburgh are required to file the PA ET-1 form.

How to fill out PA ET-1 - Pittsburgh?

To fill out PA ET-1, employers need to provide their business identification details, report the total wages paid during the quarter, and calculate the amount of tax due based on the applicable tax rates.

What is the purpose of PA ET-1 - Pittsburgh?

The purpose of PA ET-1 is to report and remit the Employer's Earnings Tax owed to the City of Pittsburgh, ensuring compliance with local tax laws.

What information must be reported on PA ET-1 - Pittsburgh?

The information that must be reported includes the employer's name, address, paycheck information, total wages paid, and tax calculations for the reporting period.

Fill out your city pittsburgh 2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Et 1 is not the form you're looking for?Search for another form here.

Keywords relevant to qualified individual

Related to et 1

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.