Get the free Business Credit Line Agreement

Show details

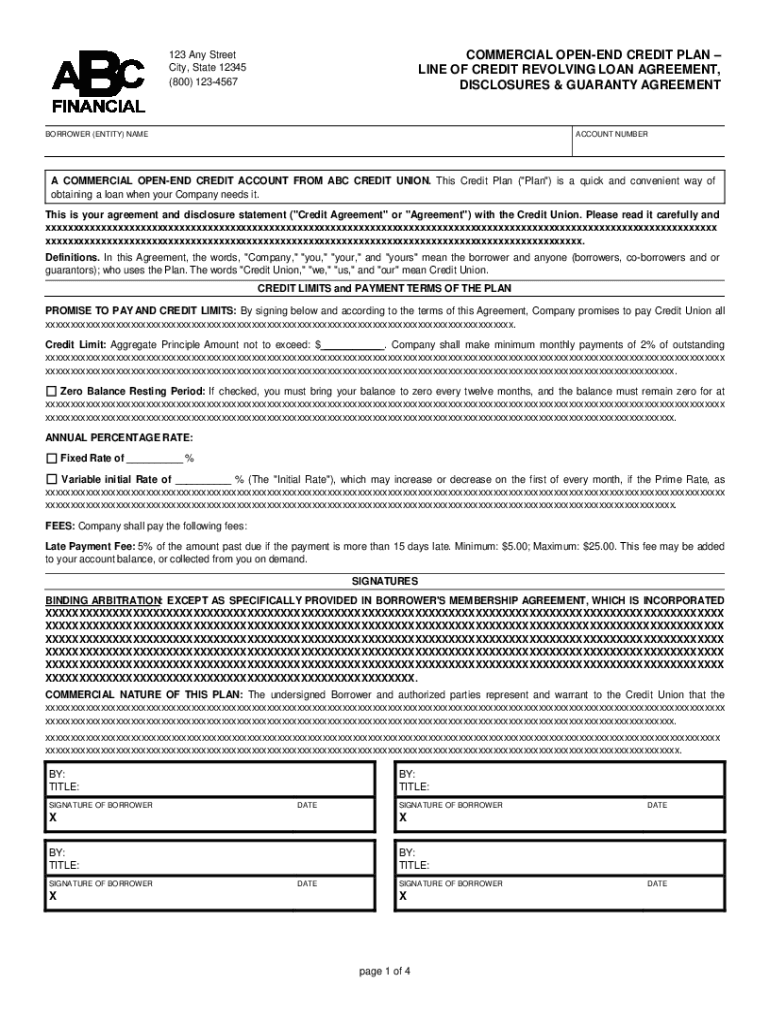

COMMERCIAL OPENEND CREDIT PLAN LINE OF CREDIT REVOLVING LOAN AGREEMENT, DISCLOSURES & GUARANTY AGREEMENT123 Any Street City, State 12345 (800) 1234567BORROWER (ENTITY) NAMEACCOUNT NUMBERA COMMERCIAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit line agreement

Edit your business credit line agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit line agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit line agreement online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business credit line agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

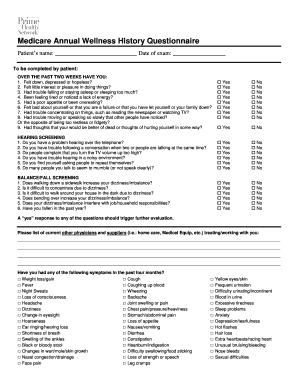

How to fill out business credit line agreement

How to fill out business credit line agreement

01

Review the terms and conditions of the business credit line agreement.

02

Fill in your company information as accurately as possible.

03

Specify the credit limit you are requesting and provide any necessary financial documentation.

04

Sign and date the agreement, ensuring that all parties involved also sign.

05

Keep a copy of the signed agreement for your records.

Who needs business credit line agreement?

01

Business owners looking to secure a revolving line of credit for their company.

02

Startups or small businesses in need of financing for operations or growth.

03

Entrepreneurs seeking to establish a financial relationship with a lender for future borrowing needs.

04

Companies looking to manage cash flow more effectively and have access to funds as needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business credit line agreement to be eSigned by others?

business credit line agreement is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get business credit line agreement?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the business credit line agreement in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the business credit line agreement in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your business credit line agreement in minutes.

What is business credit line agreement?

A business credit line agreement is a financial contract that establishes a revolving credit line that a business can draw from as needed, up to a specified limit, to manage cash flow or finance various business expenses.

Who is required to file business credit line agreement?

Typically, businesses that are seeking to utilize a line of credit or those that meet certain regulatory criteria in their jurisdiction are required to file a business credit line agreement.

How to fill out business credit line agreement?

To fill out a business credit line agreement, a business must provide details such as the business name, address, tax identification number, financial information, the amount of credit requested, and any collateral that may be offered.

What is the purpose of business credit line agreement?

The purpose of a business credit line agreement is to outline the terms and conditions under which a business can access funds from a credit line, enabling them to have flexibility in financing their operational needs.

What information must be reported on business credit line agreement?

The information that must be reported includes the business's financial status, credit limit requested, repayment terms, interest rates, collateral details, and the identities of the business owners.

Fill out your business credit line agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Line Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.