IRS 941 2024 free printable template

Show details

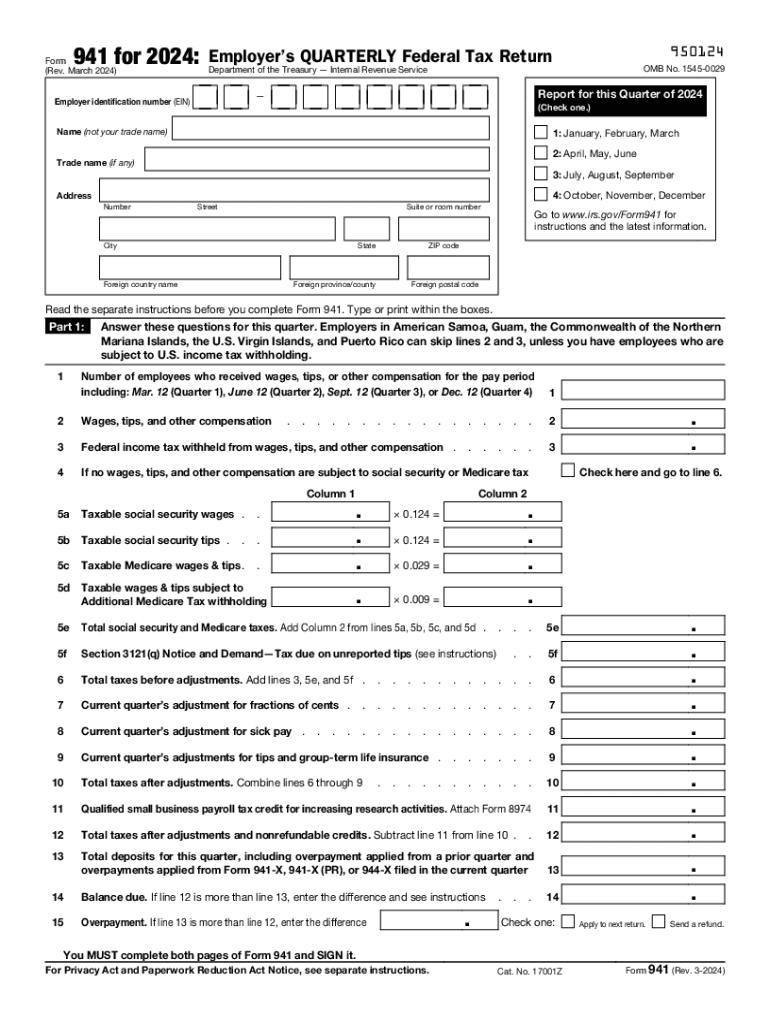

Don t use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with Form 941. Don t send cash. Don t staple Form 941-V or your payment to Form 941 or to each other. Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Note You must also complete the entity information above Part 1 on Form 941. Complete Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors and attach it to Form 941. NW IR-6526...Washington DC 20224. Don t send Form 941 to this address. Instead see Where Should You File in the Instructions for Form 941. 941-V Internal Revenue Service Don t staple this voucher or your payment to Form 941. Enter your employer identification number EIN. See Deposit Penalties in section 11 of Pub. 15. Detach Here and Mail With Your Payment and Form 941. However if you pay an amount with CAUTION Form 941 that should ve been deposited you may be subject to a penalty. Making Payments With Form...941 To avoid a penalty make your payment with Form 941 only if Your total taxes after adjustments and nonrefundable credits Form 941 line 12 for either the current quarter or the preceding quarter are less than 2 500 you didn t incur a 100 000 next-day deposit obligation during the return or payment in accordance with the Accuracy of Deposits Rule. Type or print within the boxes. Part 1 Answer these questions for this quarter. Number of employees who received wages tips or other compensation for...the pay period including Mar* 12 Quarter 1 June 12 Quarter 2 Sept. 12 Quarter 3 or Dec* 12 Quarter 4 Wages tips and other compensation. Federal income tax withheld from wages tips and other compensation. If no wages tips and other compensation are subject to social security or Medicare tax Column 1 5a Taxable social security wages. i Qualified sick leave wages ii Qualified family leave wages. 5b 5c Taxable Medicare wages tips. 5d Taxable wages tips subject to Additional Medicare Tax withholding...5e Total social security and Medicare taxes. Add Column 2 from lines 5a 5a i 5a ii 5b 5c and 5d 5f Section 3121 q Notice and Demand Tax due on unreported tips see instructions Total taxes before adjustments. Add lines 3 5e and 5f. Current quarter s adjustment for fractions of cents. Total taxes after adjustments. Combine lines 6 through 9 0. 124 0. 062 0. 029 0. 009 Check and go to line 6. Include taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after...March 31 2021 and before October 1 2021 on line 5a* Use lines 5a i and 5a ii only for taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after March 31 2020 and before April 1 2021. 11a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1 2021. If line 12 is more than line 13g enter the difference and see...instructions. Overpayment. If line 13g is more than line 12 enter the difference Part 2 Apply to next return* Send a refund.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

Instructions and Help about IRS 941

How to edit IRS 941

To edit IRS 941, utilize tools such as pdfFiller which allows for direct online editing. Start by uploading the form to the platform, where you can input the necessary corrections or updates. Be sure to save your changes to prevent data loss and keep a copy for your records.

How to fill out IRS 941

Filling out IRS 941 requires gathering essential information from your payroll records. Begin by identifying the total wages paid, tips received, and the corresponding taxes withheld. Complete each section according to the instructions provided within the form. It is advantageous to review the form for accuracy before submission to avoid potential penalties.

About IRS previous version

What is IRS 941?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 941?

IRS 941, officially known as the Employer's Quarterly Federal Tax Return, is a tax form used by employers to report payroll taxes withheld. This includes income tax, Social Security, and Medicare taxes. The form provides the IRS with vital information regarding employees' earnings and the employer's tax compliance.

What is the purpose of this form?

The primary purpose of IRS 941 is to report the amounts withheld from employee wages and to determine the employer’s tax liability. By filing this form, employers contribute to federal revenue by accurately reporting payroll information on a quarterly basis, ensuring tax obligations are met.

Who needs the form?

Any employer who pays wages subject to federal income tax, Social Security, or Medicare tax must file IRS 941. This includes businesses of all sizes, non-profits, and government entities that compensate individuals for services rendered.

When am I exempt from filling out this form?

Employers may be exempt from filing IRS 941 if they do not have any wages or tips to report for the quarter. Additionally, if an employer was not in business during the quarter or if they qualify for the 944 form due to small tax liability, they may also be exempt.

Components of the form

IRS 941 consists of multiple components, including sections for reporting the number of employees, total wages, and employment taxes. Employers also report any adjustments, such as overpayments or corrections, that may affect total tax calculations for the quarter. Each component must be accurately completed to ensure compliance with IRS requirements.

What are the penalties for not issuing the form?

Failure to file IRS 941 can result in significant penalties, including fines based on the amount of tax owed. The IRS can impose additional interest on any unpaid taxes as well. It is crucial to submit the form timely to avoid these potential financial repercussions.

What information do you need when you file the form?

When filing IRS 941, you will need detailed payroll information, including total wages paid, the number of employees, tax withholding amounts, and any applicable deductions. Additionally, your Employer Identification Number (EIN) is necessary for identification on the form.

Is the form accompanied by other forms?

IRS 941 may need to be filed alongside other forms, such as IRS 940 (for federal unemployment tax) or any necessary state tax forms, depending on local regulations. Employers should ensure all relevant forms are submitted to maintain compliance.

Where do I send the form?

The completed IRS 941 form must be sent to the appropriate IRS address, which varies based on your location and whether you are including a payment. Consult the IRS website for the specific address relevant to your filing situation to ensure timely delivery.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

good

Great for Business and Personal purposes!!

I had to provide a Care Providers Log Sheet and there is no such thing for In-Home Care Providers. Long story short PDF Filler allows me to change and make one that I could use for MONTHLY.

It makes my work easier to be able to type straight into a PDF document.

instructions were very helpful

SO FAR SO GOOD

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.