Get the free New anti-money laundering (AML) forms and rules in ...

Show details

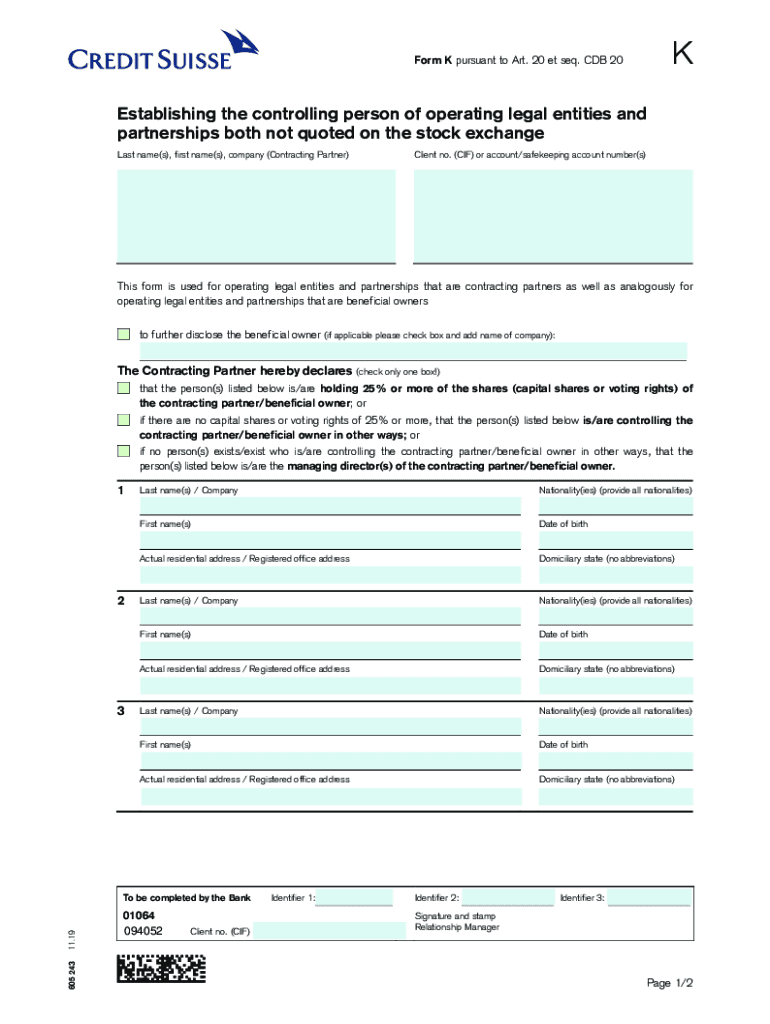

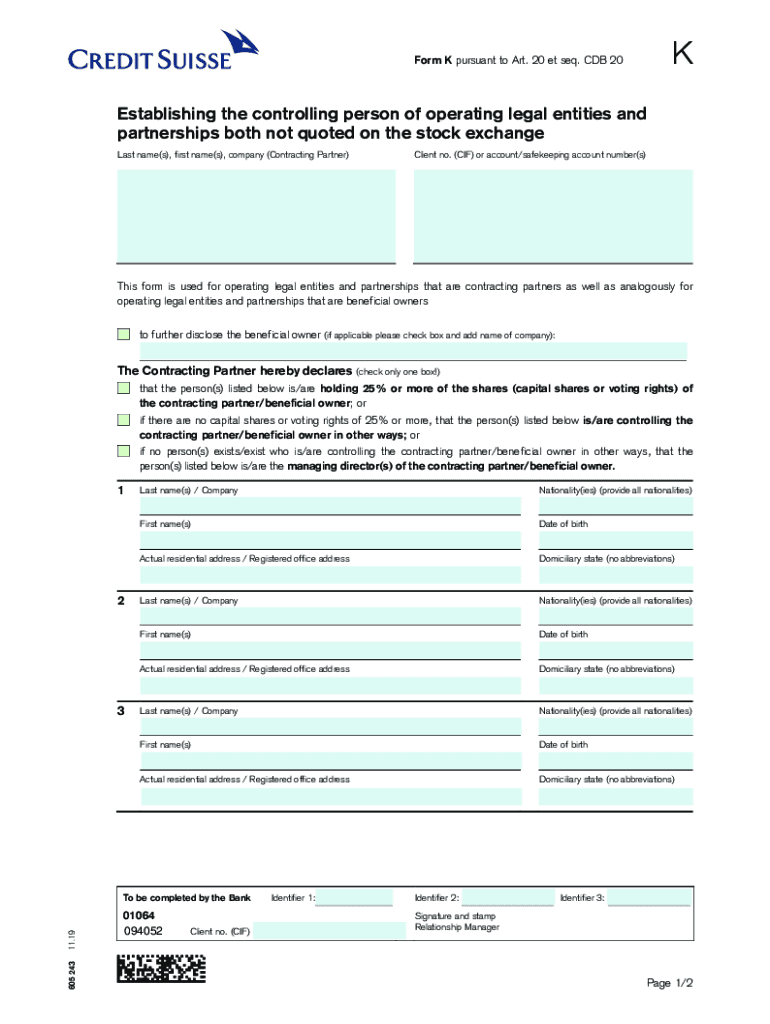

KForm K pursuant to Art. 20 et seq. CDB 20Reset dataEstablishing the controlling person of operating legal entities and partnerships both not quoted on the stock exchange Last name(s), first name(s),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new anti-money laundering aml

Edit your new anti-money laundering aml form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new anti-money laundering aml form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new anti-money laundering aml online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new anti-money laundering aml. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new anti-money laundering aml

How to fill out new anti-money laundering aml

01

Identify and verify the identity of customers.

02

Monitor transactions for suspicious activities.

03

Create and maintain customer due diligence procedures.

04

Conduct ongoing monitoring of customer accounts.

05

Implement a risk-based approach to AML compliance.

Who needs new anti-money laundering aml?

01

Financial institutions such as banks, credit unions, and money services businesses.

02

Businesses that deal with large sums of cash or have high-value transactions.

03

Online businesses that accept payments from customers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new anti-money laundering aml in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your new anti-money laundering aml and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in new anti-money laundering aml?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your new anti-money laundering aml to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out new anti-money laundering aml using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign new anti-money laundering aml. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is new anti-money laundering aml?

New anti-money laundering (AML) regulations refer to updated laws and guidelines aimed at preventing money laundering activities and ensuring financial institutions conduct thorough monitoring and reporting of suspicious transactions.

Who is required to file new anti-money laundering aml?

Entities required to file new anti-money laundering reports typically include banks, credit unions, insurance companies, securities firms, and other financial institutions, as well as certain businesses considered at risk for money laundering.

How to fill out new anti-money laundering aml?

To fill out new anti-money laundering reports, institutions must collect relevant information about the transaction, including the identities of the parties involved, transaction dates, amounts, and the rationale for suspicion, ensuring compliance with the specified reporting format.

What is the purpose of new anti-money laundering aml?

The purpose of new anti-money laundering measures is to protect the financial system from being used for the illicit transfer of funds, to detect and report suspicious activities, and to mitigate risks associated with money laundering and terrorist financing.

What information must be reported on new anti-money laundering aml?

Information that must be reported includes the name, address, and identifying information of the individuals involved, details of the transaction (amount, date, type), and any other data that suggests potential involvement in money laundering.

Fill out your new anti-money laundering aml online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Anti-Money Laundering Aml is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.