Get the free Save Income Tax Deferral of Long-Term Capital Gain CG Wisconsin Department of Revenu...

Show details

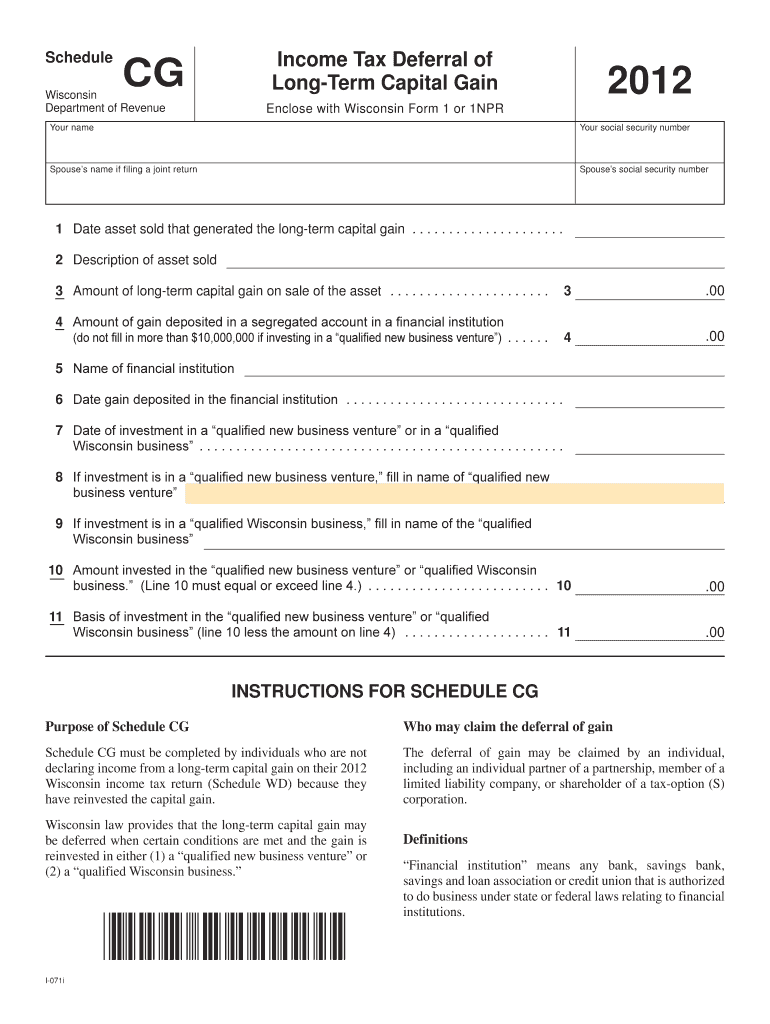

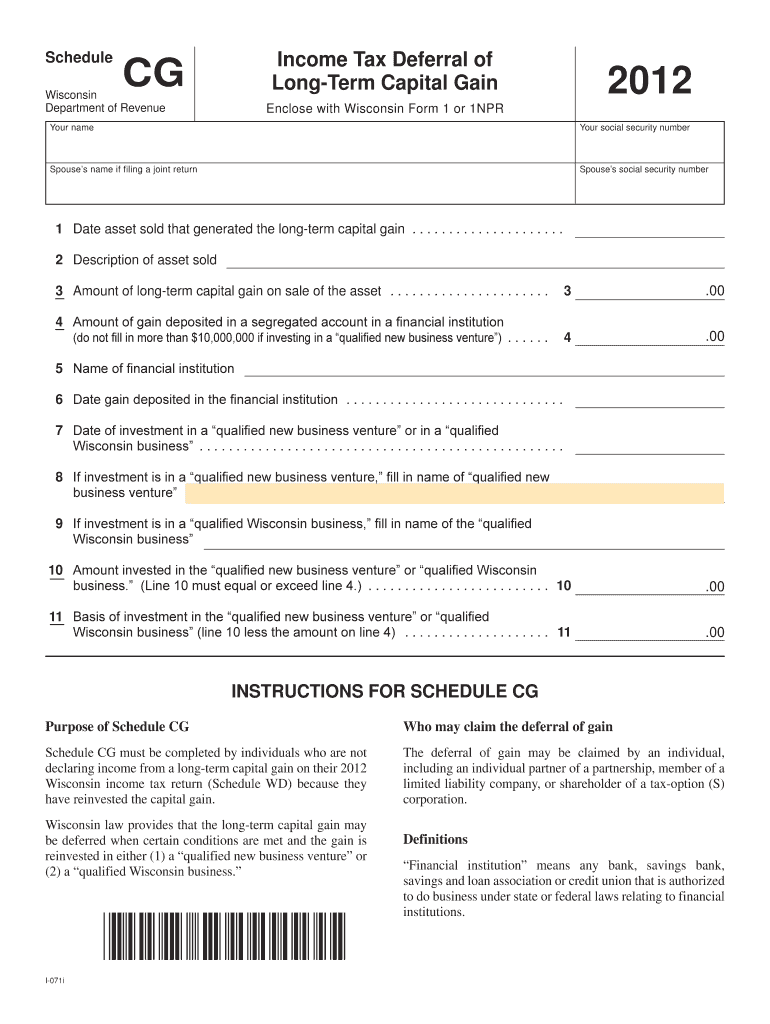

Instructions Schedule Tab to navigate within form. Use mouse to check applicable boxes, press space bar or press Enter. Save Income Tax Deferral of Long-Term Capital Gain CG Wisconsin Department of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign save income tax deferral

Edit your save income tax deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your save income tax deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit save income tax deferral online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit save income tax deferral. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out save income tax deferral

How to fill out save income tax deferral:

01

Gather all necessary documents: Before filling out the save income tax deferral form, collect all the required documents such as your income statements, expense receipts, and any other relevant financial records.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility criteria for save income tax deferral. Ensure that you meet the necessary requirements such as age, income thresholds, and any other specific conditions set by the tax authorities.

03

Obtain the save income tax deferral form: Visit the official website of the tax authority or contact your local tax office to obtain the save income tax deferral form. You may also be able to download the form directly from the website.

04

Complete personal information: Start by filling out your personal information accurately on the form. This typically includes your full name, address, social security number or tax identification number, and contact details.

05

Provide income details: Enter your income details as per the instructions on the form. Include information about all sources of income such as employment, investments, rental properties, or any other applicable sources. Ensure that you accurately report your income to avoid any penalties or discrepancies.

06

Deduct applicable expenses: Depending on the tax regulations in your jurisdiction, you may be allowed to deduct certain expenses from your taxable income. Common deductible expenses include mortgage interest, medical expenses, business expenses, and charitable contributions. Consult the instructions on the form or seek professional advice if you are unsure about allowable deductions.

07

Calculate your tax liability or refund: Once you have entered all the necessary information on the form, calculate your tax liability or refund using the provided formulas or guidelines. Ensure that you double-check your calculations for accuracy.

08

Review and sign the form: Before submitting the form, carefully review all the information you have provided. Make sure there are no errors or missing details. Once you are satisfied, sign the form and date it as required.

09

Submit the form: Depending on the specified procedure, submit the completed save income tax deferral form to the designated tax office or online portal. Follow any additional instructions provided to ensure your submission is processed correctly.

Who needs save income tax deferral?

01

Individuals with a high tax liability: Save income tax deferral can be beneficial for individuals who owe a significant amount in income taxes. Utilizing this option can help delay the payment of taxes and provide potential financial relief in the short term.

02

Self-employed individuals or freelancers: Many self-employed individuals or freelancers experience fluctuating income throughout the year. Save income tax deferral can help them manage their cash flow by deferring the tax payment until a later date when their income is more stable.

03

Business owners: Business owners, especially those with seasonal businesses, may also find save income tax deferral useful. It allows them to defer tax payments during slower months and pay them when business is thriving.

04

Individuals experiencing financial hardship: If you are facing financial difficulties and struggle to make timely tax payments, save income tax deferral can provide temporary relief by delaying the payment.

05

Those with investment opportunities: By deferring tax payments, individuals can potentially use the funds for investment purposes. This allows them to take advantage of investment opportunities without the immediate burden of paying taxes.

Note: It's important to consult with a tax professional or financial advisor to determine if save income tax deferral is the right choice for your specific financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is save income tax deferral?

Save income tax deferral is a strategy where individuals can delay paying taxes on certain income until a later date, usually during retirement when their tax rate may be lower.

Who is required to file save income tax deferral?

Individuals who have income that qualifies for deferral, such as contributions to retirement accounts or investments in tax-deferred savings vehicles, are required to file save income tax deferral.

How to fill out save income tax deferral?

To fill out save income tax deferral, individuals must accurately report and document all income that qualifies for deferral, such as retirement account contributions, capital gains, and other investment income.

What is the purpose of save income tax deferral?

The purpose of save income tax deferral is to allow individuals to defer paying taxes on certain income until a future date, usually during retirement when their tax rate may be lower, thus potentially reducing their overall tax liability.

What information must be reported on save income tax deferral?

Information such as contributions to retirement accounts, capital gains, investment income, and any other income that qualifies for tax deferral must be reported on save income tax deferral.

How can I get save income tax deferral?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the save income tax deferral. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in save income tax deferral without leaving Chrome?

save income tax deferral can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the save income tax deferral in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your save income tax deferral and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your save income tax deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Save Income Tax Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.