OK OTC 900-XM 2023 free printable template

Show details

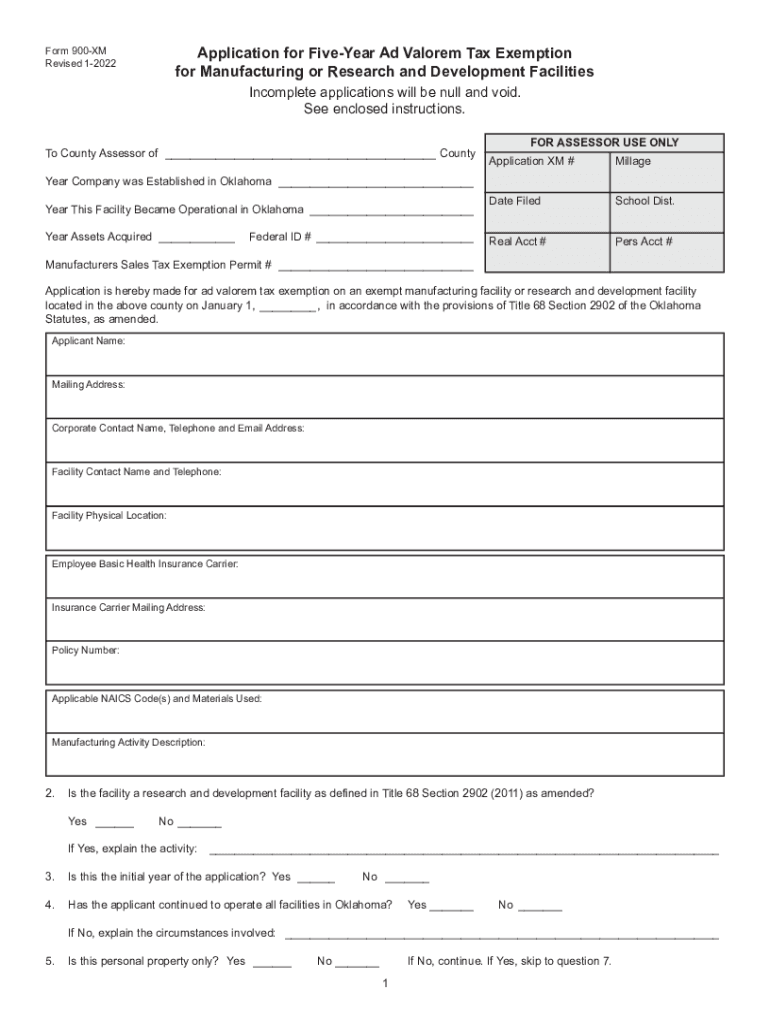

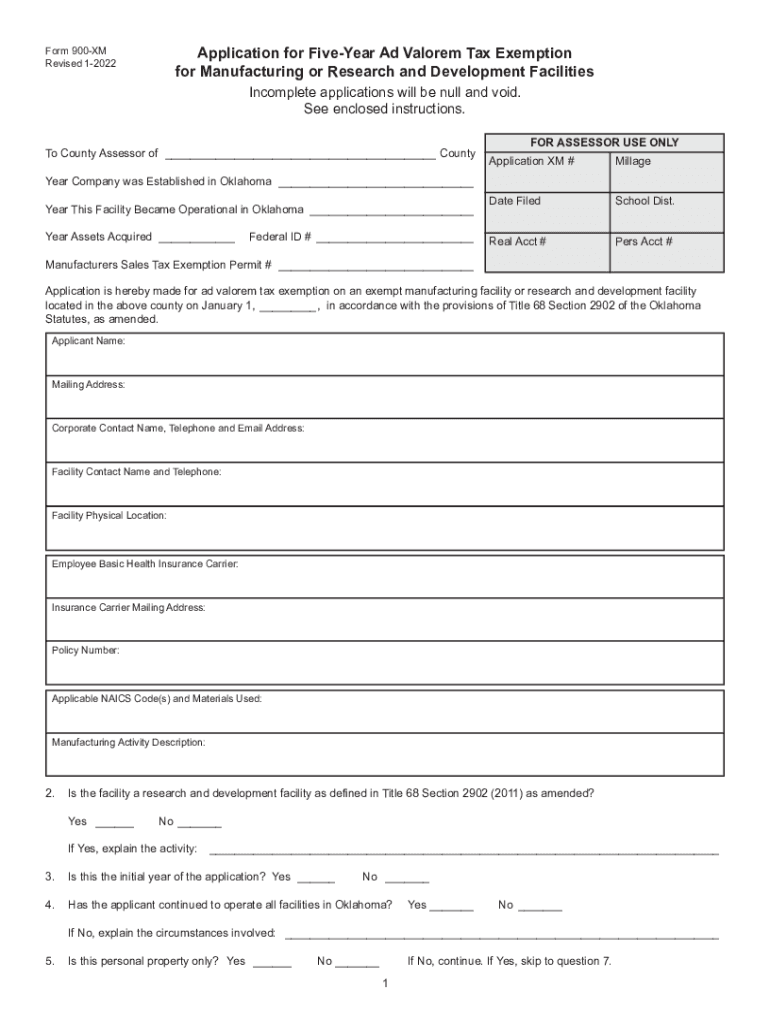

Tax Exempt Manufacturing Reference Information Oklahoma Constitution Article 10 Section 6B Title 68 Section 2902 (2001) of the Oklahoma Statutes Rules Title 710 Chapter 10 Revised August 2023Instructions

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ok exempt manufacturing template form

Edit your how to ok exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ok tax manufacturing fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ok exempt online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ok exempt manufacturing latest form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 900-XM Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ok exempt manufacturing fillable form

How to fill out OK OTC 900-XM

01

Begin by obtaining the OK OTC 900-XM form from the official website or relevant authority.

02

Read the instructions provided with the form carefully before filling it out.

03

Fill in your personal information at the top of the form, including your name, address, and contact details.

04

Specify the relevant details related to the transaction or information you are reporting in the designated sections.

05

Ensure that all required fields are completed accurately to avoid delays.

06

If applicable, attach any necessary documentation or evidence to support your submission.

07

Review the entire form for any errors or missing information before submission.

08

Submit the completed form as instructed, either electronically or via mail.

Who needs OK OTC 900-XM?

01

Individuals or businesses involved in the over-the-counter (OTC) trading of securities or commodities.

02

Regulatory bodies or authorities monitoring OTC transactions.

03

Tax professionals and accountants handling OTC transaction disclosures.

Fill

ok tax manufacturing fillable

: Try Risk Free

People Also Ask about ok exempt manufacturing make

What happens if you owe Oklahoma state taxes?

The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. You'll also be assessed interest on the balance due at a rate of 1.25% per month.

Who Must file Oklahoma partnership tax return?

If federal and Oklahoma distributive net incomes are the same, you may complete Part Three, Columns A and B, line 15; then complete Part Five. A copy of your Federal Form 1065 and K-1s must be provided with your Oklahoma return. An Oklahoma return must be filed by all partnerships having Oklahoma source income.

How many animals do you need for an ag exemption in Florida?

A minimum of six adult goats/sheep shall be required and granted on a three animal per acre ratio in most cases (herd of fifteen for five acres). A minimum of five calves is required. 4. If property is leased, the lease must be in effect as of January 1st.

What is Oklahoma Form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

How many acres do you need for a tax deduction?

Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres.

How do I get exempt from Oklahoma taxes?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

How do you become tax-exempt in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

What qualifies for Oklahoma farm tax exemption?

Nearly all items used in production agriculture are exempt from sales tax in the state including seed, feed, fertilizer, livestock pharmaceuticals and farm machinery.

Who is exempt from paying property taxes in Oklahoma?

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

What is Oklahoma 511 A?

Interest on US bonds reported on the federal return may be subtracted from the Oklahoma return. Social Security benefits that are included in the Federal AGI shall be subtracted.

How many acres is considered a farm in KY?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

What qualifies a person as tax-exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

Who has to file Oklahoma state income tax?

Oklahoma residents are required to file an Oklahoma income tax return when they have enough income that they must file a federal income tax return. Nonresidents are also required to file an Oklahoma income tax return if they have at least $1,000 of income from an Oklahoma employer or other source.

What is the Oklahoma retirement exclusion?

Section 710:50-15-49 - Deduction for retirement income (a)General provisions applicable to Oklahoma or federal government retirement income. Each individual taxpayer may deduct up to Five Thousand Five Hundred Dollars ($5,500.00) of retirement benefits paid by the State of Oklahoma or by the federal government.

What qualifies as a farm to the IRS?

A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

What is Oklahoma form 511ef?

2021 Form 511-EF Oklahoma Individual Income Tax Declaration for Electronic Filing. Page 1.

What qualifies as a farm in Arkansas?

A farm is “any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.” Government payments are included in sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ok exempt manufacturing printable online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ok tax manufacturing pdf to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out ok tax manufacturing edit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your ok exempt manufacturing download by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit how to oklahoma tax manufacturing on an Android device?

You can make any changes to PDF files, like ok tax manufacturing online, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is OK OTC 900-XM?

OK OTC 900-XM is a regulatory form used for reporting certain transactions and activities related to over-the-counter (OTC) derivatives in the state of Oklahoma.

Who is required to file OK OTC 900-XM?

Entities involved in trading OTC derivatives, such as financial institutions and trading platforms, are typically required to file OK OTC 900-XM.

How to fill out OK OTC 900-XM?

To fill out OK OTC 900-XM, one must provide details about the transaction, including parties involved, transaction amount, and relevant dates, following the instructions provided with the form.

What is the purpose of OK OTC 900-XM?

The purpose of OK OTC 900-XM is to ensure transparency and regulatory oversight of OTC derivatives transactions within the state, helping to mitigate risks in the financial system.

What information must be reported on OK OTC 900-XM?

The information that must be reported on OK OTC 900-XM includes transaction details such as type of derivative, involved parties, transaction amounts, dates, and any other relevant information as specified by the form.

Fill out your oklahoma exemption certificate 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ok Tax Manufacturing Search is not the form you're looking for?Search for another form here.

Keywords relevant to ok tax manufacturing form

Related to otc form 900xm online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.