OH EPA 3451 2023-2025 free printable template

Show details

Exemption/Extension Application Instructions

Ohio EPA is working to improve the air quality in Ohio while providing the best customer service possible. In that effort, if

you have questions about

pdfFiller is not affiliated with any government organization

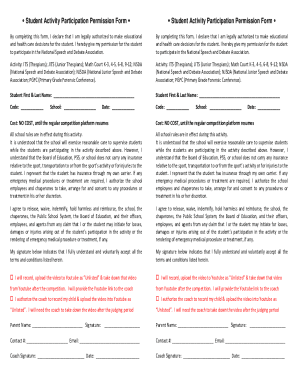

Get, Create, Make and Sign ohio e check exemption extension application form

Edit your ohio e check exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio 3451 agency exemption extension application form fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio vaccine exemption form pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ohio vaccine exemption form 2025. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH EPA 3451 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out echeck exemption form

How to fill out learn about exemptions amp

01

Gather all necessary information and documentation regarding the exemptions you are interested in learning about.

02

Search for reputable sources such as government websites, tax professionals, or educational resources to learn more about the specific exemptions.

03

Study the eligibility criteria and requirements for each exemption to determine if you qualify.

04

Fill out the necessary forms or applications accurately and completely, paying attention to deadlines and submission instructions.

05

Double-check your work and seek assistance from a professional if needed to ensure accuracy and compliance with regulations.

Who needs learn about exemptions amp?

01

Individuals who are seeking to reduce their tax liability or qualify for certain benefits may need to learn about exemptions in order to take advantage of available opportunities.

02

Business owners or individuals with complex financial situations may also benefit from understanding exemptions in order to make informed decisions and maximize their financial resources.

Fill

ohio e check repair waiver pdf

: Try Risk Free

People Also Ask about ohio vaccine exemption form 2023

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How many exemptions should I claim Ohio?

An employee can only claim his/her natural dependents. This includes one exemption each for the employee, his or her spouse, and each dependent.

What is the Homestead Exemption for 2023 in Ohio?

“Total income” is defined in R.C. 323.151(C) to be the Ohio Adjusted Gross Income (OAGI) of the owner and spouse for the year preceding the year in which a homestead application is made. The current maximum allowed is $36,100 for the 2023 application period.

Do I use 1 or 0 for tax withholding in Ohio?

If you move during the tax year, complete an updated IT 4 immediately reflecting your new address and/ or school district of residence. Line 1: If you can be claimed on someone else's Ohio income tax return as a dependent, then you are to enter “0” on this line. Everyone else may enter “1”.

What is a personal exemption Ohio?

Dependent Exemptions. Ohio allows a dependent exemption for dependent children and persons other than yourself and your spouse to whom you provide support and claim on your federal tax return. You are entitled to a $1,850 - $2,350 deduction for each dependent exemption depending on your modified adjusted gross income.

How do I apply for property tax exemption in Ohio?

To apply, complete the application form (DTE 105A, Homestead Exemption Application Form for Senior Citizens, Disabled Persons, and Surviving Spouses), then file it with your local county auditor. The form is available on the Department of Taxation's website and is also available from county auditors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ohio e check extension from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your e check exemption ohio into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in ohio vaccine exemption form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ohio homestead exemption application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit ohio vaccination exemption form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ohio e check waiver on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is learn about exemptions amp?

Learn about exemptions refers to understanding the specific circumstances under which certain individuals or entities may be exempt from certain taxes or regulatory requirements.

Who is required to file learn about exemptions amp?

Typically, individuals or organizations that wish to claim an exemption from taxes or regulations are required to file. This may include nonprofits, certain businesses, or individuals who meet specific criteria.

How to fill out learn about exemptions amp?

To fill out a learn about exemptions form, gather all necessary information about your income, organization status, and any supporting documentation. Follow the instructions on the form carefully and provide accurate details.

What is the purpose of learn about exemptions amp?

The purpose of learning about exemptions is to ensure that individuals and businesses understand their rights and obligations regarding exemptions, which can lead to tax savings and compliance with regulations.

What information must be reported on learn about exemptions amp?

The information that must be reported typically includes identification details, the basis for claiming the exemption, financial information, and relevant supporting documentation.

Fill out your OH EPA 3451 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Echeck Waiver Ohio is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.