Get the free Taxes - International Student Services - BYUHawaii

Show details

Clear Form

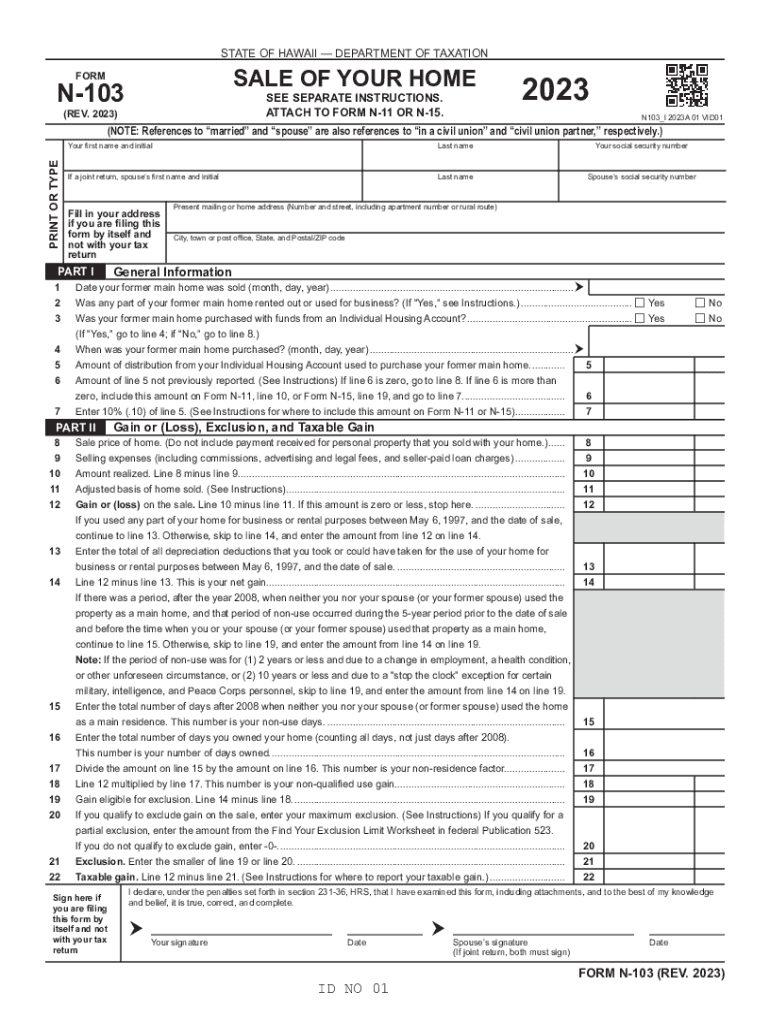

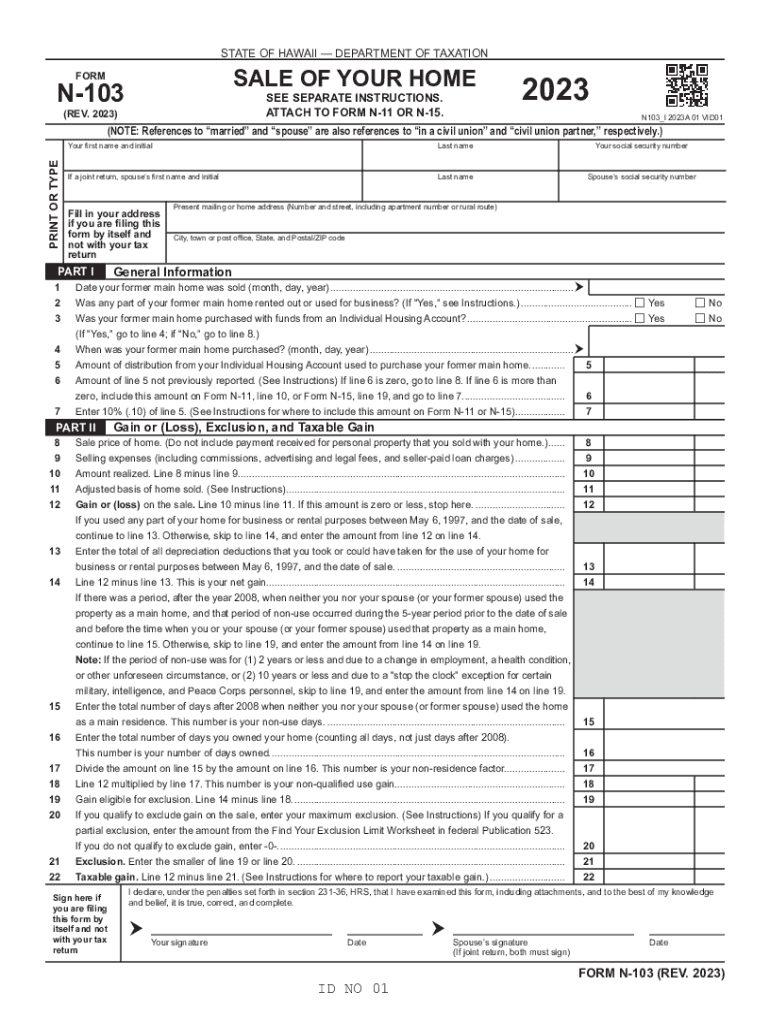

STATE OF HAWAII DEPARTMENT OF TAXATIONSALE OF YOUR HOMEFORMN103SEE SEPARATE INSTRUCTIONS.

ATTACH TO FORM N11 OR N15.(REV. 2023)2023

N103_I 2023A 01 VID01PRINT OR TYPE(NOTE: References to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes - international student

Edit your taxes - international student form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxes - international student form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxes - international student online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxes - international student. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxes - international student

How to fill out taxes - international student

01

Determine your tax residency status in the country where you are studying.

02

Gather all necessary documentation such as passport, visa, and any income statements from employment or scholarships.

03

Determine if you are eligible for any tax treaty benefits between your country of residence and the country where you are studying.

04

Fill out the required tax forms accurately and truthfully, including any income earned from sources within the country where you are studying.

05

Submit your tax forms by the deadline specified by the tax authorities in the country where you are studying.

06

Keep copies of all documentation and tax forms for your records.

Who needs taxes - international student?

01

International students who earn income in the country where they are studying.

02

International students who have scholarships or grants that may be considered taxable income.

03

International students who want to comply with the tax laws of the country where they are studying.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit taxes - international student in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your taxes - international student, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the taxes - international student in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your taxes - international student in minutes.

How can I fill out taxes - international student on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your taxes - international student from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is taxes - international student?

Taxes are mandatory financial charges imposed by the government on income earned by individuals, including international students. International students may have to pay taxes on income earned in the host country.

Who is required to file taxes - international student?

International students who earn income in the host country, receive scholarships or grants, or have any form of taxable income are required to file taxes.

How to fill out taxes - international student?

International students can fill out taxes by gathering necessary documents such as income statements, logging into the designated tax filing website, completing the required forms, and submitting them before the deadline.

What is the purpose of taxes - international student?

The purpose of taxes for international students is to contribute to public services and infrastructure in the host country, as well as comply with legal financial obligations.

What information must be reported on taxes - international student?

International students must report their income, scholarships, and any other relevant financial information, including personal details such as name, address, and taxpayer identification number.

Fill out your taxes - international student online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes - International Student is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.