Get the free MATC Equipment Loan Program Request Form

Show details

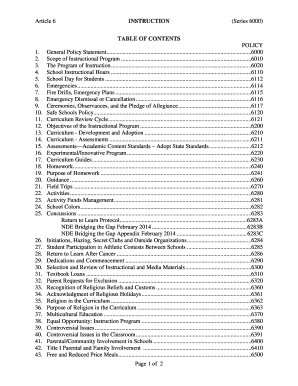

EQUIPMENT LOAN PROGRAM In order to increase the likelihood of adoption of new technologies, the FHWAs Mobile Asphalt Technology Center (MATC) provides loans of laboratory and field equipment to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign matc equipment loan program

Edit your matc equipment loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your matc equipment loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit matc equipment loan program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit matc equipment loan program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out matc equipment loan program

How to fill out matc equipment loan program

01

Visit the MATC equipment loan program website

02

Create an account or log in to your existing account

03

Browse the available equipment and select the items you wish to borrow

04

Check the availability and loan period for each item

05

Fill out the loan request form with the required information

06

Submit the form and wait for approval from the program administrator

07

Once approved, schedule a pick-up time to collect the equipment

08

Return the equipment on time and in good condition to avoid any fines or penalties

Who needs matc equipment loan program?

01

Students who require specific equipment for their coursework or projects but cannot afford to purchase it

02

Faculty members who need specialized equipment for teaching purposes

03

Staff members who need equipment for official MATC activities or events

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find matc equipment loan program?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the matc equipment loan program in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute matc equipment loan program online?

With pdfFiller, you may easily complete and sign matc equipment loan program online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit matc equipment loan program in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your matc equipment loan program, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is matc equipment loan program?

The MATC Equipment Loan Program is designed to assist students and faculty in obtaining necessary equipment for educational purposes, facilitating access to technology and resources essential for academic success.

Who is required to file matc equipment loan program?

Students and faculty members at MATC who wish to borrow equipment must file for the MATC Equipment Loan Program.

How to fill out matc equipment loan program?

To fill out the MATC Equipment Loan Program application, individuals should complete the designated application form available at the MATC library or online, providing the required personal information and details about the equipment being requested.

What is the purpose of matc equipment loan program?

The purpose of the MATC Equipment Loan Program is to provide students and faculty with access to high-quality equipment that enhances learning and teaching experiences.

What information must be reported on matc equipment loan program?

Essential information required on the MATC Equipment Loan Program includes personal identification details, the specific equipment requested, and the intended purpose or use of the equipment.

Fill out your matc equipment loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Matc Equipment Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.