Get the free Home Mortgage Disclosure Act (HMDA) Update - HUD

Show details

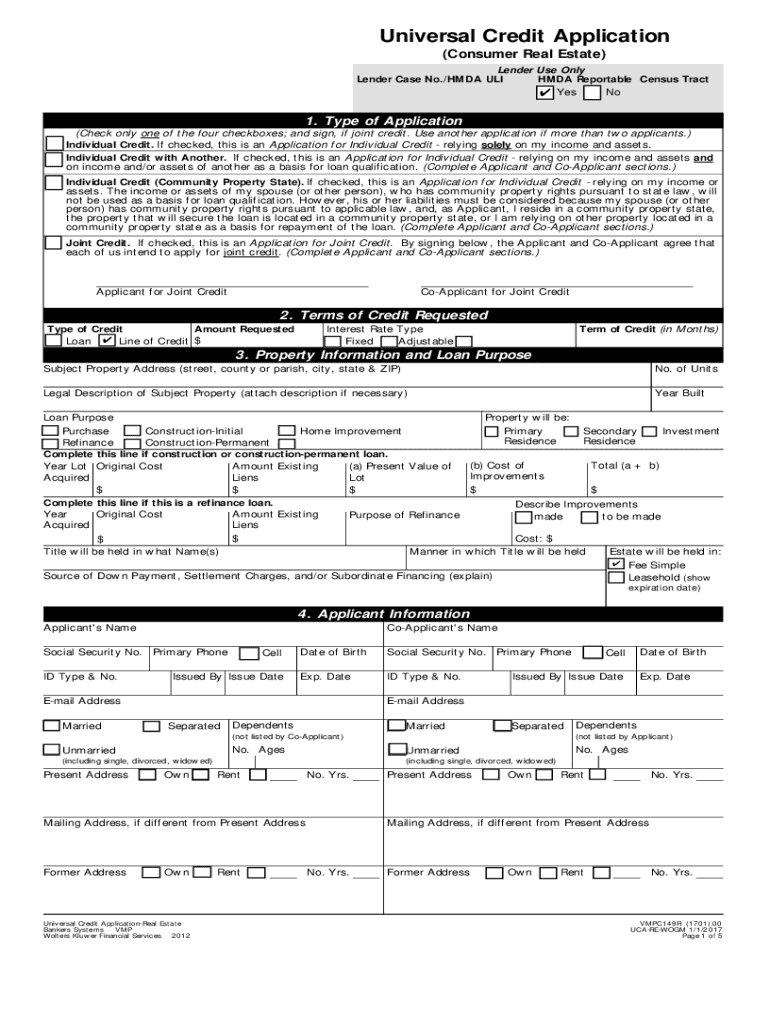

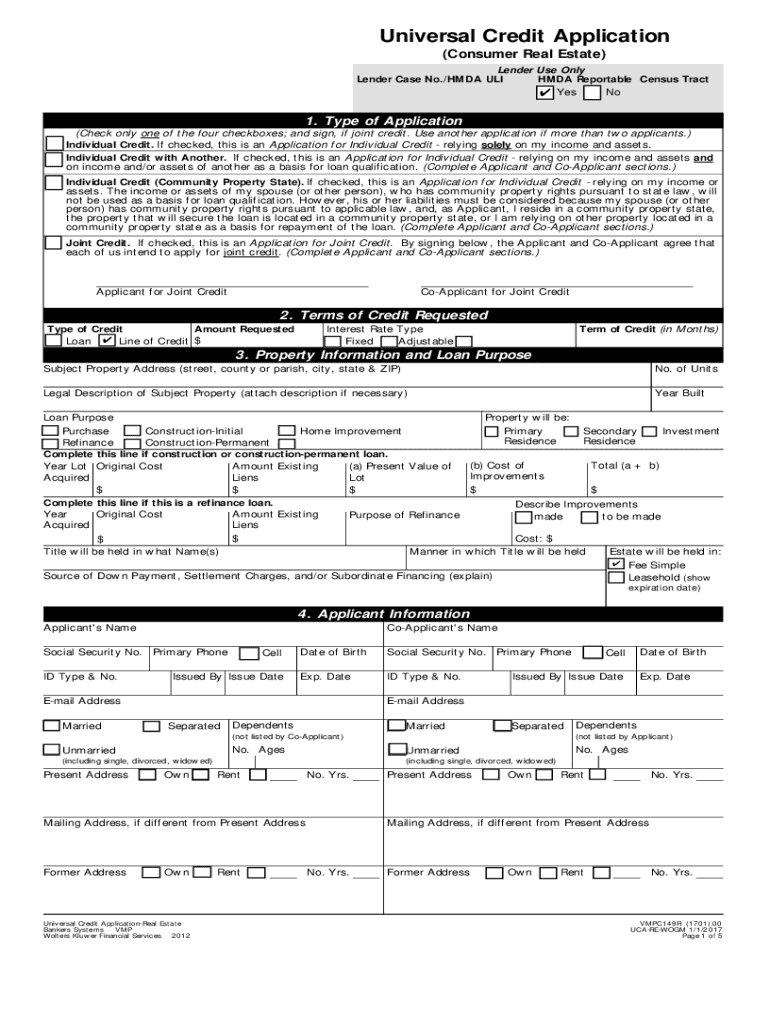

Universal Credit Application (Consumer Real Estate) Lender Use Only Lender Case No./HMD UPI HMD Reportable Census Tract l Yes l No1. Type of Application l(Check only one of the four checkboxes; and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home mortgage disclosure act

Edit your home mortgage disclosure act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home mortgage disclosure act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home mortgage disclosure act online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit home mortgage disclosure act. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home mortgage disclosure act

How to fill out home mortgage disclosure act

01

Begin by gathering all necessary information such as loan details, property information, and borrower information.

02

Complete the loan application form accurately and thoroughly, providing all required information.

03

Ensure that all disclosures required by the Home Mortgage Disclosure Act are included in the application.

04

Review the completed application for accuracy and completeness before submitting it to the lender.

05

Keep copies of all documents submitted for your records.

Who needs home mortgage disclosure act?

01

Lenders and financial institutions who originate residential mortgage loans are required to comply with the Home Mortgage Disclosure Act.

02

Individuals or entities applying for a residential mortgage loan may also benefit from the protections and disclosures provided by the Home Mortgage Disclosure Act.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find home mortgage disclosure act?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific home mortgage disclosure act and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my home mortgage disclosure act in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your home mortgage disclosure act right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit home mortgage disclosure act on an iOS device?

You certainly can. You can quickly edit, distribute, and sign home mortgage disclosure act on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is home mortgage disclosure act?

The Home Mortgage Disclosure Act (HMDA) is a federal law enacted in 1975 that requires financial institutions to provide mortgage data to the public. Its primary purpose is to promote transparency in mortgage lending and help identify discriminatory lending practices.

Who is required to file home mortgage disclosure act?

Entities required to file the HMDA include banks, credit unions, and other mortgage lenders that meet specific criteria, such as the number of home loans originated in a calendar year and the type of lending activities conducted.

How to fill out home mortgage disclosure act?

Filling out the HMDA requires financial institutions to collect data on mortgage applications, originations, denials, and the demographics of applicants. The reported data must be submitted using the appropriate reporting format to the appropriate federal agency within the set deadlines.

What is the purpose of home mortgage disclosure act?

The primary purpose of the HMDA is to ensure that lenders are serving the housing needs of their communities, to help identify patterns of discrimination in mortgage lending, and to assist governmental agencies in enforcing fair lending laws.

What information must be reported on home mortgage disclosure act?

Lenders must report information including loan type, loan amount, property location, applicant demographics (such as race, ethnicity, and sex), and whether the loan was originated or denied.

Fill out your home mortgage disclosure act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Mortgage Disclosure Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.