Get the free Receiving Cash or Checks on Behalf of SPPS

Show details

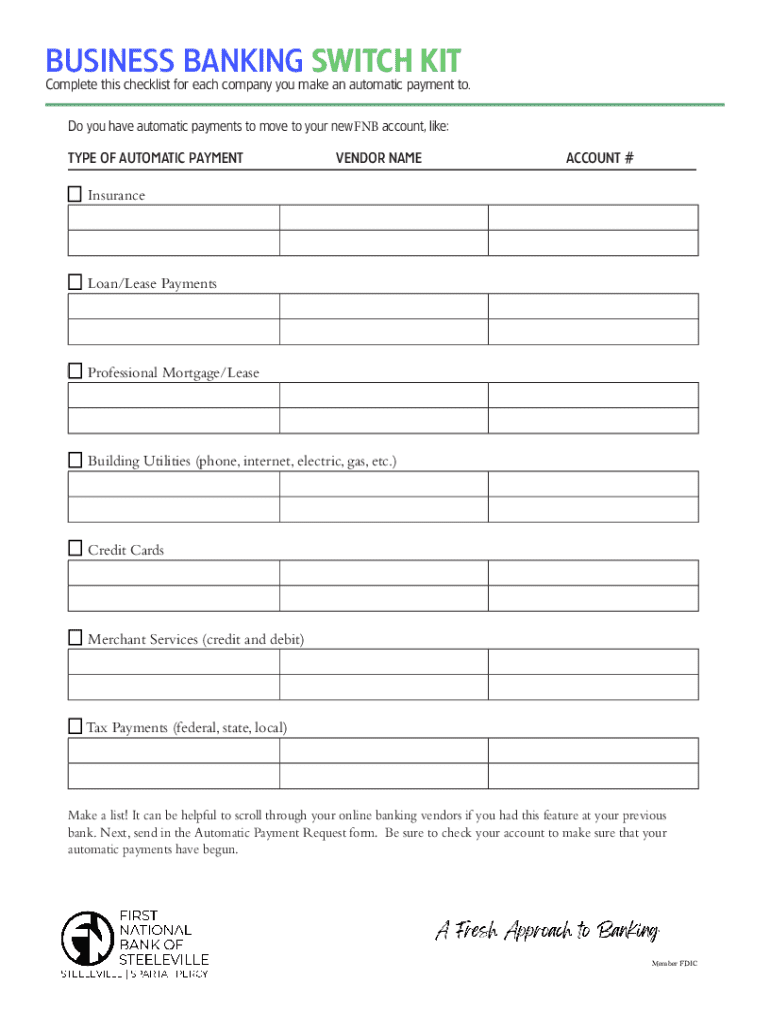

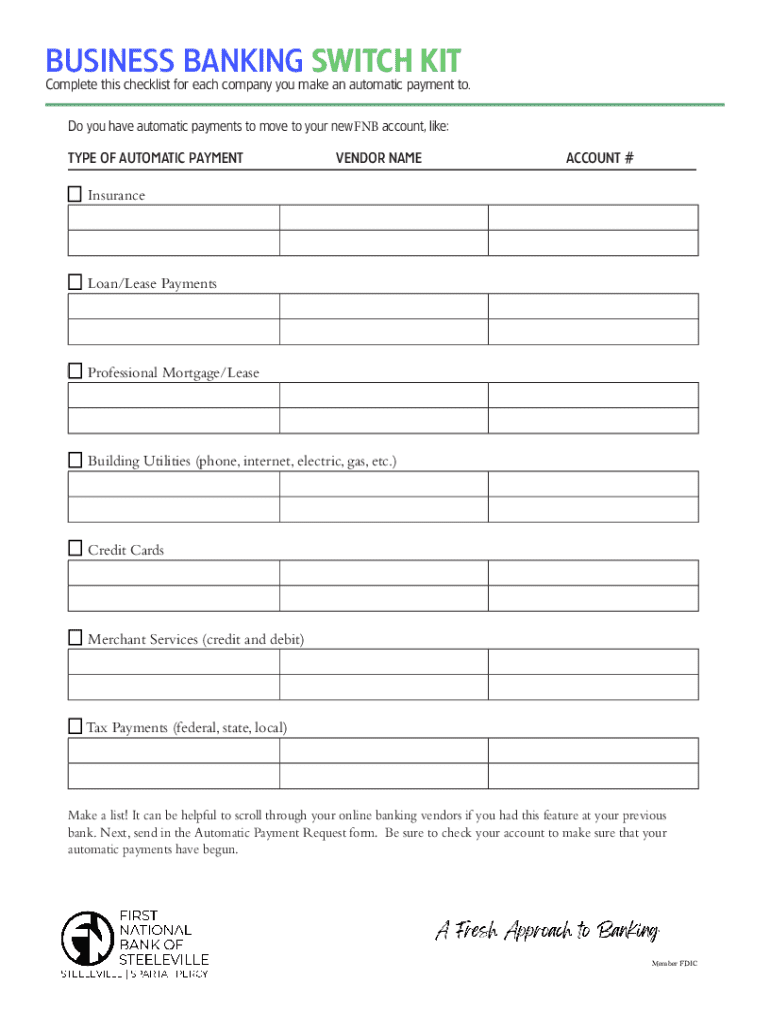

BUSINESS BANKINGSWITCH KIT

*SPAS[XLIWIWMQTPIWXITWXSQSZI]SYVFYWMRIWWGLIGOMRKVIPEXMSRWLMTXS\'JSU/BUXOM#BOLPG4UFFMFWJMMF \'/#

0RYLQJDOORXUEXVLQHVVDFFRXQWVWR)LUVW1DWLRQDO%DQNRI6WHHOHYLOOHKDVQHYHUEHHQHDVLHU6LPSO

UHIHUWRWKHIROORZLQJJXLGHWRPDNHRXUVZLWFKHDVDQGFRQYHQLHQW6WHS2SHQD)1%%XVLQHVVFKHFNLQJDFFRXQW4UPQCZUIF\'/#MPDBUJPOOFBSFTUZPVBOEWJTJUXJUIB$VTUPNFS4FSWJDF3FQSFTFOUBUJWFXIPDBOBTTJTUZPVJOPQFOJOH

ZPVSOFXBDDPVOU×GJUhTNPSFDPOWFOJFOU

DBMMVTUPHFUUIFQSPDF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receiving cash or checks

Edit your receiving cash or checks form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receiving cash or checks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing receiving cash or checks online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit receiving cash or checks. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receiving cash or checks

How to fill out receiving cash or checks

01

Collect cash or checks from the payer.

02

Record the amount received in a receipt or deposit slip.

03

Verify the accuracy of the amount received.

04

Secure the cash or checks in a safe place.

05

Update the organization's financial records to reflect the payment received.

Who needs receiving cash or checks?

01

Any individual or organization that receives payments in the form of cash or checks may need to fill out receiving cash or checks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my receiving cash or checks directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your receiving cash or checks and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get receiving cash or checks?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific receiving cash or checks and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute receiving cash or checks online?

pdfFiller has made filling out and eSigning receiving cash or checks easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is receiving cash or checks?

Receiving cash or checks refers to the process of accepting payments in the form of physical cash or written negotiable instruments like checks.

Who is required to file receiving cash or checks?

Businesses and individuals who receive cash or checks as income are generally required to file documentation regarding these transactions for tax purposes.

How to fill out receiving cash or checks?

To fill out receiving cash or checks, detail the amount received, the date of receipt, the payer's information, and purpose of the transaction in a record or receipt format.

What is the purpose of receiving cash or checks?

The purpose of receiving cash or checks is to facilitate transactions for goods or services provided, while maintaining a clear record for accounting and tax obligations.

What information must be reported on receiving cash or checks?

Information that must be reported includes the amount received, date, payer's details, payment method, and the nature of the transaction.

Fill out your receiving cash or checks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receiving Cash Or Checks is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.