Get the free 24 Bad Debt - hfs illinois

Show details

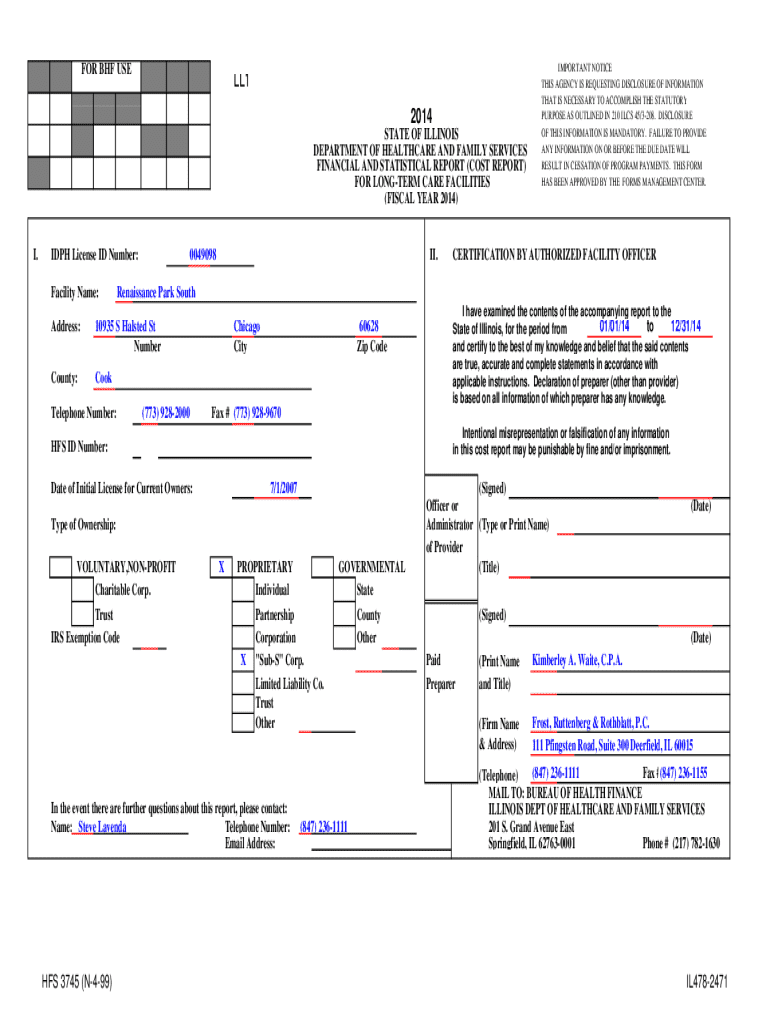

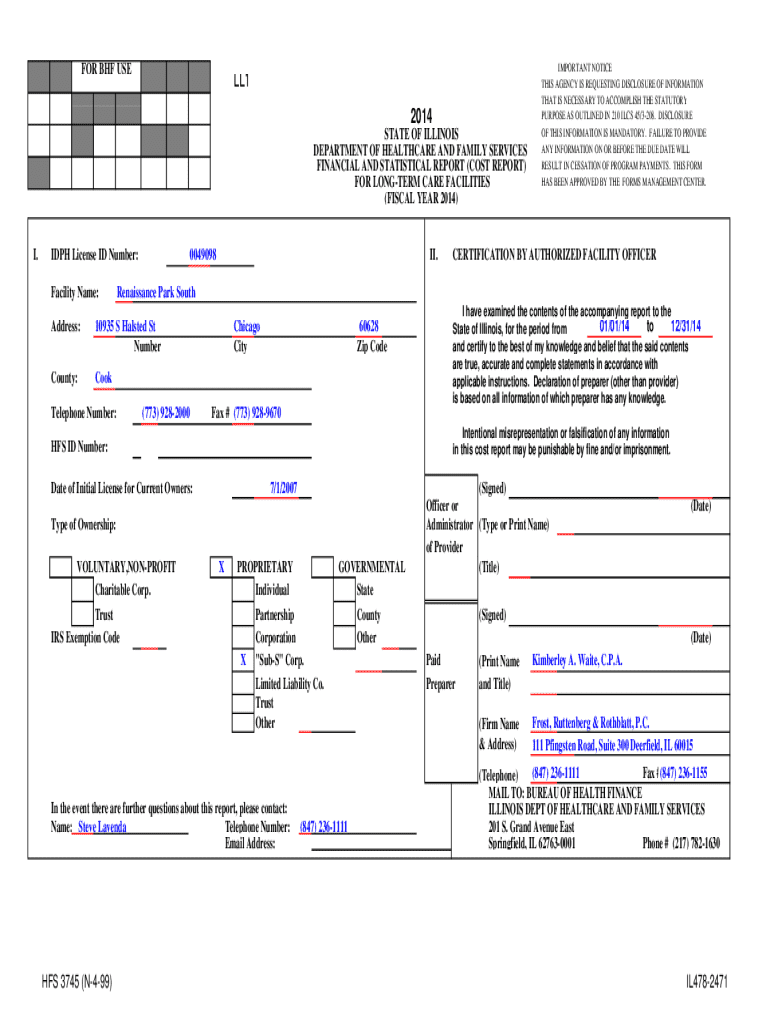

FOR BHF USELL1

2014

STATE OF ILLINOIS

DEPARTMENT OF HEALTHCARE AND FAMILY SERVICES

FINANCIAL AND STATISTICAL REPORT (COST REPORT)

FOR LONGER CARE FACILITIES

(FISCAL YEAR 2014)I.DPH License ID Number:

Facility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 24 bad debt

Edit your 24 bad debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 24 bad debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 24 bad debt online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 24 bad debt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 24 bad debt

How to fill out 24 bad debt

01

Gather all necessary information related to the bad debt, such as the amount owed, date of the debt, and contact information of the debtor.

02

Update your accounting records to reflect the bad debt by creating an allowance for doubtful accounts.

03

Write off the bad debt by debiting the allowance for doubtful accounts and crediting accounts receivable.

04

Send a notification to the debtor informing them of the write-off and any further actions that will be taken.

05

Monitor any future payments or attempts to collect the debt.

Who needs 24 bad debt?

01

Businesses that have outstanding debts that they are unable to collect may need to fill out 24 bad debt.

02

Individuals who have lent money to others and have not been able to recover the debt may also need to fill out 24 bad debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 24 bad debt?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 24 bad debt to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit 24 bad debt on an iOS device?

Create, modify, and share 24 bad debt using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit 24 bad debt on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 24 bad debt. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is 24 bad debt?

24 bad debt refers to a specific form used by taxpayers to report business-related unpaid debts that are deemed uncollectible. This form helps businesses claim a deduction for these debts.

Who is required to file 24 bad debt?

Typically, businesses or self-employed individuals who have reported bad debts on their tax returns are required to file 24 bad debt.

How to fill out 24 bad debt?

To fill out 24 bad debt, taxpayers need to provide details about the debtor, the amount of the debt, evidence of efforts made to collect the debt, and other relevant financial information.

What is the purpose of 24 bad debt?

The purpose of 24 bad debt is to allow taxpayers to report and claim deductions for debts that are no longer collectible, thereby reducing their taxable income.

What information must be reported on 24 bad debt?

Information required includes debtor details, the amount of the uncollectible debt, the date it was written off, and documentation supporting the debt's uncollectibility.

Fill out your 24 bad debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

24 Bad Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.