Get the free Kotak Equity Savings Fund - KIM - 0914

Show details

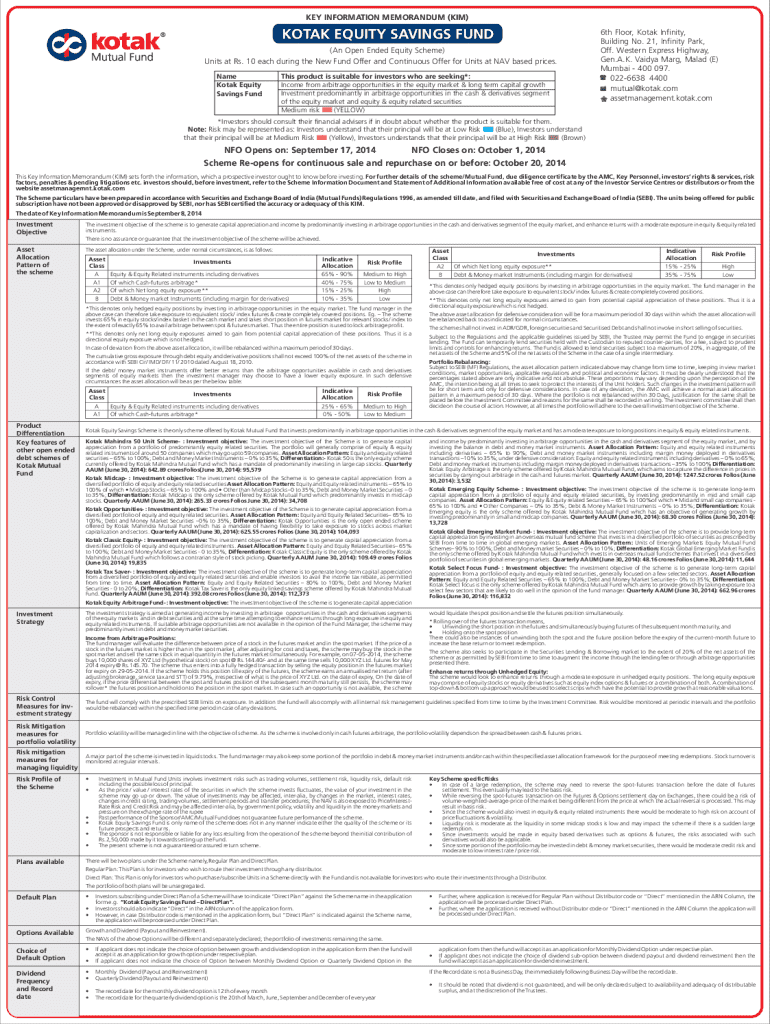

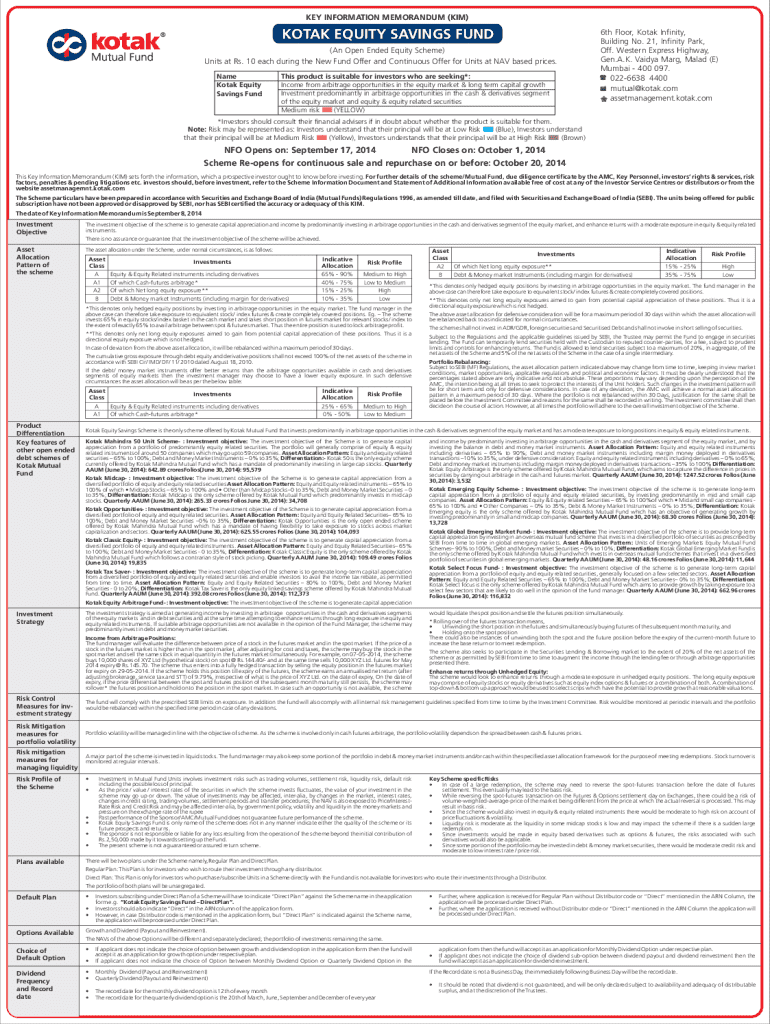

KEY INFORMATION MEMORANDUM (KIM)KODAK EQUITY SAVINGS FUND (An Open Ended Equity Scheme) Units at Rs. 10 each during the New Fund Offer and Continuous Offer for Units at NAV based prices. Name Kodak

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kotak equity savings fund

Edit your kotak equity savings fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kotak equity savings fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kotak equity savings fund online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kotak equity savings fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kotak equity savings fund

How to fill out kotak equity savings fund

01

Start by opening a demat account with a registered stockbroker.

02

Complete the necessary KYC formalities by submitting required documents.

03

Once the KYC is completed, log in to your demat account.

04

Search for 'Kotak Equity Savings Fund' in the mutual fund section.

05

Select the fund and choose the amount you wish to invest.

06

Proceed to make the payment through the available options like NEFT, net banking, etc.

07

Confirm the transaction and wait for the units to be allocated to your demat account.

Who needs kotak equity savings fund?

01

Individuals who are looking for a balanced investment option with exposure to equity and fixed income securities.

02

Investors who have a moderate risk appetite and are seeking potential capital appreciation along with regular income.

03

Those who prefer a professionally managed fund and do not have the time or expertise to manage their investments actively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find kotak equity savings fund?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific kotak equity savings fund and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the kotak equity savings fund in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your kotak equity savings fund in seconds.

How can I fill out kotak equity savings fund on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your kotak equity savings fund from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is kotak equity savings fund?

Kotak Equity Savings Fund is a mutual fund scheme that aims to provide capital appreciation while managing risk through a mix of equity, arbitrage, and fixed income instruments.

Who is required to file kotak equity savings fund?

Individuals who have invested in the Kotak Equity Savings Fund and need to declare their income from investments for tax purposes are required to file.

How to fill out kotak equity savings fund?

To fill out the application for Kotak Equity Savings Fund, investors typically need to provide personal details, investment amount, and choose their preferred plan, either regular or direct.

What is the purpose of kotak equity savings fund?

The purpose of Kotak Equity Savings Fund is to generate returns from a diversified portfolio while protecting the capital by investing in relatively less volatile instruments.

What information must be reported on kotak equity savings fund?

Investors must report their investment details, including the amount invested, returns earned, and any withdrawals made during the financial year.

Fill out your kotak equity savings fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kotak Equity Savings Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.