CT DRS CT-706 NT 2015 free printable template

Show details

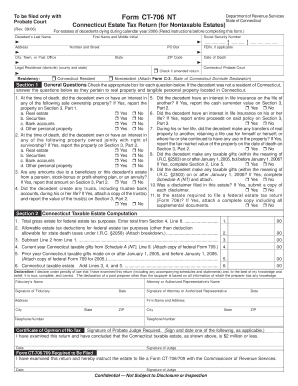

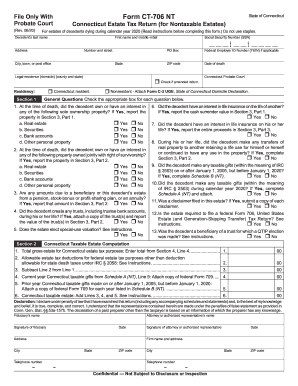

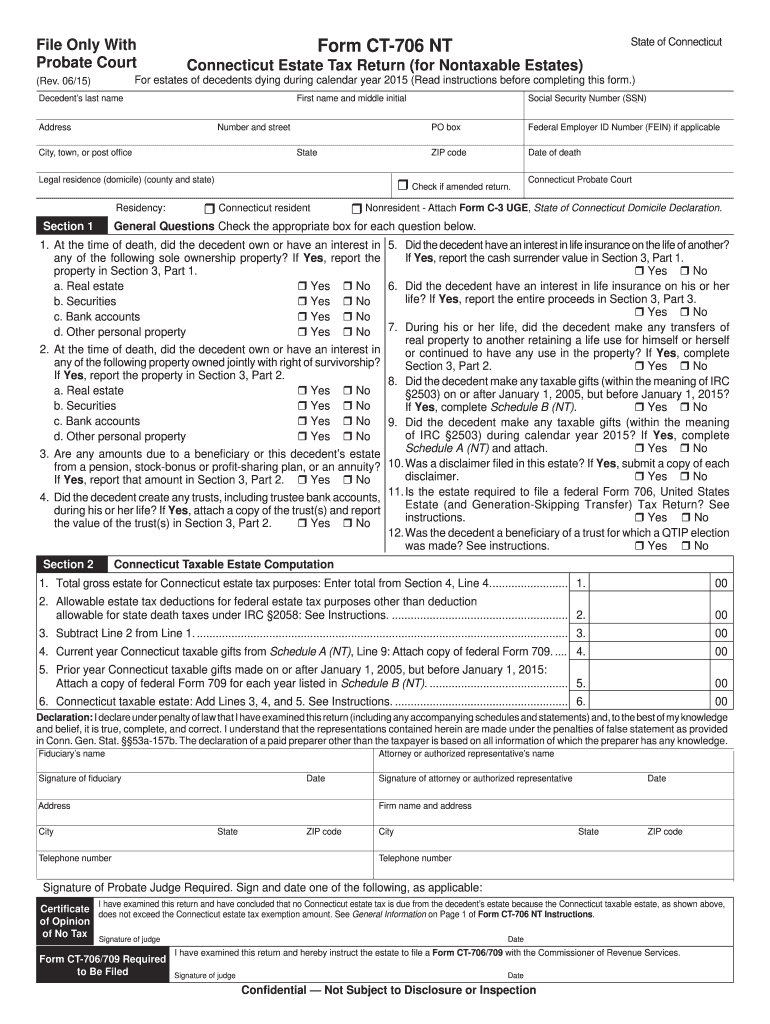

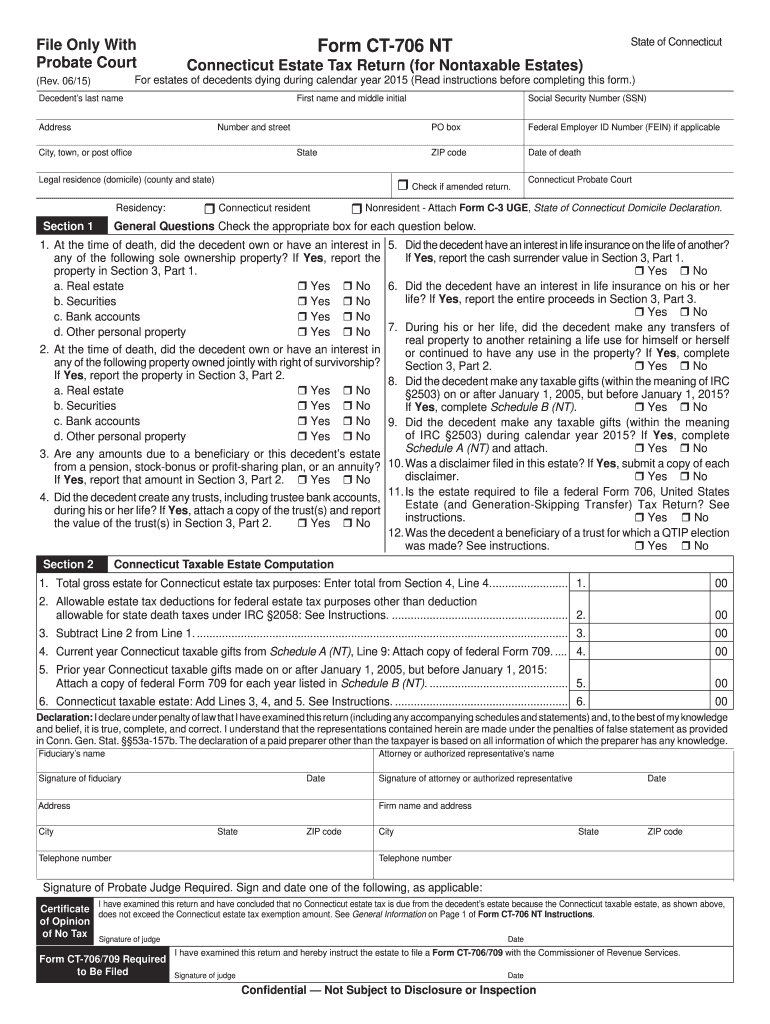

If necessary attach additional sheet s and continue with Item 3D. 13. 3A 14. 3B 15. 3C Form CT-706 NT Rev. 06/15 Page 2 of 5 Total Gross Estate as It Would Be Valued for Connecticut Estate Tax Purposes Enter amount from Section 3 Part 1 Column D Line 6. See General Information on Page 1 of Form CT-706 NT Instructions. of Opinion of No Tax Signature of judge Form CT-706/709 Required to Be Filed Signature of judge Confidential Not Subject to Disclosure or Inspection Go to page 2 Property and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-706 NT

Edit your CT DRS CT-706 NT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-706 NT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-706 NT online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS CT-706 NT. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-706 NT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-706 NT

How to fill out CT DRS CT-706 NT

01

Gather necessary documents: Collect all relevant financial information and documents required for the DRS CT-706 NT form.

02

Fill in personal information: Enter your name, address, and Social Security number at the top of the form.

03

List all real property: Clearly identify all real property for which you are seeking a tax exemption, including addresses and descriptions.

04

Provide ownership details: Indicate the type of ownership you have for each property listed, such as sole owner, co-owner, or trust.

05

Complete the exemption section: Fill in the section that outlines the type of exemption you are claiming and provide supporting reasons.

06

Sign and date the form: Ensure that you sign and date the form at the designated area to validate your submission.

07

Submit the form: Send the completed CT-706 NT form to the appropriate Connecticut DRS office by the specified deadline.

Who needs CT DRS CT-706 NT?

01

Individuals who are claiming a property tax exemption in Connecticut.

02

Homeowners who have properties meeting the criteria for the exemptions provided under Connecticut tax laws.

03

Representatives or trustees managing estates that are entitled to such exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Is there an extension of time to file CT-706 NT?

If a Form CT-706 NT EXT is filed and an extension is granted, interest will begin to accrue 30 days after the extended due date of Form CT-706 NT. Fill in the district of the Probate Court to which the form is to be submitted. Complete the name and address of decedent. Complete the fiduciary's name and address.

How do I file an extension for a 706?

Use Form 4768 to: Apply for an automatic 6-month extension of time to file Form 706, Form 706-A, Form 706-NA, or Form 706-QDT. Apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768).

What is a CT-706 NT form?

Connecticut Estate Tax Return (for Nontaxable Estates) For estates of decedents dying during calendar year 2022 (Read instructions before completing this form.)

Who must file a CT-706?

The executor or administrator of the decedent's estate must sign and file Form CT‑706 NT. If there is no executor or administrator, then each person in actual or constructive possession of any property of the decedent must file Form CT‑706 NT. If there is more than one fiduciary, all must sign the return.

What is the estate tax exemption for 2015 in CT?

For estates of decedents dying during 2015, the Connecticut estate tax exemption amount is $2 million. Therefore, Connecticut estate tax is due from a decedent's estate if the Connecticut taxable estate is more than $2 million.

What is the extension of time to file Form 706?

Automatic extension. An executor may apply for an automatic 6-month extension of time to file Form 706, 706-A, 706-NA, or 706-QDT. Unless you are an executor who is out of the country (see below), the automatic extension of time to file is 6 months from the original due date of the applicable return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT DRS CT-706 NT online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your CT DRS CT-706 NT to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the CT DRS CT-706 NT electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CT DRS CT-706 NT in minutes.

How do I edit CT DRS CT-706 NT on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CT DRS CT-706 NT. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is CT DRS CT-706 NT?

CT DRS CT-706 NT is a tax form used in Connecticut for reporting the estate tax exemption and the related estate tax for decedent estates that are not subject to the Connecticut estate tax.

Who is required to file CT DRS CT-706 NT?

The executor or administrator of an estate must file CT DRS CT-706 NT if the estate is not subject to Connecticut estate tax and if the gross estate exceeds certain thresholds established by the state.

How to fill out CT DRS CT-706 NT?

To fill out CT DRS CT-706 NT, you must provide information regarding the decedent, the date of death, details about the assets of the estate, and the calculation of any applicable tax exemptions.

What is the purpose of CT DRS CT-706 NT?

The purpose of CT DRS CT-706 NT is to document and report the estate's eligibility for the Connecticut estate tax exemption, ensuring compliance with state tax laws.

What information must be reported on CT DRS CT-706 NT?

Information that must be reported on CT DRS CT-706 NT includes the decedent's identity, estate valuation, deductions, and any exemptions applicable under Connecticut tax law.

Fill out your CT DRS CT-706 NT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-706 NT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.