Get the free Overdraft Fees Vs. NSF Fees: How They Differ

Show details

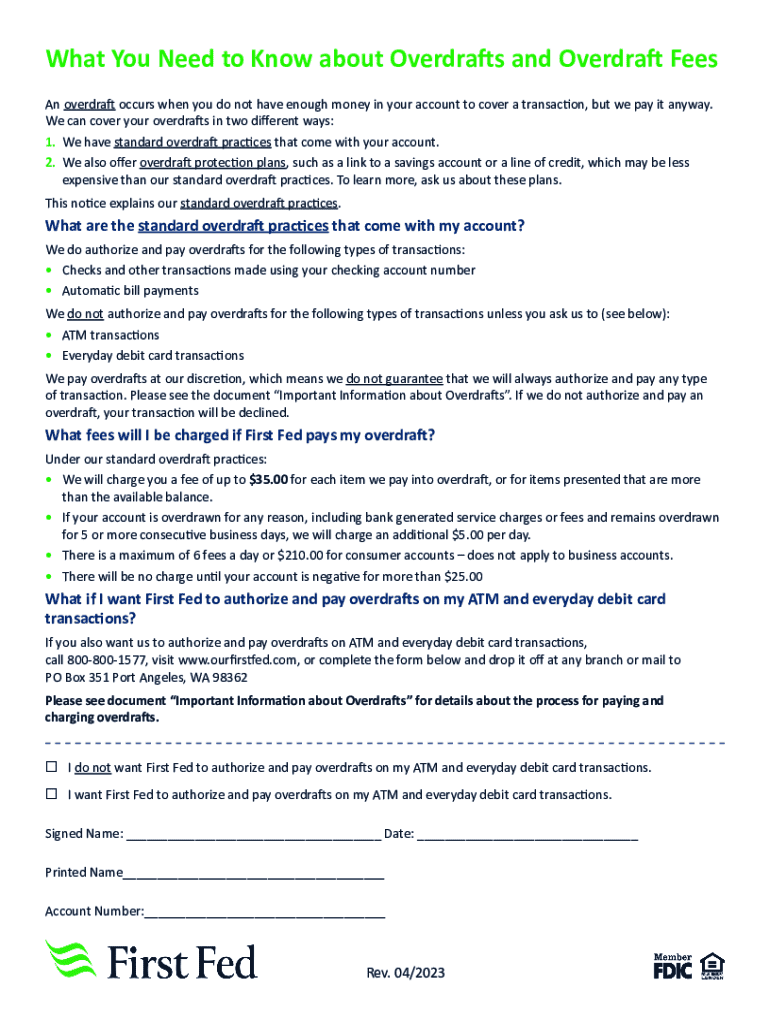

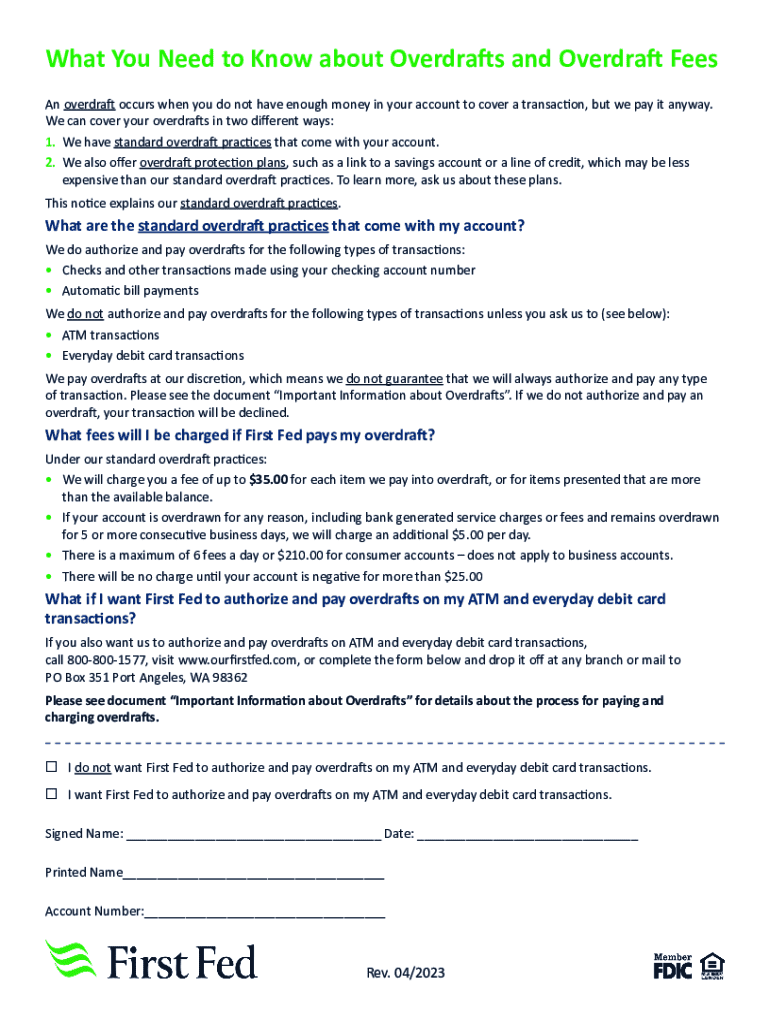

What You Need to Know about Overdrafts and Overdraft Fees An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We can cover your overdrafts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overdraft fees vs nsf

Edit your overdraft fees vs nsf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overdraft fees vs nsf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing overdraft fees vs nsf online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit overdraft fees vs nsf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overdraft fees vs nsf

How to fill out overdraft fees vs nsf

01

Understand the difference between overdraft fees and NSF (Non-Sufficient Funds) fees.

02

Keep track of your bank account balance to avoid overdraft fees and NSF fees.

03

Set up alerts or notifications for low balances to prevent triggering these fees.

04

Opt out of overdraft protection if you want to avoid overdraft fees.

05

Communicate with your bank if you have any questions or concerns about these fees.

Who needs overdraft fees vs nsf?

01

People who want to avoid overdrawing their bank account and incurring fees.

02

Individuals who want to manage their finances responsibly and avoid unnecessary charges.

03

Customers who want to understand the terms and conditions of their bank accounts to make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute overdraft fees vs nsf online?

pdfFiller has made it easy to fill out and sign overdraft fees vs nsf. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in overdraft fees vs nsf?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your overdraft fees vs nsf and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit overdraft fees vs nsf in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your overdraft fees vs nsf, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is overdraft fees vs nsf?

Overdraft fees are charges incurred when a transaction exceeds the available balance in an account, allowing the transaction to go through at a cost. NSF, or Non-Sufficient Funds fees, are charged when a transaction cannot be processed due to insufficient funds, resulting in a returned transaction.

Who is required to file overdraft fees vs nsf?

Typically, financial institutions are required to report overdraft fees and NSF fees, as part of their account management and consumer disclosure requirements. Additionally, individuals or businesses affected by these fees may need to track and report them for personal finance management.

How to fill out overdraft fees vs nsf?

To fill out a record or report on overdraft fees vs NSF, begin by documenting each occurrence, including the date, amount of the transaction, the fee charged, and the account balance at the time. This can often be done through bank statements or personal finance software.

What is the purpose of overdraft fees vs nsf?

The purpose of overdraft fees is to cover the risk taken by the bank when allowing transactions that exceed the account balance. NSF fees serve to penalize account holders for attempting to spend more than what is available, discouraging overdrawing and maintaining transaction integrity.

What information must be reported on overdraft fees vs nsf?

Information that must be reported includes the account holder's name, the date of the transaction, the amount of the transaction, the incurred fee for overdraft or NSF, and the remaining balance after the transaction.

Fill out your overdraft fees vs nsf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overdraft Fees Vs Nsf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.