RI Form BAR 2024-2025 free printable template

Show details

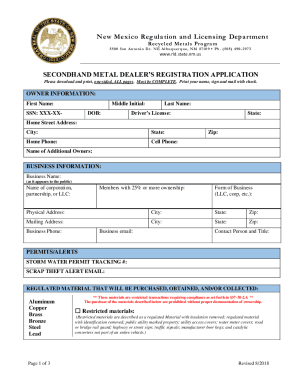

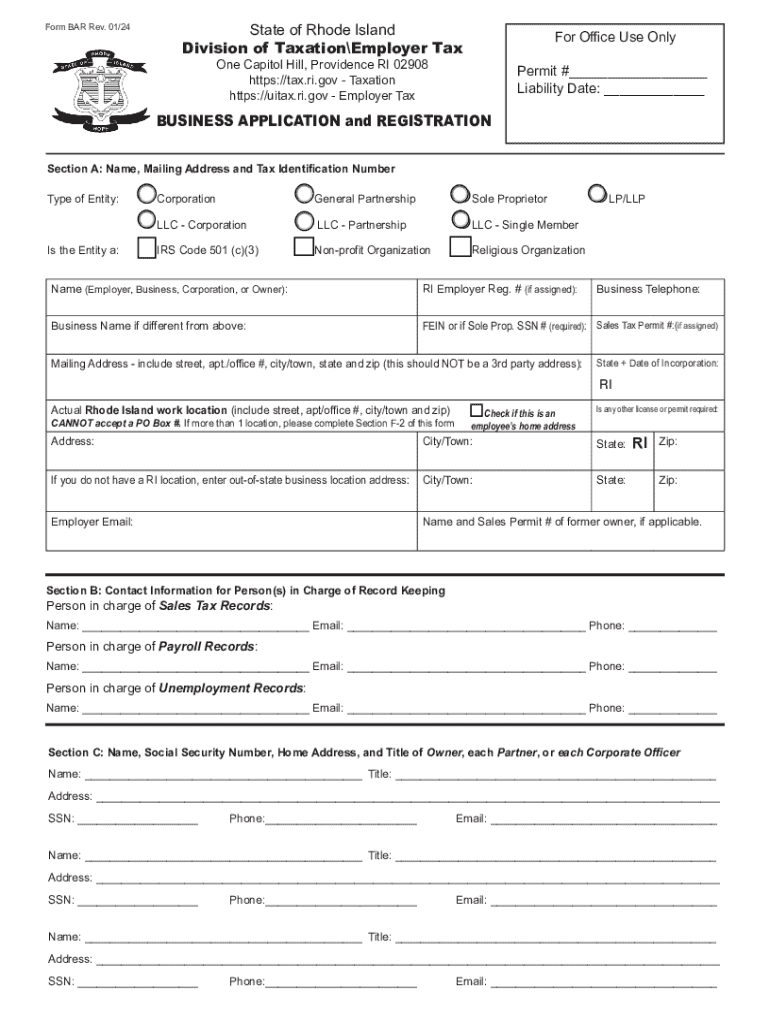

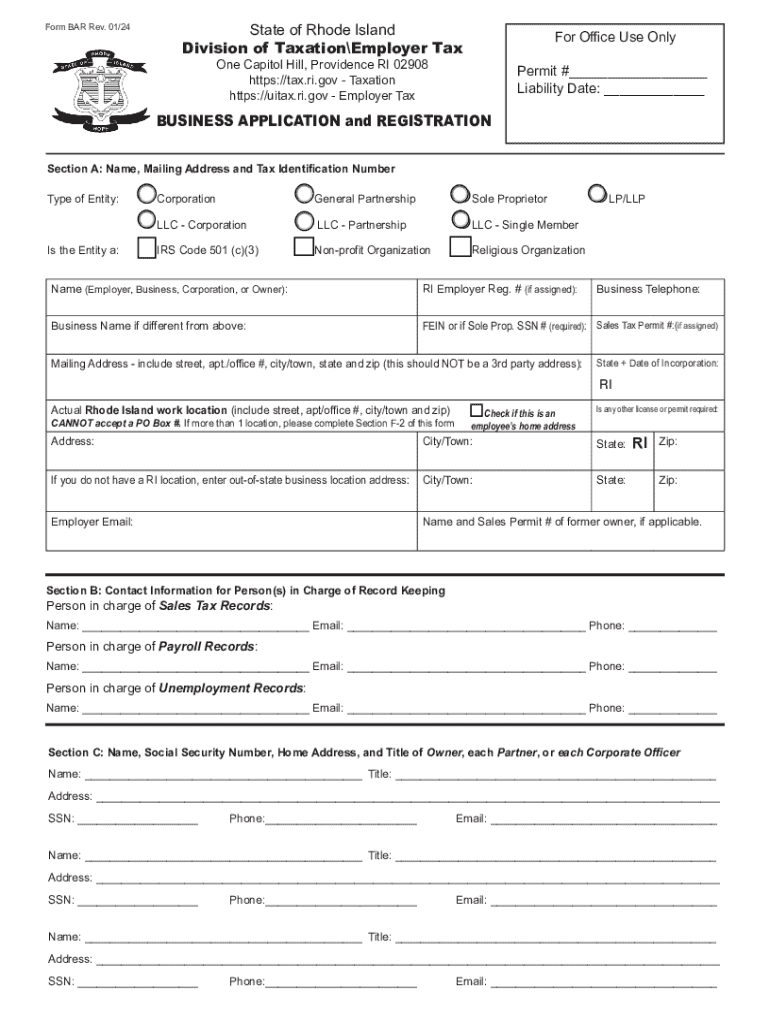

Form BAR Rev. 01/24State of Rhode Island

Division of TaxationEmployer Taylor Office Use Online Capitol Hill, Providence RI 02908

https://tax.ri.gov Taxation

https://uitax.ri.gov Employer Permit #___

Liability

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ri form bar business pdf

Edit your rhode island form bar business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

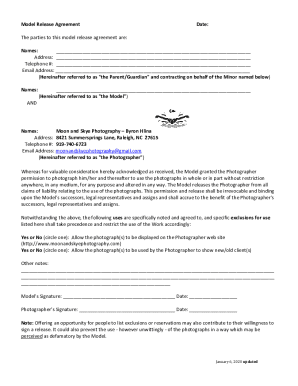

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ri application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ri form bar business edit online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ri form bar business fill. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI Form BAR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ri form bar business

How to fill out RI Form BAR

01

Obtain the RI Form BAR from the official website or local office.

02

Read the instructions carefully to understand the requirements.

03

Fill out the personal information section accurately.

04

Provide details of your current employment status or business.

05

Attach any required documents such as identification or proof of income.

06

Review the form for any errors or missing information.

07

Sign and date the form at the designated area.

08

Submit the completed form through the specified method (online, mail, or in-person).

Who needs RI Form BAR?

01

Individuals applying for benefits under specific programs in Rhode Island.

02

Businesses seeking to report their financial status or tax information.

03

Residents needing to declare income for assistance programs or tax purposes.

Fill

ri form bar business fillable

: Try Risk Free

People Also Ask about ri form bar business blank

What is RI registration sales tax?

New or used vehicles, sales tax is 7% of the purchase price, minus trade-in and other allowances. This applies to passenger vehicles and motor homes only. All other vehicles are excluded from the trade-in allowance.

How much is an EIN number in RI?

Applying for an EIN for your Rhode Island LLC is completely free. The IRS doesn't charge any service fees for the EIN online application process.

How much is business tax in Rhode Island?

Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island's tax system ranks 42nd overall on our 2023 State Business Tax Climate Index.

How do I register for sales and use tax in Rhode Island?

You can register online, or by mailing a “Business Application and Registration Form” to Division of Taxation, One Capitol Hill, Providence, RI 02908 along with the $10 fee. You need this information to register for a sales tax permit in Rhode Island: Personal identification info (SSN, address, etc.)

How do I get a tax ID number for my business in Rhode Island?

Rhode Island Tax Account Numbers If you are a new business, register online with the RI Department of Revenue. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

Do I need a business license in Rhode Island?

Rhode Island requires businesses to obtain any necessary licenses before starting operations. Many businesses will need to obtain a Permit to Make Sales at Retail from the State of Rhode Island Division of Taxation. Most business structures will also have to register with the Rhode Island Department of State.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ri form bar business online for eSignature?

When you're ready to share your nonmetallic smithfield cafeterias, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute ri registration 2024-2025 form online?

pdfFiller has made it simple to fill out and eSign ri registration 2024-2025 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I fill out ri registration 2024-2025 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your ri registration 2024-2025 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is RI Form BAR?

RI Form BAR is a reporting form used by businesses to disclose their business activities and financial information to the Rhode Island government.

Who is required to file RI Form BAR?

Businesses operating in Rhode Island that meet certain thresholds of income or activity are required to file RI Form BAR.

How to fill out RI Form BAR?

To fill out RI Form BAR, businesses should gather necessary financial data, follow the instructions on the form, and ensure all required fields are completed accurately before submission.

What is the purpose of RI Form BAR?

The purpose of RI Form BAR is to ensure compliance with state regulations and to collect important financial information for tax assessment and economic analysis.

What information must be reported on RI Form BAR?

Information required on RI Form BAR typically includes business identification details, financial data such as revenue and expenses, and other general business activity details relevant to the state.

Fill out your ri registration 2024-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri Registration 2024-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.