Get the free Credit Card Invoice Template

Show details

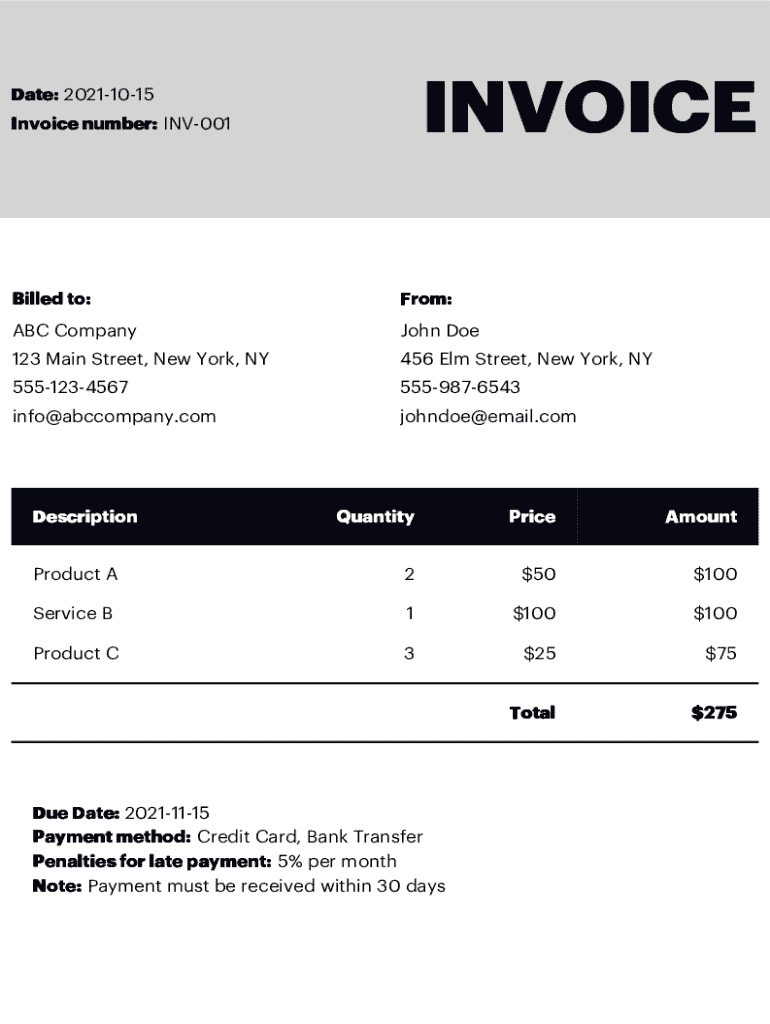

INVOICED ate: 20211015

Invoice number: INV001Billed to:From:ABC Company John Doe123 Main Street, New York, NY456 Elm Street, New York, NY55512345675559876543info@abccompany.comjohndoe@email.comDescriptionQuantityPriceAmountPro$2ct

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is credit card invoice template

A credit card invoice template is a pre-formatted document used to bill customers for purchases made using a credit card.

pdfFiller scores top ratings on review platforms

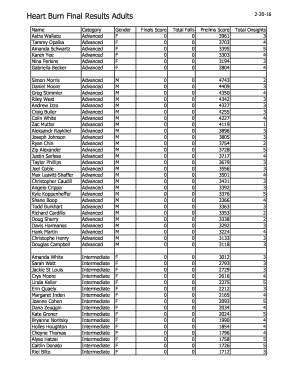

Who needs credit card invoice template?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Creating and Managing a Credit Card Invoice Template Form

How do credit card invoices work?

A credit card invoice template form is crucial for clear billing purposes. It details transactions made on a credit card and serves as a formal request for payment. Accurate invoicing minimizes confusion and promotes timely payments, benefiting both the business and its clients.

-

An invoice is a document issued by a seller to a buyer, indicating the products, quantities, and agreed prices for products or services.

-

The purpose of invoicing is to request payment and provide a record for both parties regarding the transaction.

-

Accurate invoicing is vital as it ensures both parties agree on the details, preventing disputes and late payments.

-

Processing these invoices requires special attention to card details, payment methods, and secure handling of customer information.

What are the key components of an invoice?

Every invoice must contain specific fields to ensure clarity and legality. Essential components include the date, invoice number, and billing details, all of which help track payments efficiently.

-

These include the date of the invoice and a unique invoice number, which help in tracking payments.

-

This section provides the names and addresses of both the sender and receiver, ensuring clarity on whom the invoice is intended for.

-

Contact details must be accurate to facilitate communication regarding the invoice.

-

A detailed description along with associated prices helps avoid misunderstandings and serves as a record of what was sold.

How do fill out the credit card invoice?

Filling out your credit card invoice template form accurately is crucial, guiding the recipient on how to proceed with payment. Follow detailed instructions for each section to ensure no information is missed.

-

Begin by adding the current date and a unique invoice number at the top of the form.

-

Enter the complete address and contact information for both parties to prevent payment delays.

-

Clearly describe each product or service provided, along with its pricing.

-

Make sure to calculate the total amount due, including any applicable taxes, to provide an accurate figure for payment.

What should consider when selecting an invoice template?

Choosing the right credit card invoice template can greatly influence how professional your invoices appear. Consider the specific needs of your industry and your business model before deciding.

-

Review different templates to find the one that best suits your invoicing style and business needs.

-

Select templates designed for specific industries to ensure relevance and effectiveness.

-

Use platforms like pdfFiller that allow you to modify templates according to your company branding and invoicing needs.

What are payment terms and penalty clauses?

Clearly stated payment terms are essential for establishing expectations and preventing late payments. Detail penalties to ensure clients understand the consequences of delay.

-

Specify accepted payment methods including credit card, bank transfer, and online payment platforms.

-

Outline any late payment fees or interest rates applicable to encourage timely payments.

-

Provide clear instructions on how and where to make payments.

How can pdfFiller improve invoice management?

Using pdfFiller for managing invoices offers a range of advantages that streamline the invoicing process. The platform's features help in editing, signing, and collaborating efficiently.

-

Access and manage your invoices from anywhere, ensuring flexibility and ease of use.

-

Ensure your invoices are signed securely, adding an extra layer of credibility and security.

-

Utilize collaboration options for team invoicing, improving efficiency and reducing errors.

What are common mistakes to avoid when creating invoices?

Being aware of frequent pitfalls can help businesses maintain professionalism and accuracy in their invoices. Avoid these common issues to ensure smoother transaction processes.

-

Missed fields can lead to confusion and delay in payments. Always double-check your form.

-

Incorrect pricing can damage reputation and lead to financial discrepancies. Always verify costs before sending.

-

Ambiguous terms may result in misunderstandings. Be explicit in what is required from the client.

How can enhance invoicing efficiency?

Integrating advanced tools and features into your invoicing process can significantly improve efficiency and accuracy. Embrace technology to minimize repetitive tasks and errors.

-

Consider using tools that streamline the invoicing process, making it easier to track and manage invoices.

-

Employ templates to save time on frequently issued invoices.

-

Use analytical tools to monitor invoicing trends and outcomes, helping you make data-driven decisions.

How to fill out the credit card invoice template

-

1.Open the credit card invoice template in pdfFiller.

-

2.Fill in the date of the invoice at the top of the document.

-

3.Enter your company name and contact information in the designated fields.

-

4.Input the client's name and address in the provided area.

-

5.List the products or services rendered along with their corresponding costs in the itemized section.

-

6.Include subtotal, taxes, and any discounts before calculating the total amount due.

-

7.Fill in the credit card payment information section carefully, ensuring accuracy.

-

8.Add any additional notes or terms related to the payment at the bottom, if necessary.

-

9.Review the completed invoice for any errors or omissions.

-

10.Save your finished invoice as a PDF or send it directly to the client via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.