Get the free Employer Information Report 2022. Employer Information Report 2022

Show details

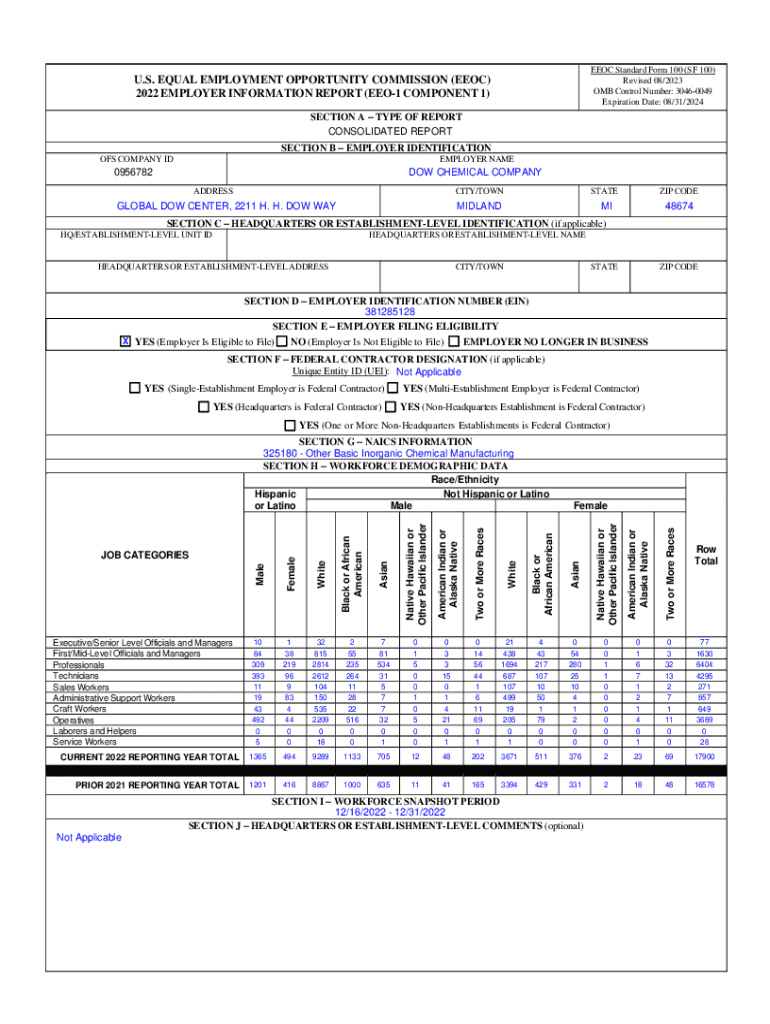

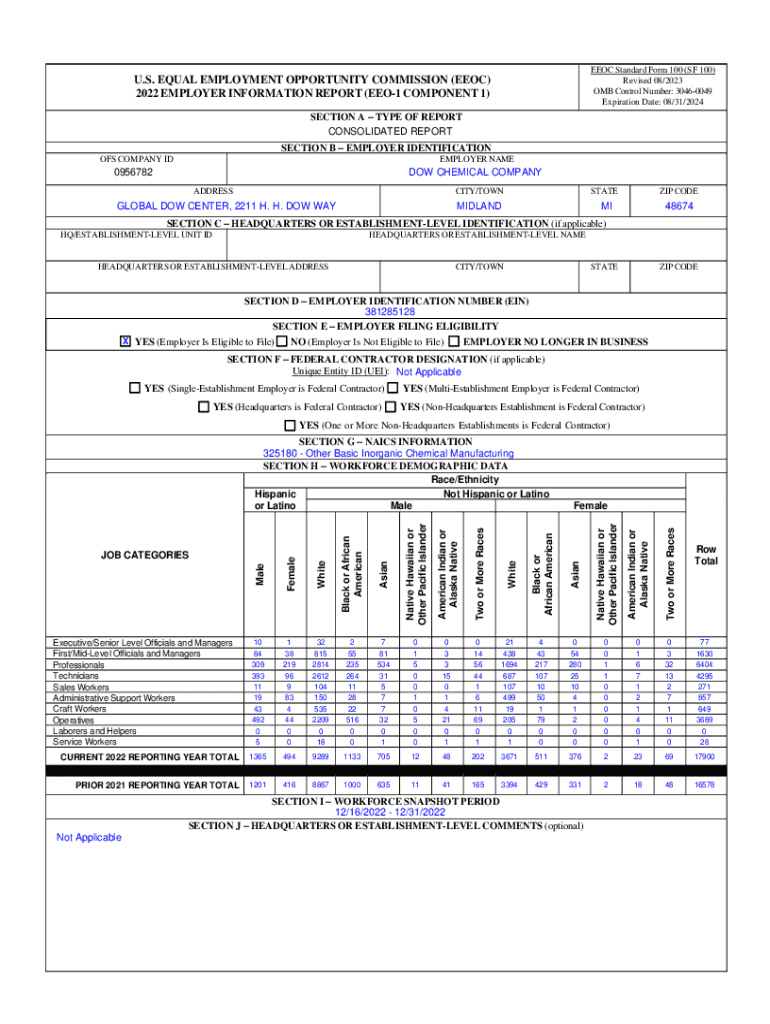

EEOC Standard Form 100 (SF 100)

Revised 08/2023

OMB Control Number: 30460049

Expiration Date: 08/31/2024U. S. EQUAL EMPLOYMENT OPPORTUNITY COMMISSION (EEOC)

2022 EMPLOYER INFORMATION REPORT (EEO1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer information report 2022

Edit your employer information report 2022 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer information report 2022 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer information report 2022 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employer information report 2022. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer information report 2022

How to fill out employer information report 2022

01

Gather all necessary information such as employer details, employee details, and financial information.

02

Access the official website of the governing body where the employer information report needs to be submitted.

03

Look for the specific form for the employer information report 2022.

04

Fill out the form carefully, ensuring all information is accurate and up-to-date.

05

Double-check the form for any errors or missing information before submitting.

06

Submit the completed employer information report through the designated method (online submission, mail, etc.).

Who needs employer information report 2022?

01

Employers who are required by law to report their employee and financial information for the year 2022.

02

Government agencies or regulating bodies that use the employer information report for statistical or compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my employer information report 2022 directly from Gmail?

employer information report 2022 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send employer information report 2022 for eSignature?

When you're ready to share your employer information report 2022, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete employer information report 2022 on an Android device?

Use the pdfFiller Android app to finish your employer information report 2022 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is employer information report employer?

The Employer Information Report, commonly known as EEO-1, is a report required by the Equal Employment Opportunity Commission (EEOC) that provides a snapshot of an employer's workforce demographics, including race, gender, and job category.

Who is required to file employer information report employer?

Private employers with 100 or more employees, as well as federal contractors with 50 or more employees and a contract of $50,000 or more, are required to file the Employer Information Report.

How to fill out employer information report employer?

To fill out the Employer Information Report, employers need to collect data on their workforce demographics and categorize employees by race, gender, and job descriptions. This data is then submitted through the EEOC's online reporting system.

What is the purpose of employer information report employer?

The purpose of the Employer Information Report is to support civil rights enforcement and help the EEOC monitor compliance with anti-discrimination laws.

What information must be reported on employer information report employer?

Employers must report the number of employees by race, ethnicity, and gender across various job categories, including executives, professionals, and administrative staff.

Fill out your employer information report 2022 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Information Report 2022 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.