Get the free 2014 DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule - colorado

Show details

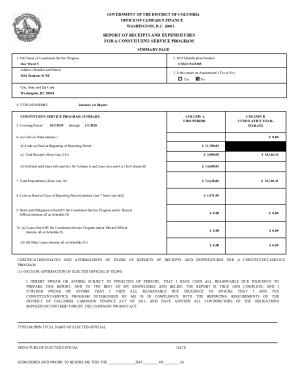

*140104AM19999* DR 0104AMT (09/11/14) COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0005 www.TaxColorado.com 2014 Colorado Alternative Minimum Tax Computation Schedule Individual taxpayers are subject

We are not affiliated with any brand or entity on this form

Instructions and Help about 2014 dr 0104amt colorado

How to edit 2014 dr 0104amt colorado

How to fill out 2014 dr 0104amt colorado

Instructions and Help about 2014 dr 0104amt colorado

How to edit 2014 dr 0104amt colorado

To edit the 2014 dr 0104amt Colorado tax form, download it from the Colorado Department of Revenue website or access it through a tax form service like pdfFiller. If using pdfFiller, you can upload the form and utilize the editing tools to modify any necessary fields.

How to fill out 2014 dr 0104amt colorado

To fill out the 2014 dr 0104amt Colorado tax form, first ensure you have your financial documents at hand, such as W-2s and 1099s. Follow these steps:

01

Download the form from the official Colorado Department of Revenue website.

02

Begin with your personal information at the top, including name, address, and Social Security number.

03

Record your income in the designated sections, including wages and other earnings.

04

Fill in any deductions and credits that apply to your situation.

05

Review your information for accuracy and completeness before submission.

Latest updates to 2014 dr 0104amt colorado

Latest updates to 2014 dr 0104amt colorado

The 2014 dr 0104amt Colorado tax form has undergone a few updates since its initial release. Always verify with the Colorado Department of Revenue for the latest guidelines and requirements to ensure your compliance.

All You Need to Know About 2014 dr 0104amt colorado

What is 2014 dr 0104amt colorado?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2014 dr 0104amt colorado

What is 2014 dr 0104amt colorado?

The 2014 dr 0104amt Colorado tax form is a document used by individuals and businesses to report income and calculate taxes owed for the state of Colorado. It is essential for those who earned taxable income during the 2014 tax year.

What is the purpose of this form?

The purpose of the 2014 dr 0104amt Colorado tax form is to enable individuals to accurately report their income and claim deductions or credits as applicable. This form ensures compliance with Colorado state tax laws and helps determine the correct tax liability.

Who needs the form?

Any individual or entity earning income within Colorado during the tax year 2014 must file the 2014 dr 0104amt tax form. This includes residents, part-year residents, and non-residents who have earned income in Colorado.

When am I exempt from filling out this form?

You may be exempt from filling out the 2014 dr 0104amt Colorado form if your income does not meet the minimum threshold for tax liability or if you are a non-resident without Colorado-source income. Always check the specific exemption criteria outlined by the Colorado Department of Revenue.

Components of the form

The 2014 dr 0104amt Colorado tax form consists of several key components, including:

01

Personal information section for taxpayer identification.

02

Income reporting section for various income sources.

03

Deductions and credits section to lower your taxable income.

04

Final calculations section to determine tax owed or refund due.

Due date

The due date for submitting the 2014 dr 0104amt Colorado tax form is typically April 15 of the following year, which would have been April 15, 2015, for the 2014 tax year. If this date falls on a weekend or holiday, the deadline may be adjusted.

What are the penalties for not issuing the form?

Failure to file the 2014 dr 0104amt Colorado tax form may result in penalties from the state, including fines and interest on any unpaid taxes. It is crucial to file on time to avoid these repercussions.

What information do you need when you file the form?

When filing the 2014 dr 0104amt Colorado tax form, you need various information, including:

01

W-2 forms for employment income.

02

1099 forms for freelance or contract work.

03

Receipts or records for deductible expenses.

04

Tax identification number or Social Security number.

Is the form accompanied by other forms?

Depending on your specific circumstances, the 2014 dr 0104amt Colorado tax form may need to be accompanied by additional forms, such as schedules for additional income, deductions, or credits. Review guidelines provided by the Colorado Department of Revenue for clarity.

Where do I send the form?

The completed 2014 dr 0104amt Colorado tax form should be submitted to the Colorado Department of Revenue. Check the latest submission instructions on their official website to ensure timely delivery to the correct department.

See what our users say