Get the free 10. School Expenses K-12 Worksheet

Show details

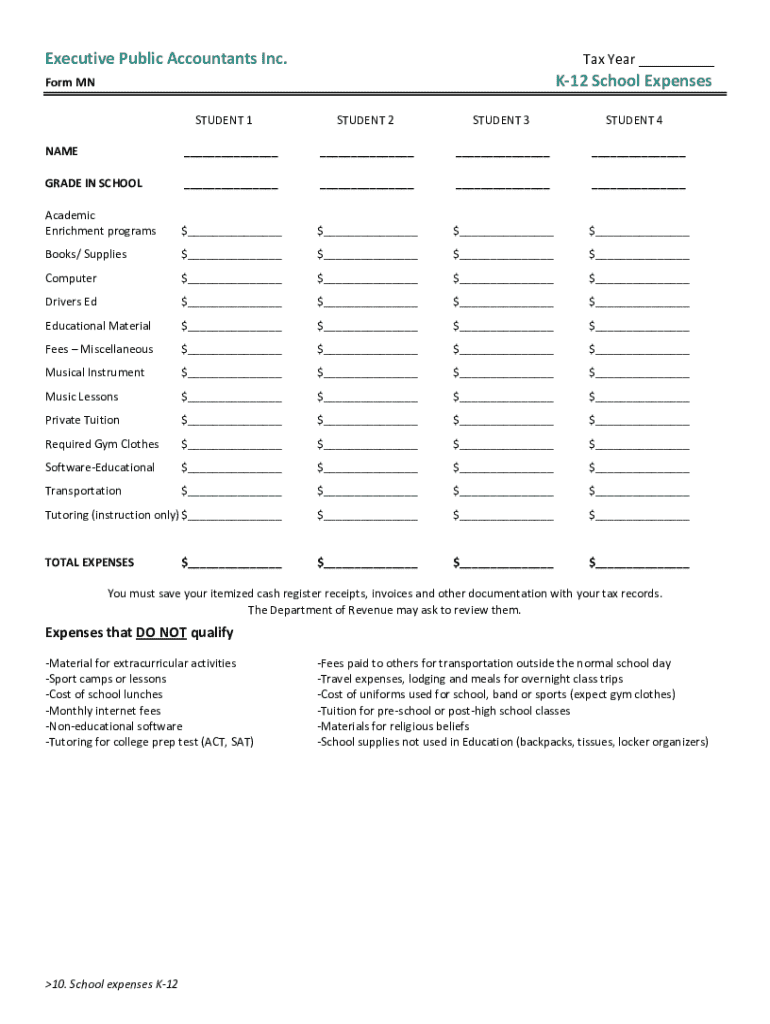

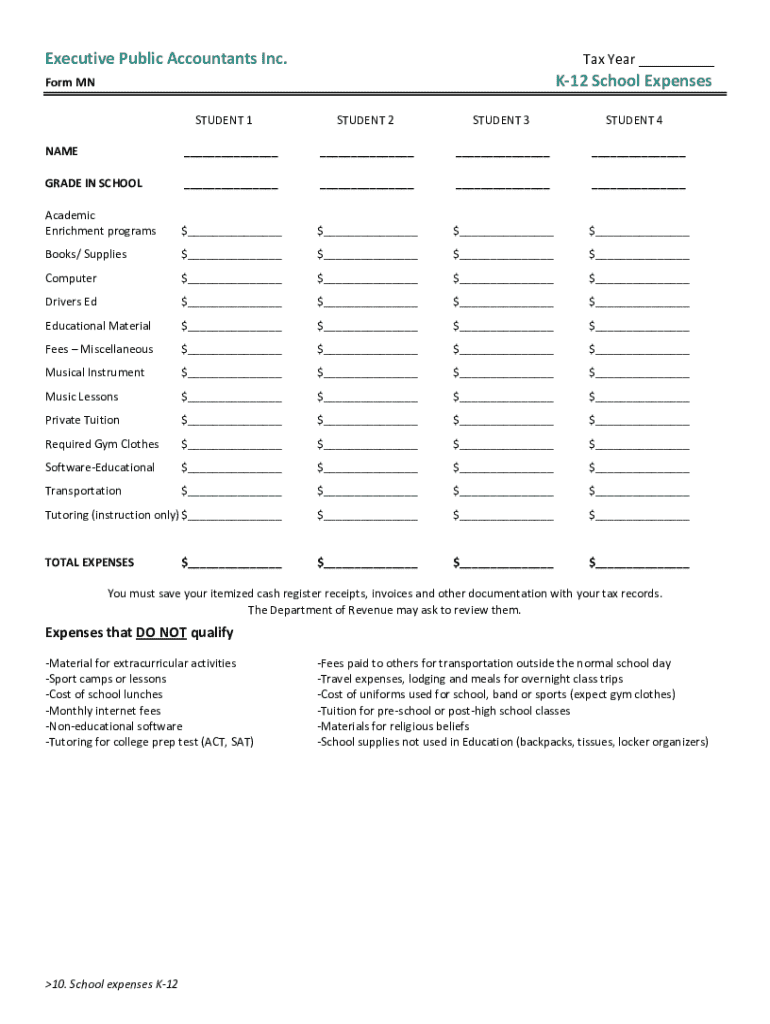

Executive Public Accountants Inc. Tax Year ___K12 School ExpensesForm MN

STUDENT 1STUDENT 2STUDENT 3STUDENT 4NAME____________GRADE IN SCHOOL____________Academic

Enrichment programs___$___$___$___Books/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 10 school expenses k-12

Edit your 10 school expenses k-12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10 school expenses k-12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 10 school expenses k-12 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 10 school expenses k-12. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10 school expenses k-12

How to fill out 10 school expenses k-12

01

Make a list of all the necessary school supplies and expenses for grades K-12.

02

Include items such as textbooks, notebooks, pens, pencils, backpack, lunchbox, uniforms, school fees, field trip expenses, and any extracurricular activity fees.

03

Estimate the cost of each item and create a budget for the total expenses.

04

Shop for the supplies at various stores to find the best prices and deals.

05

Consider buying used or discounted items to save money.

06

Keep track of receipts and expenses to stay within budget.

07

Label all items with the student's name to prevent loss or mix-ups.

08

Prepare for additional expenses that may arise throughout the school year.

09

Review and update the expenses list regularly to ensure all costs are accounted for.

10

Stay organized and plan ahead to avoid last-minute purchases and overspending.

Who needs 10 school expenses k-12?

01

Parents of students attending grades K-12.

02

Guardians or caregivers responsible for purchasing school supplies and covering school expenses.

03

School administrators or educators managing budgets and purchasing supplies for students.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 10 school expenses k-12 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 10 school expenses k-12, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my 10 school expenses k-12 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 10 school expenses k-12 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit 10 school expenses k-12 on an Android device?

You can make any changes to PDF files, such as 10 school expenses k-12, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is 10 school expenses k-12?

10 school expenses K-12 refers to the specific costs incurred by families for their children's education from kindergarten through 12th grade. These expenses may include tuition, textbooks, school supplies, technology fees, transportation, extracurricular activities, field trips, uniforms, sports fees, tutoring, and school-related fees.

Who is required to file 10 school expenses k-12?

Families who incur educational expenses for their children attending school from kindergarten through 12th grade may be required to file 10 school expenses K-12 for tax benefits or deductions.

How to fill out 10 school expenses k-12?

To fill out 10 school expenses K-12, gather records of all eligible expenses throughout the school year, categorize them appropriately, and follow the specific filing guidelines provided by the tax authority. Ensure to provide accurate documentation for each expense claimed.

What is the purpose of 10 school expenses k-12?

The purpose of 10 school expenses K-12 is to provide parents and guardians with an opportunity to claim tax benefits, deductions, or credits for the educational expenses incurred while enrolling their children in K-12 education.

What information must be reported on 10 school expenses k-12?

Information that must be reported includes the nature of the expenses, the amount spent, dates of payments, the name of the educational institution, and any relevant student identification information.

Fill out your 10 school expenses k-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10 School Expenses K-12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.