Get the free NUA (net unrealized appreciation) tax strategy

Show details

NUA Strategies:A Comprehensive OverviewNUA Strategies A Comprehensive Overview2NUA Strategies A Comprehensive OverviewForeword As educators, our role is not to make things easier for our students.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nua net unrealized appreciation

Edit your nua net unrealized appreciation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nua net unrealized appreciation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nua net unrealized appreciation online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nua net unrealized appreciation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nua net unrealized appreciation

How to fill out nua net unrealized appreciation

01

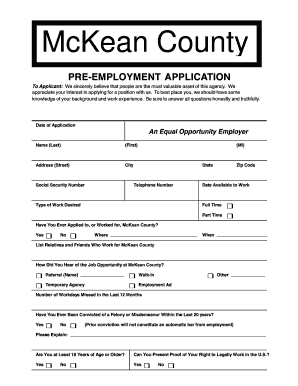

Determine if you are eligible for NUA treatment by having employer stock in a 401(k) or other qualified retirement plan.

02

Meet the requirements for a qualifying event such as reaching age 59 1/2, separation from service, or disability.

03

Request a lump sum distribution of your employer stock from your retirement account.

04

Transfer the employer stock to a taxable brokerage account.

05

File IRS Form 1099-R and report the distribution on your taxes, ensuring proper NUA tax treatment.

Who needs nua net unrealized appreciation?

01

Individuals with employer stock in a retirement account

02

Those who are eligible for NUA treatment under IRS rules

03

Investors looking to take advantage of potential tax benefits

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nua net unrealized appreciation without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your nua net unrealized appreciation into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit nua net unrealized appreciation on an iOS device?

You certainly can. You can quickly edit, distribute, and sign nua net unrealized appreciation on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit nua net unrealized appreciation on an Android device?

You can edit, sign, and distribute nua net unrealized appreciation on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

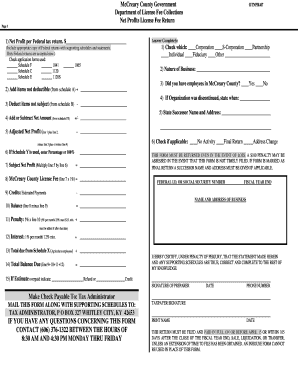

What is nua net unrealized appreciation?

NUA net unrealized appreciation refers to the increase in the value of securities held in a retirement account, primarily an employee stock ownership plan (ESOP) or a 401(k). It represents the difference between the market value of the securities at the time of distribution and their cost basis.

Who is required to file nua net unrealized appreciation?

Individuals who take a distribution from a qualified retirement plan and elect to transfer appreciated securities to a brokerage account for tax treatment as net unrealized appreciation must file for NUA.

How to fill out nua net unrealized appreciation?

To fill out NUA forms, you typically need to report the cost basis and the fair market value of the securities being distributed. This is done on IRS Form 8949 and Schedule D of Form 1040 to report capital gains when the shares are sold.

What is the purpose of nua net unrealized appreciation?

The purpose of NUA is to allow individuals to take advantage of favorable tax treatment on the appreciation of company stock after rolling over other funds to an IRA or a taxable account, which helps in reducing overall tax liabilities.

What information must be reported on nua net unrealized appreciation?

Information that must be reported includes the original cost basis of the shares, the fair market value at the time of distribution, the date of distribution, and any capital gains when the shares are later sold.

Fill out your nua net unrealized appreciation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nua Net Unrealized Appreciation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.