Get the free Property Tax Online Payment

Show details

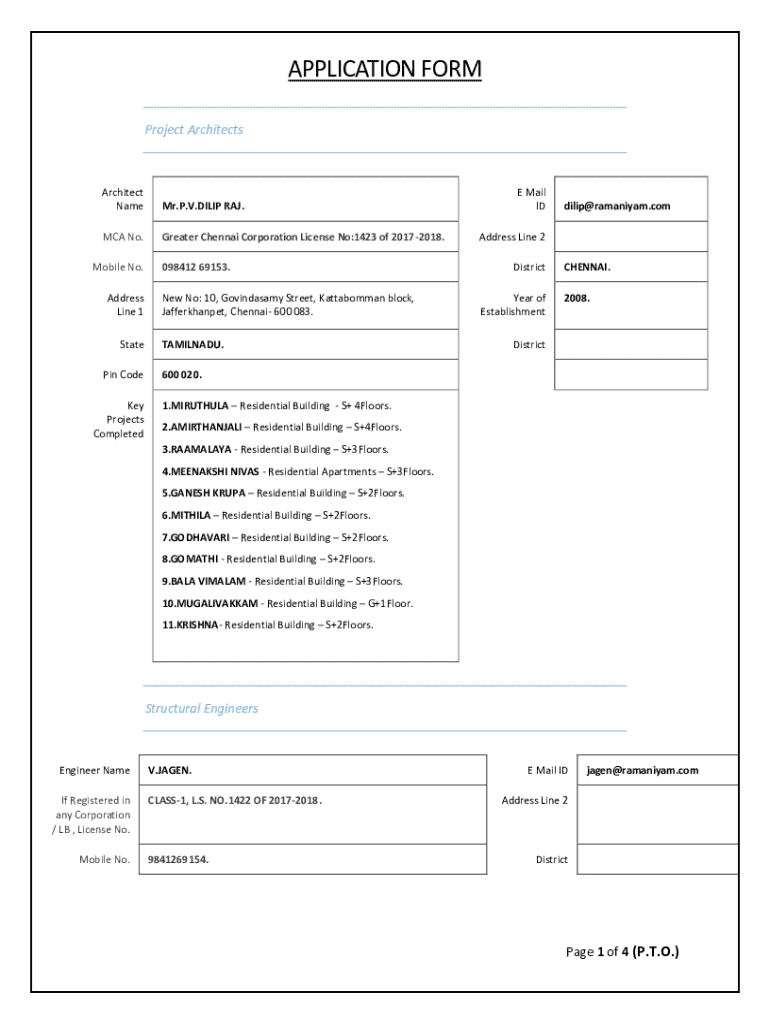

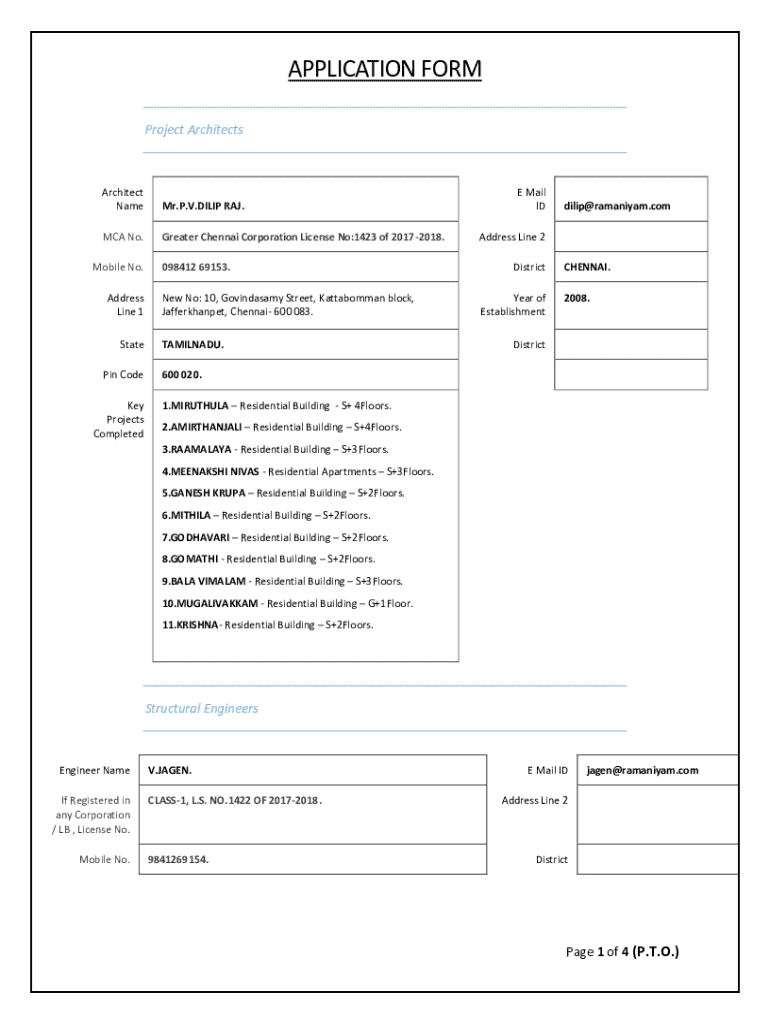

APPLICATION FORM Project ArchitectsArchitect Name Mr. P.V.DIL IP RAJ.MCA No. Greater Chennai Corporation License No:1423 of 20172018. Mobile No. Address Line 1 State Pin Code Key Projects Completed098412

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax online payment

Edit your property tax online payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax online payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax online payment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property tax online payment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax online payment

How to fill out property tax online payment

01

Visit the property tax website of your local government.

02

Look for the online payment section and click on it.

03

Enter the required details such as property ID, owner's name, and payment amount.

04

Choose the payment method (credit card, debit card, net banking, etc).

05

Review the information entered and proceed to make the payment.

06

Once the payment is successful, make sure to keep a copy of the transaction receipt for future reference.

Who needs property tax online payment?

01

Property owners who want to pay their taxes conveniently without visiting the tax office in person.

02

Busy individuals who prefer the ease and speed of online payments.

03

Residents who are located far away from the tax office and find it inconvenient to travel for payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my property tax online payment directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your property tax online payment and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send property tax online payment for eSignature?

property tax online payment is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out property tax online payment using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign property tax online payment and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is property tax online payment?

Property tax online payment is a digital method that allows property owners to pay their property taxes via the internet, making the process more convenient and efficient.

Who is required to file property tax online payment?

Property owners who are liable for property taxes are required to file property tax online payments. This typically includes individuals or entities that own real estate.

How to fill out property tax online payment?

To fill out a property tax online payment, property owners must access the designated tax authority's website, provide the necessary property identification information, enter payment details, and confirm the transaction.

What is the purpose of property tax online payment?

The purpose of property tax online payment is to simplify the payment process, ensuring timely tax payments and reducing the need for paper checks and in-person visits to tax offices.

What information must be reported on property tax online payment?

The information that must be reported includes the property identification number, the amount of tax due, the taxpayer's details, and payment information like credit card or bank account details.

Fill out your property tax online payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Online Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.