Get the free 2007 Audited Financial Statements - Muskegon Charter Township

Show details

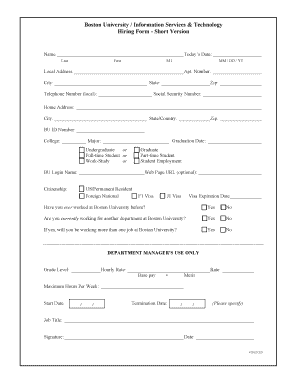

Michigan Department of Treasury 496 (02/06) Auditing Procedures Report Issued under P.A. 2 of 1968, as amended and P.A. 71 of 1919, as amended. 1Local Unit Name Local Unit of Government Type County

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2007 audited financial statements

Edit your 2007 audited financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 audited financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2007 audited financial statements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2007 audited financial statements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2007 audited financial statements

How to fill out 2007 audited financial statements:

01

Start by gathering all the necessary financial data for the year 2007. This includes income statements, balance sheets, cash flow statements, and any other relevant financial records.

02

Review the previous year's audited financial statements to understand the format and requirements.

03

Organize the financial data according to the standard accounting principles and guidelines. This may involve categorizing revenues, expenses, assets, liabilities, and equity.

04

Ensure the accuracy and completeness of the financial data by cross-checking and reconciling the records.

05

Prepare the financial statements by presenting the information in a clear and logical format. This may involve using spreadsheets or financial software to generate professional-looking statements.

06

Include necessary disclosures and footnotes that provide additional information and explanation for certain items in the financial statements.

07

Have the audited financial statements reviewed or audited by a qualified accountant or audit firm to ensure compliance with auditing standards and regulations.

08

Make any necessary adjustments or revisions based on the audit findings or recommendations.

09

Finalize the audited financial statements by signing and dating them, indicating the responsible parties who prepared and reviewed the statements.

Who needs 2007 audited financial statements:

01

Corporations: Companies often need audited financial statements for various purposes, such as meeting legal and regulatory requirements, attracting investors, obtaining loans, or complying with tax obligations.

02

Non-profit organizations: Non-profit organizations may require audited financial statements to demonstrate financial transparency and accountability to donors, grantors, and other stakeholders.

03

Government agencies: Government agencies may request audited financial statements from businesses or organizations to ensure compliance with financial regulations or to assess their financial health.

04

Investors or shareholders: Individuals or entities considering investing in a company may request audited financial statements to evaluate its financial performance and stability.

05

Lenders or creditors: Financial institutions or creditors may require audited financial statements as part of the loan application process to assess the borrower's creditworthiness and ability to repay the debt.

06

Regulatory bodies: Certain industries or sectors may be subject to specific regulations that mandate the submission of audited financial statements to regulatory authorities for monitoring or compliance purposes.

07

Potential buyers or acquirers: When a business is being sold or merged with another, potential buyers or acquirers may request audited financial statements to evaluate the target company's financial situation and potential risks.

08

Internal stakeholders: Even if not legally required, companies or organizations may choose to have their financial statements audited to provide assurance and confidence to their internal stakeholders, such as management, board of directors, or employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is audited financial statements?

Audited financial statements are reports that have been prepared by an independent auditor to provide assurance on the accuracy and fairness of a company's financial position.

Who is required to file audited financial statements?

Publicly traded companies, large private companies, and organizations receiving federal grants or funding may be required to file audited financial statements.

How to fill out audited financial statements?

Audited financial statements are typically filled out by a company's accounting department and reviewed by an independent auditor who will verify the accuracy of the information provided.

What is the purpose of audited financial statements?

The purpose of audited financial statements is to provide stakeholders, such as investors, lenders, and regulators, with assurance that the financial information presented is reliable and accurate.

What information must be reported on audited financial statements?

Audited financial statements typically include a balance sheet, income statement, statement of cash flows, and notes to the financial statements.

How can I send 2007 audited financial statements for eSignature?

To distribute your 2007 audited financial statements, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete 2007 audited financial statements online?

pdfFiller has made it simple to fill out and eSign 2007 audited financial statements. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out 2007 audited financial statements using my mobile device?

Use the pdfFiller mobile app to fill out and sign 2007 audited financial statements on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your 2007 audited financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2007 Audited Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.