Get the free Tax Exempt Organization Search (IRS)

Show details

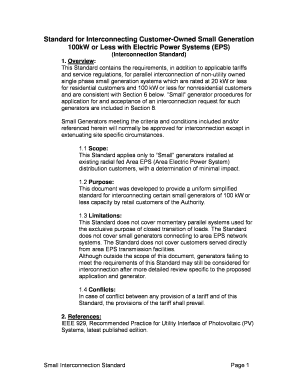

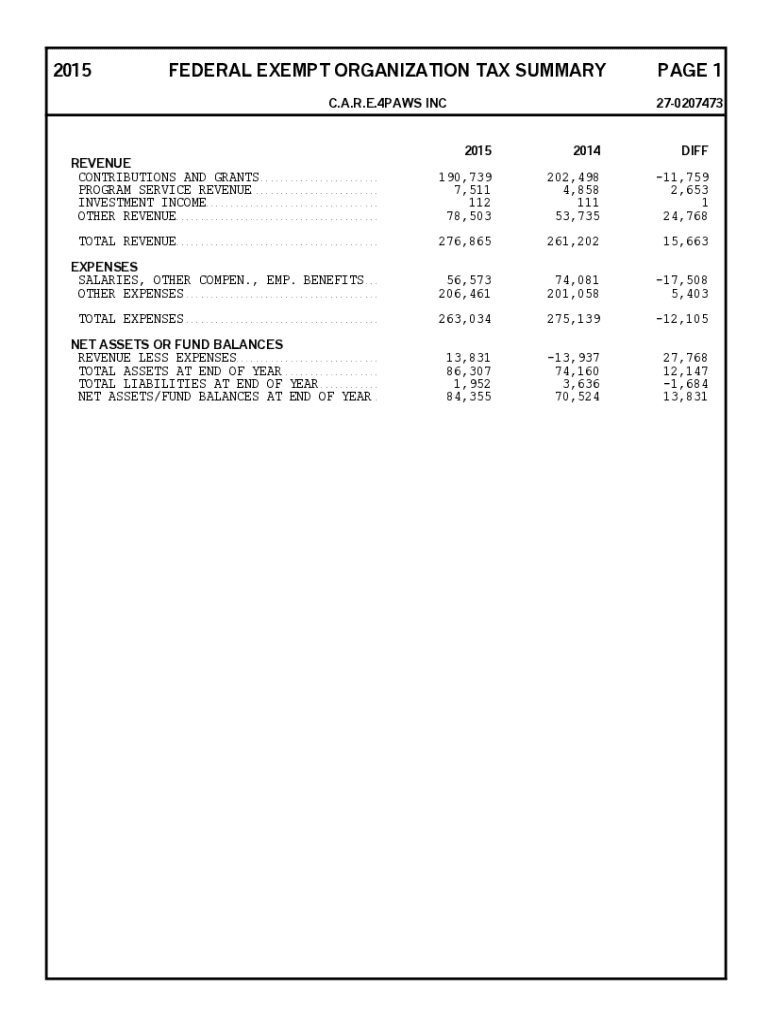

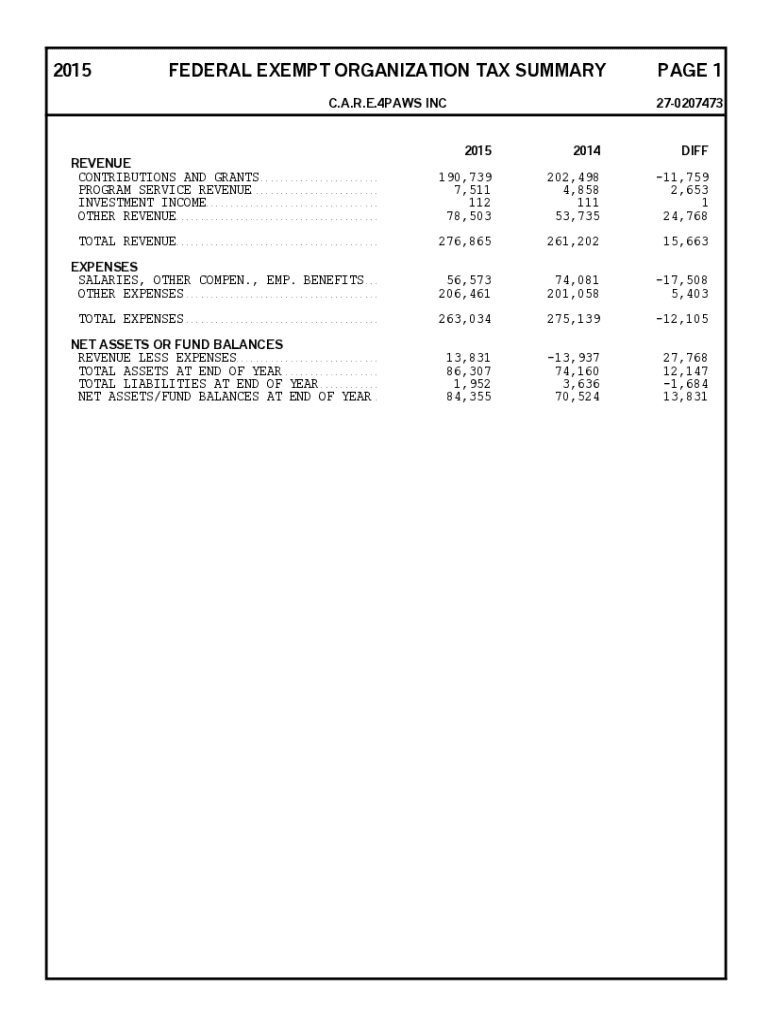

2015FEDERAL EXEMPT ORGANIZATION TAX SUMMARYPAGE 1C. A.R.E.4PAWS INC270207473REVENUE CONTRIBUTIONS AND GRANTS. . . . . . . . . . . . . . . . . . . . . . . . PROGRAM SERVICE REVENUE. . . . . . . . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt organization search

Edit your tax exempt organization search form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt organization search form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exempt organization search online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax exempt organization search. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt organization search

How to fill out tax exempt organization search

01

Go to the IRS website

02

Click on 'Search for Charities' under the 'Charities & Non-Profits' section

03

Enter the name or EIN (Employer Identification Number) of the organization you are searching for

04

Click on 'Search' to view the results

05

Review the information provided to verify if the organization is tax exempt

Who needs tax exempt organization search?

01

Individuals looking to make donations to a tax exempt organization and want to verify its status

02

Organizations or businesses considering partnering with a tax exempt organization and want to ensure its legitimacy

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax exempt organization search without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tax exempt organization search. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find tax exempt organization search?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tax exempt organization search. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the tax exempt organization search form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tax exempt organization search. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is tax exempt organization search?

A tax exempt organization search is a process used to identify and verify organizations that have been granted tax-exempt status by the IRS, typically under Section 501(c) of the Internal Revenue Code.

Who is required to file tax exempt organization search?

Organizations applying for tax-exempt status, or those needing to maintain their status, may be required to file a tax exempt organization search as part of the compliance and verification process for their financial activities.

How to fill out tax exempt organization search?

To fill out a tax exempt organization search, organizations typically need to provide their legal name, EIN (Employer Identification Number), and details regarding their operations and activities. The process can be completed through designated IRS forms or online systems designed for tax-exempt status verification.

What is the purpose of tax exempt organization search?

The purpose of a tax exempt organization search is to ensure transparency and accountability in the use of tax-exempt status, helping to inform the public and donors about the eligibility and legitimacy of charitable organizations.

What information must be reported on tax exempt organization search?

Information that must be reported includes the organization's name, address, EIN, the type of tax exemption being claimed, a description of its activities, and financial information such as revenue and expenses.

Fill out your tax exempt organization search online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Organization Search is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.