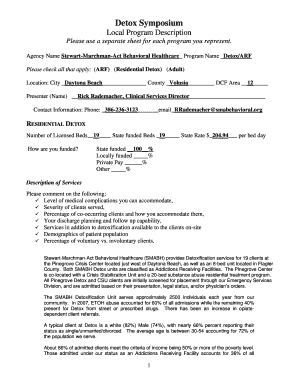

IL Real Estate Transfer Declaration Form - City of Evanston 2023-2025 free printable template

Show details

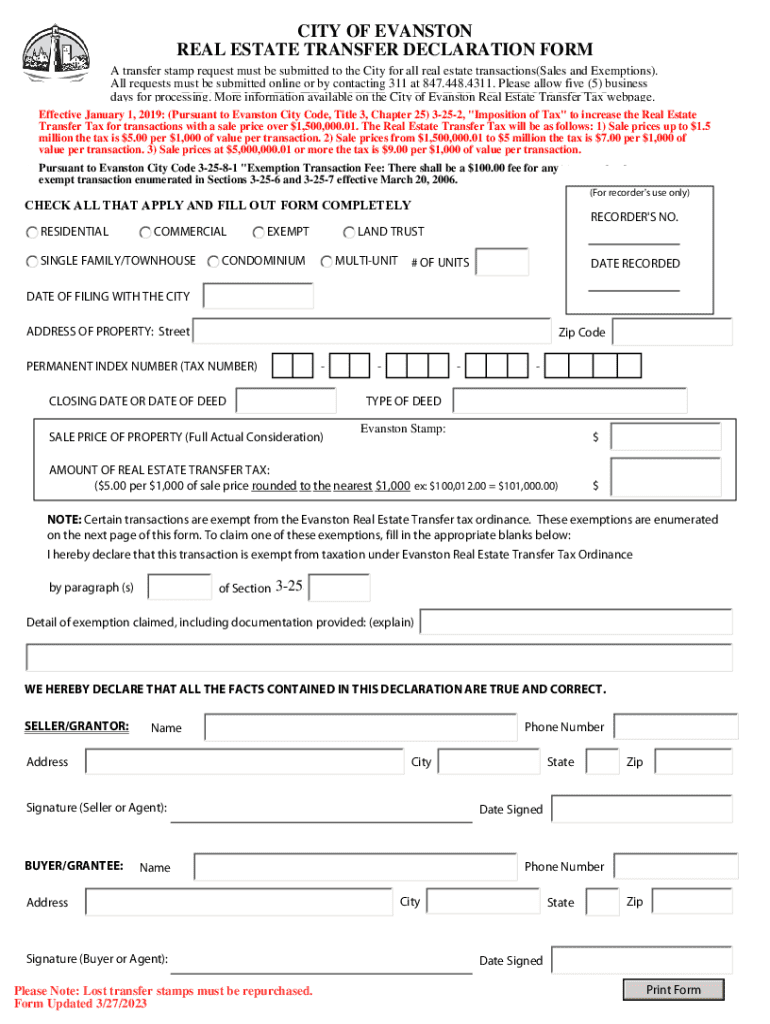

CITY OF EVANSTON

REAL ESTATE TRANSFER DECLARATION From

A transfer stamp request must be submitted to the City for all real estate transactions(Sales and Exemptions).

All requests must be submitted

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign relates to form following

Edit your relates to form following form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your relates to form following form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing relates to form following online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit relates to form following. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL Real Estate Transfer Declaration Form - City of Evanston Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out relates to form following

How to fill out IL Real Estate Transfer Declaration Form

01

Obtain the IL Real Estate Transfer Declaration Form from your local county assessor’s office or online.

02

Fill in the property address in the designated area at the top of the form.

03

Provide the names of the buyer and seller in the respective fields.

04

Indicate the sale date of the property.

05

Enter the purchase price of the property.

06

If applicable, disclose any applicable exemptions or deductions.

07

Sign and date the form to certify its accuracy.

08

Submit the completed form to your local assessor's office or with the deed during the transfer.

Who needs IL Real Estate Transfer Declaration Form?

01

All sellers of real estate in Illinois are required to complete the IL Real Estate Transfer Declaration Form.

02

Buyers may also need this form as part of the closing process to ensure all property details are recorded.

03

Real estate agents and attorneys involved in the transaction must ensure the form is filled out accurately.

Fill

form

: Try Risk Free

People Also Ask about

Who pays the transfer tax in NY?

Who pays the real estate transfer tax in New York? The tax is generally paid for by the seller and can't be imposed on the buyer. However, there are certain exceptions to this rule (new construction often transfers the obligation to the buyer).

How do I transfer ownership of a property in NY?

The most common way to transfer land ownership, especially residential property, is with a warranty deed. Warranty deeds not only make it possible for a property owner to transfer ownership to the buyer. But this type of deed also explicitly promises that the title is good and clear of all liens or other issues.

What is an IT 2663 form?

Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT‑2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

Do I have to pay NY taxes if I work remotely?

This rule requires taxpayers who switch from commuting across state lines into New York to working remotely in their home state to continue paying taxes to New York — so long as their switch to remote work was a matter of “convenience” and not absolute necessity.

What is the standard deduction for 2023 in NY?

What is New York state's standard deduction? The standard deduction allows taxpayers to reduce their taxable income by a fixed amount. The New York state standard deductions for tax year 2022 (taxes filed in 2023) are: Single: $8,000.

How much is New York State transfer tax?

New York State Transfer Tax When combined with the NYC Real Property transfer tax, buyers can expect to pay a total New York transfer tax of between 1.4% and 2.075% depending on the price of the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send relates to form following for eSignature?

To distribute your relates to form following, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get relates to form following?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific relates to form following and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in relates to form following?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your relates to form following to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

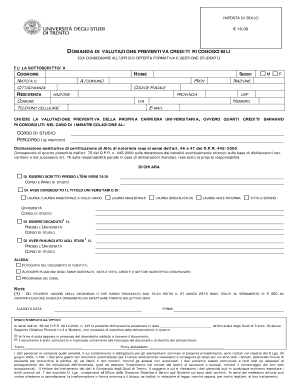

What is IL Real Estate Transfer Declaration Form?

The IL Real Estate Transfer Declaration Form is a document that provides information about the transfer of real property in Illinois, including details about the property, the sale price, and the parties involved.

Who is required to file IL Real Estate Transfer Declaration Form?

The seller or the seller's agent is typically required to file the IL Real Estate Transfer Declaration Form when real property is sold in Illinois.

How to fill out IL Real Estate Transfer Declaration Form?

To fill out the IL Real Estate Transfer Declaration Form, you need to provide information such as the names of the buyer and seller, property address, sale price, and any exemptions that may apply, ensuring all sections are completed accurately.

What is the purpose of IL Real Estate Transfer Declaration Form?

The purpose of the IL Real Estate Transfer Declaration Form is to provide a record of real estate transactions for assessment and taxation purposes, and to ensure compliance with state and local laws related to property transfers.

What information must be reported on IL Real Estate Transfer Declaration Form?

Required information includes the names and addresses of the buyer and seller, the property's legal description, the sale price, the date of transfer, and any applicable exemptions or adjustments.

Fill out your relates to form following online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Relates To Form Following is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.