Get the free Tax Cap - States of Guernsey

Show details

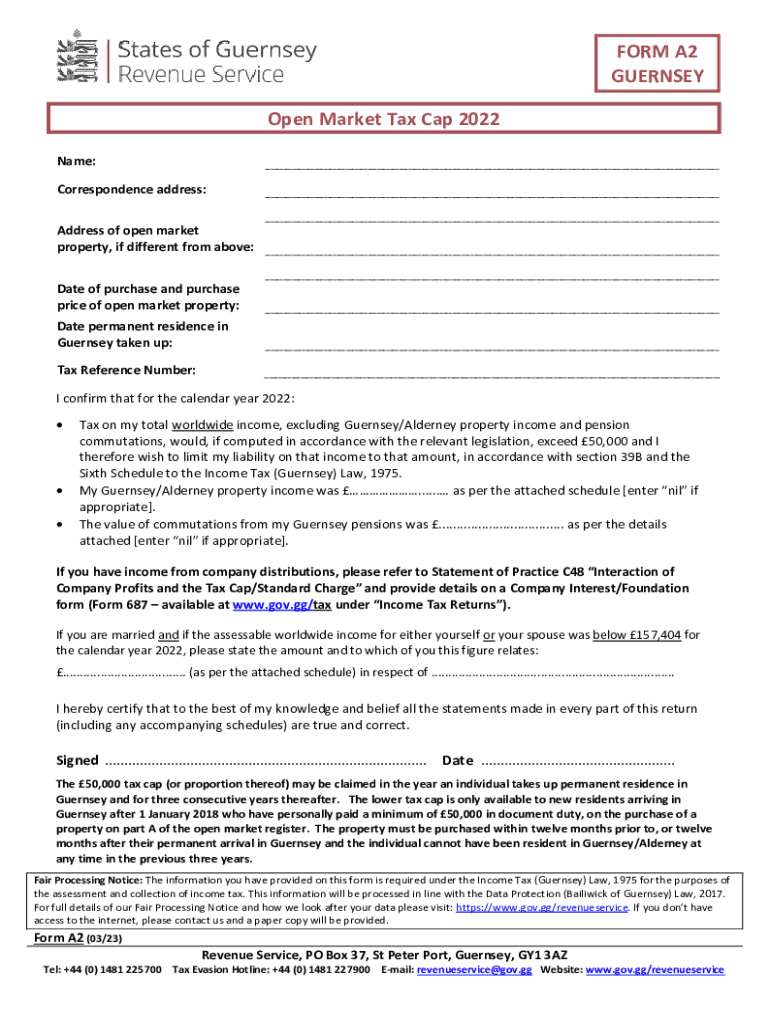

FORM A2 GUERNSEY Open Market Tax Cap 2022 Name: Correspondence address: Address of open market property, if different from above: Date of purchase and purchase price of open market property: Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax cap - states

Edit your tax cap - states form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax cap - states form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax cap - states online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax cap - states. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax cap - states

How to fill out tax cap - states

01

Gather all necessary tax documents such as W-2s, 1099s, and any other forms that show income

02

Fill out Form 1040 or applicable tax form for your state

03

Include any deductions or credits that you qualify for

04

Double check all information for accuracy before submitting

Who needs tax cap - states?

01

States that want to limit the growth of property taxes or other taxes may implement a tax cap to ensure that increases do not exceed a certain percentage

02

Tax cap - states can be beneficial for taxpayers looking for predictability and stability in their tax obligations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax cap - states?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax cap - states and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute tax cap - states online?

pdfFiller makes it easy to finish and sign tax cap - states online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit tax cap - states on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax cap - states on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tax cap - states?

A tax cap refers to a limitation set by state law on the amount of property tax that can be levied or increased by local governments or taxing entities within a specified period.

Who is required to file tax cap - states?

Typically, local governments, counties, and municipalities that impose property taxes are required to file under tax cap regulations, ensuring they adhere to the established limits.

How to fill out tax cap - states?

Filling out tax cap forms usually involves providing details about the assessed property taxes, calculations reflecting compliance with the tax cap, and any justifications for exceeding limits if applicable.

What is the purpose of tax cap - states?

The purpose of a tax cap is to protect taxpayers from excessive tax increases and to promote predictable and manageable tax rates within local jurisdictions.

What information must be reported on tax cap - states?

Reported information typically includes proposed tax rates, previous year's taxes, reasons for tax changes, and compliance with statutory limitations on tax increases.

Fill out your tax cap - states online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Cap - States is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.