PenFed Fannie Mae/Freddie Mac Form 710 2021-2026 free printable template

Show details

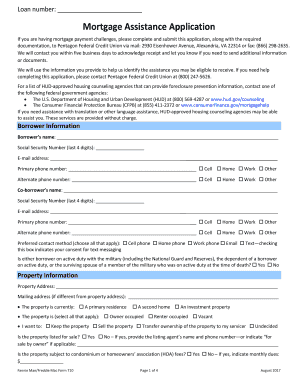

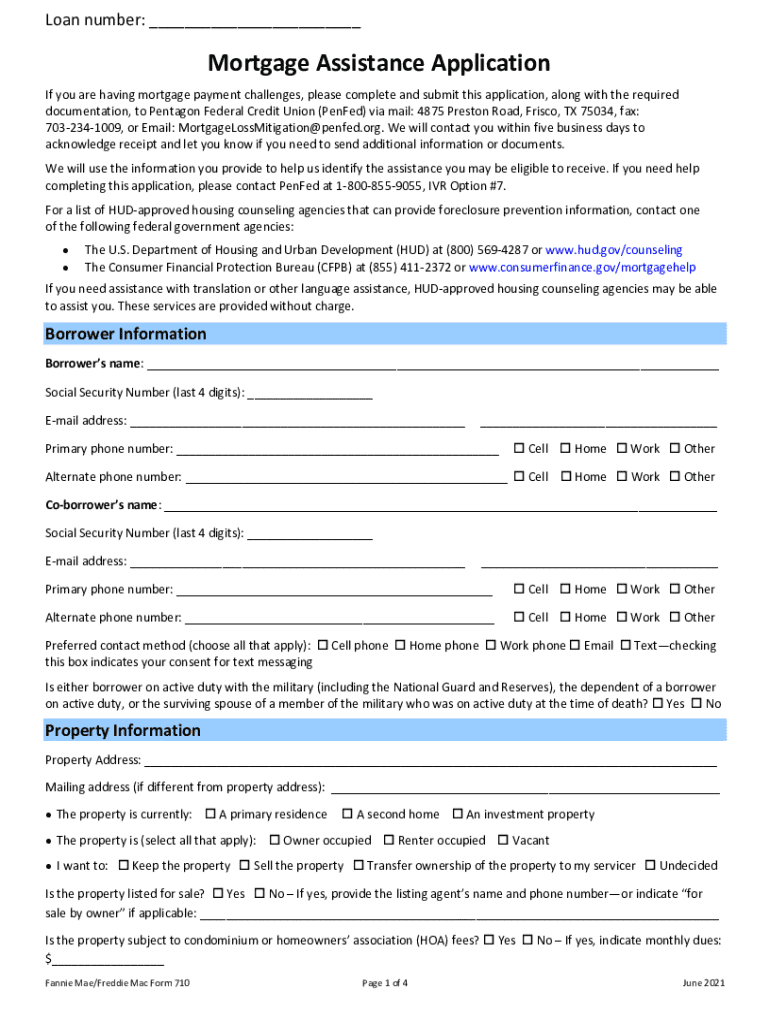

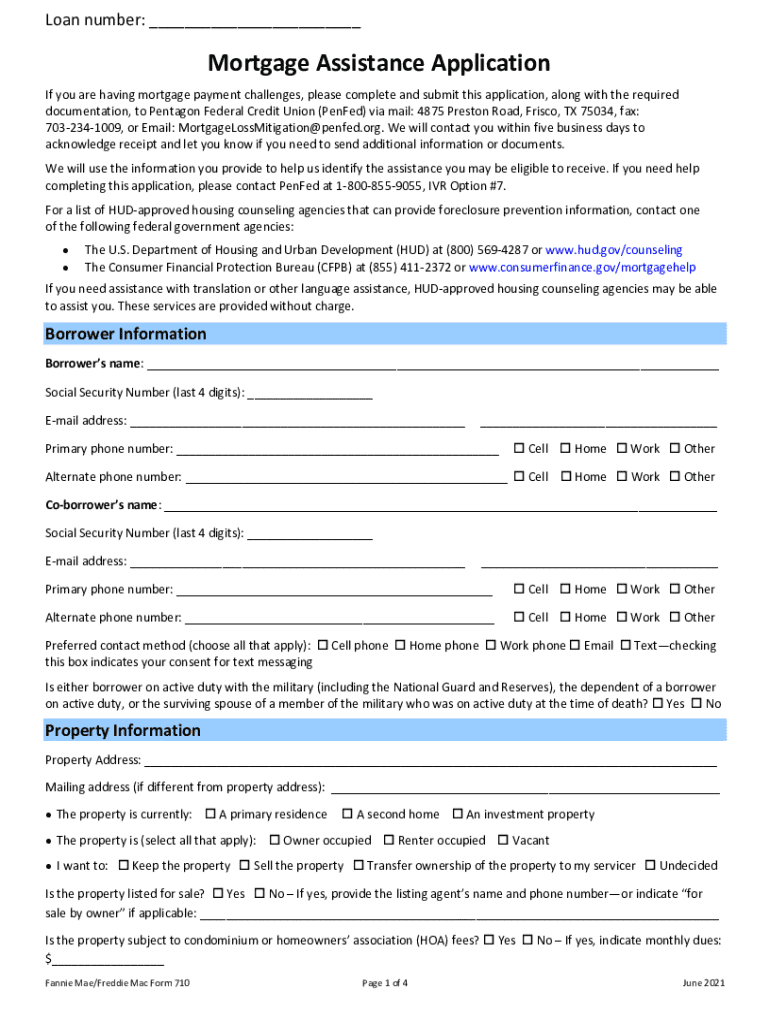

Loan number: ___Mortgage Assistance Application

If you are having mortgage payment challenges, please complete and submit this application, along with the required

documentation, to Pentagon Federal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PenFed Fannie MaeFreddie Mac Form 710

Edit your PenFed Fannie MaeFreddie Mac Form 710 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PenFed Fannie MaeFreddie Mac Form 710 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PenFed Fannie MaeFreddie Mac Form 710 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PenFed Fannie MaeFreddie Mac Form 710. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PenFed Fannie Mae/Freddie Mac Form 710 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PenFed Fannie MaeFreddie Mac Form 710

How to fill out PenFed Fannie Mae/Freddie Mac Form 710

01

Obtain the PenFed Fannie Mae/Freddie Mac Form 710 from the PenFed website or your lender.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide information about the property in question, such as the address, type of property, and loan information.

05

Enter your financial information accurately, including income, assets, and liabilities as requested.

06

Include any relevant documentation to support your application, such as pay stubs or asset statements.

07

Review the completed form for accuracy and completeness before submitting.

08

Sign and date the form to validate your application.

09

Submit the form to your lender or the appropriate institution as per the instructions.

Who needs PenFed Fannie Mae/Freddie Mac Form 710?

01

Homeowners seeking to modify their mortgage under the Fannie Mae or Freddie Mac programs.

02

Borrowers who are experiencing financial hardship and need assistance to keep their home.

03

Individuals looking to refinance their mortgage with PenFed under Fannie Mae or Freddie Mac guidelines.

04

Anyone who has a mortgage backed by Fannie Mae or Freddie Mac and needs to provide official documentation for loan processing.

Fill

form

: Try Risk Free

People Also Ask about

What is the phone number to PenFed?

Log in to PenFed Online. Scroll down to your account and click on the account name or nickname. Log in to the PenFed Mobile App. Tap the account you want to view. Tap the blue plus icon. at the right of the Available Balance to display the full account number and PenFed's routing number.

Is PenFed payable on death?

Upon the death of a joint owner without survivor- ship, PenFed may, upon request, pay funds in the account to surviving joint owners, or to the representative or heirs of the deceased owner. Ownership of the funds will be determined between these parties.

What is the phone number for Penfed Estate accounts?

CALL US at 1-800-247-5626.

What is a hardship loan?

If your Universal Credit has been cut because of a sanction or penalty for fraud, you might be able to get some emergency money to help you cover household expenses like food and bills. This is called a 'hardship payment'. A hardship payment is a loan, so you'll usually have to pay it back when your sanction ends.

What is a permanent hardship?

Definition: permanent hardship Permanent hardship means that the income support recipient's financial situation is unlikely to improve in the foreseeable future.

Does Penfed offer forbearance?

Depending on your loan type, we have the following relief options for you: Deferring payments. Forbearance Plan.

How do you get approved for PenFed?

ing to current PenFed membership requirements, all you need to do is open a regular savings account or a premium online savings account and fund it with $5. You may also become a member by applying for any other PenFed product, such as a money market account, a loan or a credit card.

Does PenFed have a grace period on loans?

PenFed is federally insured through the National Credit Union Administration (NCUA). Autopay is available via PenFed checking account or savings account. There is a five-day grace period for monthly payments; otherwise, late payment fees are 20% of the amount you pay in interest each month.

Does PenFed offer forbearance?

Depending on your loan type, we have the following relief options for you: Deferring payments. Forbearance Plan.

Does PenFed do a soft pull?

While some credit unions carry out hard credit pulls when dealing with membership applications, PenFed only conducts a soft pull of your credit report to verify your identity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get PenFed Fannie MaeFreddie Mac Form 710?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific PenFed Fannie MaeFreddie Mac Form 710 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out PenFed Fannie MaeFreddie Mac Form 710 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign PenFed Fannie MaeFreddie Mac Form 710 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit PenFed Fannie MaeFreddie Mac Form 710 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute PenFed Fannie MaeFreddie Mac Form 710 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is PenFed Fannie Mae/Freddie Mac Form 710?

PenFed Fannie Mae/Freddie Mac Form 710 is a document used in the mortgage process that helps evaluate a borrower's eligibility for a loan backed by Fannie Mae or Freddie Mac, detailing financial information and confirming the borrower's identity.

Who is required to file PenFed Fannie Mae/Freddie Mac Form 710?

Borrowers applying for conventional loans that are backed by Fannie Mae or Freddie Mac are required to file PenFed Fannie Mae/Freddie Mac Form 710 as part of their loan application process.

How to fill out PenFed Fannie Mae/Freddie Mac Form 710?

To fill out PenFed Fannie Mae/Freddie Mac Form 710, borrowers must provide accurate personal and financial information, including income, debts, assets, and other relevant details as instructed on the form, ensuring all sections are completed entirely.

What is the purpose of PenFed Fannie Mae/Freddie Mac Form 710?

The purpose of PenFed Fannie Mae/Freddie Mac Form 710 is to collect essential data to assess a borrower's financial situation, ensuring that they meet the underwriting criteria for obtaining a mortgage loan supported by these government-sponsored enterprises.

What information must be reported on PenFed Fannie Mae/Freddie Mac Form 710?

Information that must be reported on PenFed Fannie Mae/Freddie Mac Form 710 includes the borrower's personal identification details, income sources, employment history, debt obligations, asset values, and any other relevant financial information as specified in the form instructions.

Fill out your PenFed Fannie MaeFreddie Mac Form 710 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PenFed Fannie MaeFreddie Mac Form 710 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.