Get the free State Tax Form 96-1 - mass

Show details

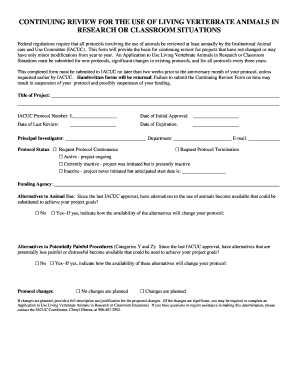

17 The Commonwealth of Massachusetts State Tax Form 96-1 41 Assessors Use only Date Received Revised 7/2015 Application No. Parcel I'd. Name of City or Town SENIOR FISCAL YEAR APPLICATION FOR STATUTORY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state tax form 96-1

Edit your state tax form 96-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state tax form 96-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state tax form 96-1 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state tax form 96-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state tax form 96-1

How to fill out state tax form 96-1?

01

Start by gathering all relevant documents such as W-2 forms, 1099 forms, and any other income or deduction records.

02

Read through the instructions provided with the form 96-1 to understand the requirements and information needed.

03

Begin filling out the personal information section, including your name, address, and social security number.

04

Proceed to the income section and enter the details of your earnings for the tax year, including wages, salaries, and any other income sources.

05

If applicable, provide information about any deductions or credits you are eligible for, such as mortgage interest or education expenses.

06

Double-check all the information you have entered to ensure accuracy and completeness.

07

If you are filing jointly or claiming dependents, provide their information following the specified sections on the form.

08

Sign and date the form to certify the accuracy of the information provided.

09

Make a copy of the completed form for your records before submitting it to the appropriate tax authorities.

Who needs state tax form 96-1?

01

Individuals who are required to file state taxes must use state tax form 96-1.

02

This form is typically used by residents of a particular state to report their income, deductions, credits, and tax liability.

03

The specific criteria for needing form 96-1 may vary depending on the state's tax laws and requirements, so it is essential to consult the specific instructions or consult with a tax professional to determine if this form is necessary for your situation.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a property tax abatement in MA?

Taxpayers seeking to obtain an abatement of a tax or penalty that has been assessed by DOR should use MassTaxConnect (MTC) and follow the instructions provided for disputing a tax or penalty. Alternatively, taxpayers may file a paper Form ABT, Application for Abatement.

What is the medical dental exemption in Massachusetts?

Medical/dental exemption For 2022, if you itemize on U.S. Schedule A (Line 4) and have medical/dental expenses greater than 7.5% of federal AGI, you may claim a medical and dental exemption in Massachusetts equal to the amount you reported on U.S. Schedule A, line 4.

At what age do you stop paying property tax in Massachusetts?

Eligibility. You may be eligible for this exemption if you meet the following requirements: You are 65 years old or older as of July 1 of the fiscal year. You owned and occupied your current property as your domicile as of July 1 of the fiscal year.

How much is a pension taxed in Massachusetts?

Massachusetts is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.00%.

How are pensions taxed in Massachusetts?

Pension and Retirement Income Income from most private pensions or annuity plans is taxable in Massachusetts but many government pensions are exempt. Withdrawals from a traditional IRA are taxable but the Massachusetts taxable amount may be different from the federal taxable amount.

Are pensions taxable income in Massachusetts?

Pension and Retirement Income Income from most private pensions or annuity plans is taxable in Massachusetts but many government pensions are exempt. Withdrawals from a traditional IRA are taxable but the Massachusetts taxable amount may be different from the federal taxable amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the state tax form 96-1 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your state tax form 96-1 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the state tax form 96-1 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign state tax form 96-1 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete state tax form 96-1 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your state tax form 96-1, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is state tax form 96-1?

State tax form 96-1 is a form used to report state income tax information to the tax authorities.

Who is required to file state tax form 96-1?

Individuals and businesses who have taxable income in the state are required to file state tax form 96-1.

How to fill out state tax form 96-1?

State tax form 96-1 must be filled out with accurate information regarding income, deductions, credits, and any other required details as per the instructions provided with the form.

What is the purpose of state tax form 96-1?

The purpose of state tax form 96-1 is to report income earned in the state and calculate the amount of state income tax owed or refunded.

What information must be reported on state tax form 96-1?

State tax form 96-1 requires information on income sources, deductions, credits, and any other relevant tax-related details as per the specific requirements of the state tax laws.

Fill out your state tax form 96-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Tax Form 96-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.