Get the free Travel Expenses: Allowed - Controller's Department

Show details

Reimbursement Guidelines. Mileage Reimbursement Unless otherwise species by the Employees Department, mileage reimbursement will be assessed at the IRS rate of $0.67 per mile within (less than, or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign travel expenses allowed

Edit your travel expenses allowed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your travel expenses allowed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit travel expenses allowed online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit travel expenses allowed. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

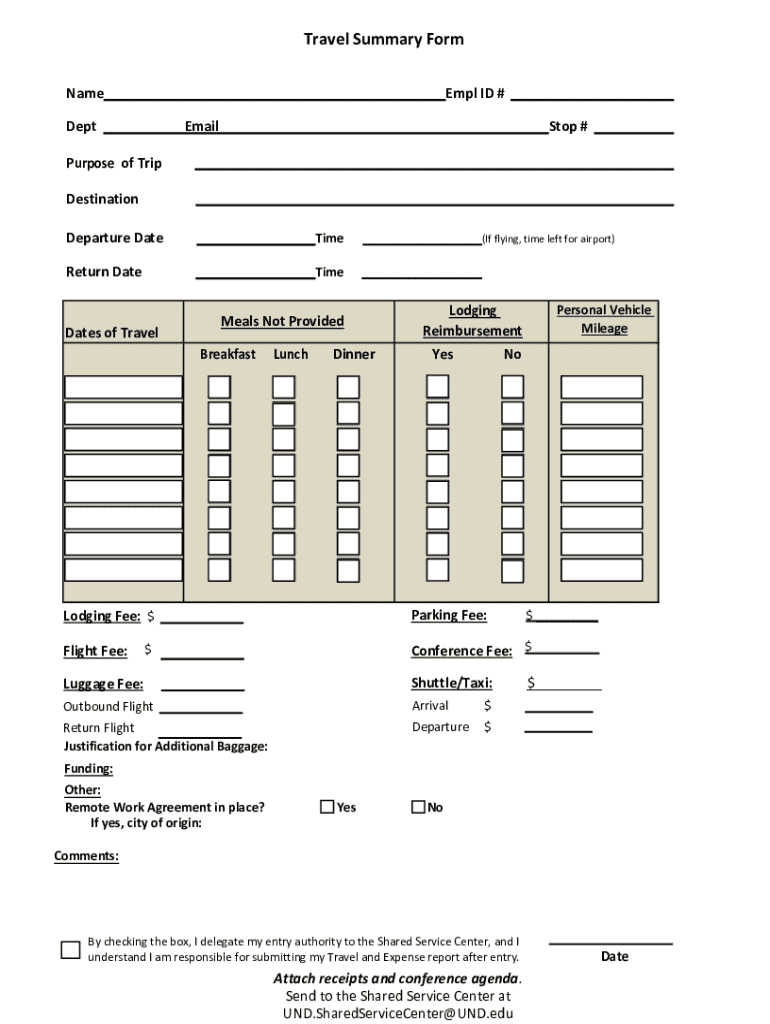

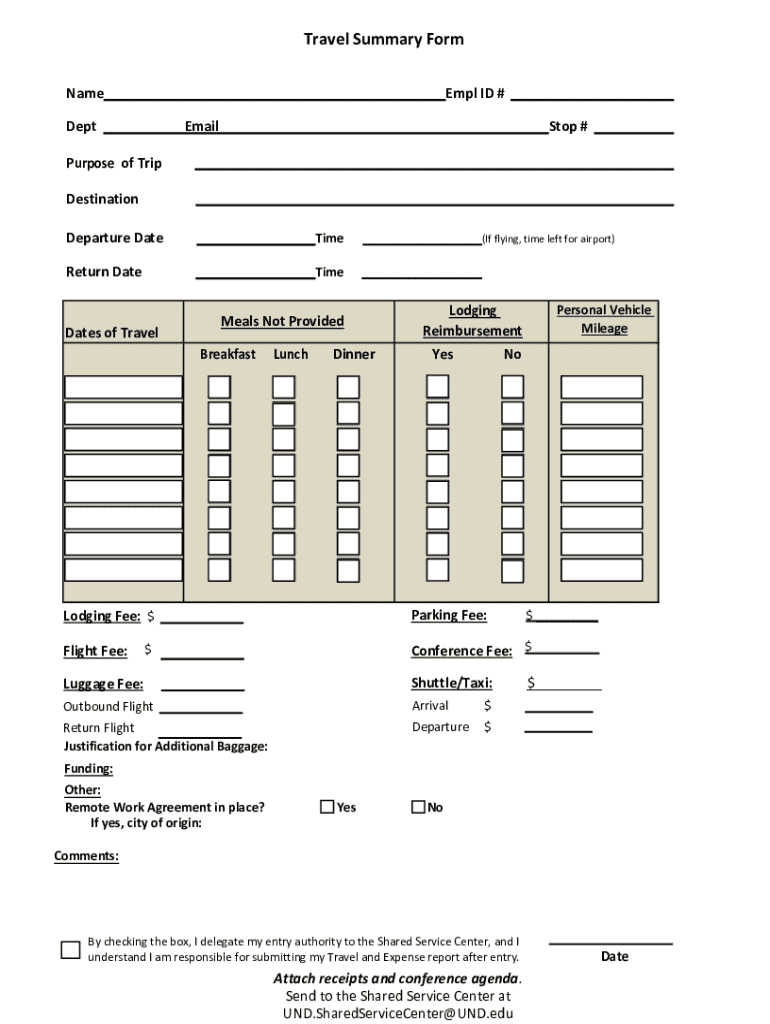

How to fill out travel expenses allowed

How to fill out travel expenses allowed

01

Gather all receipts and documentation related to travel expenses incurred.

02

Fill out the travel expenses form provided by the company or organization.

03

Include details such as date of travel, purpose of trip, mode of transportation, distance traveled, and any accommodations or meals purchased.

04

Double-check all information for accuracy and attach the necessary receipts before submitting the form for approval.

Who needs travel expenses allowed?

01

Employees who have incurred travel expenses for work-related trips and are seeking reimbursement from their employer.

02

Freelancers or contractors who have agreed upon a travel expenses allowance as part of their contract.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my travel expenses allowed directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign travel expenses allowed and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit travel expenses allowed from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your travel expenses allowed into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the travel expenses allowed in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your travel expenses allowed and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is travel expenses allowed?

Travel expenses allowed refers to the reimbursement or allowance for costs associated with travel for business purposes.

Who is required to file travel expenses allowed?

Employees who incur travel expenses for business purposes are required to file travel expenses allowed.

How to fill out travel expenses allowed?

Travel expenses allowed can be filled out by documenting the expenses incurred during travel, including transportation, accommodation, meals, and other related costs.

What is the purpose of travel expenses allowed?

The purpose of travel expenses allowed is to reimburse employees for the costs they incur while traveling for business purposes.

What information must be reported on travel expenses allowed?

The information that must be reported on travel expenses allowed includes the date of travel, purpose of travel, expenses incurred, receipts, and any other supporting documentation.

Fill out your travel expenses allowed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Travel Expenses Allowed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.