NY TR-579-WT 2024-2025 free printable template

Show details

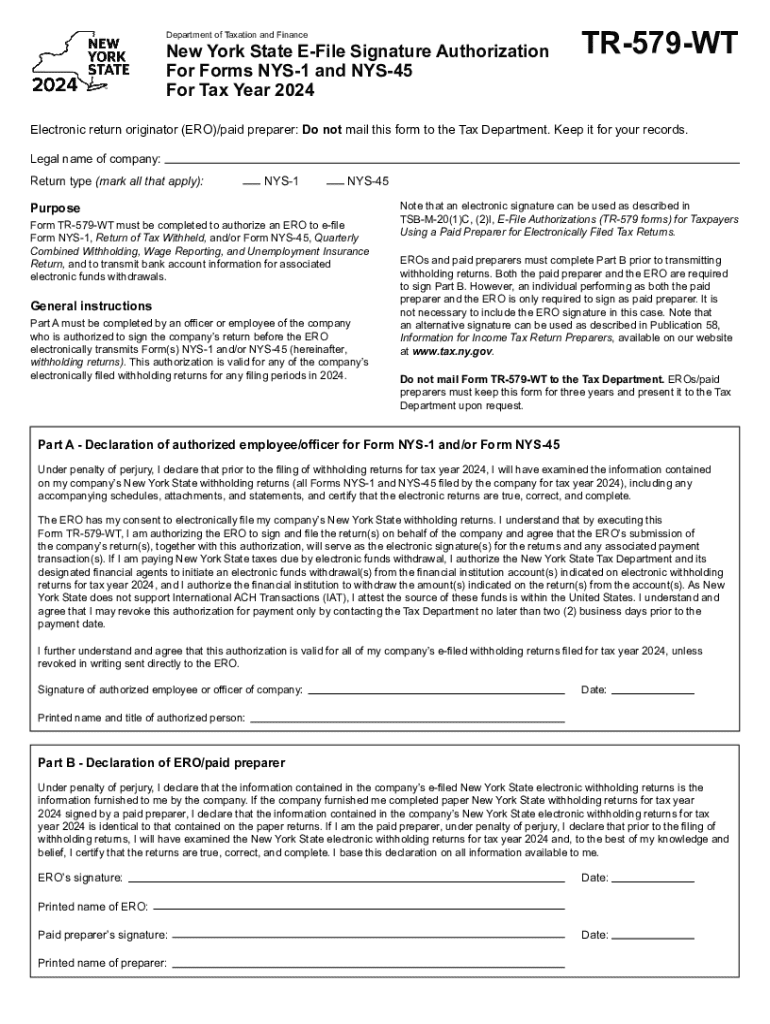

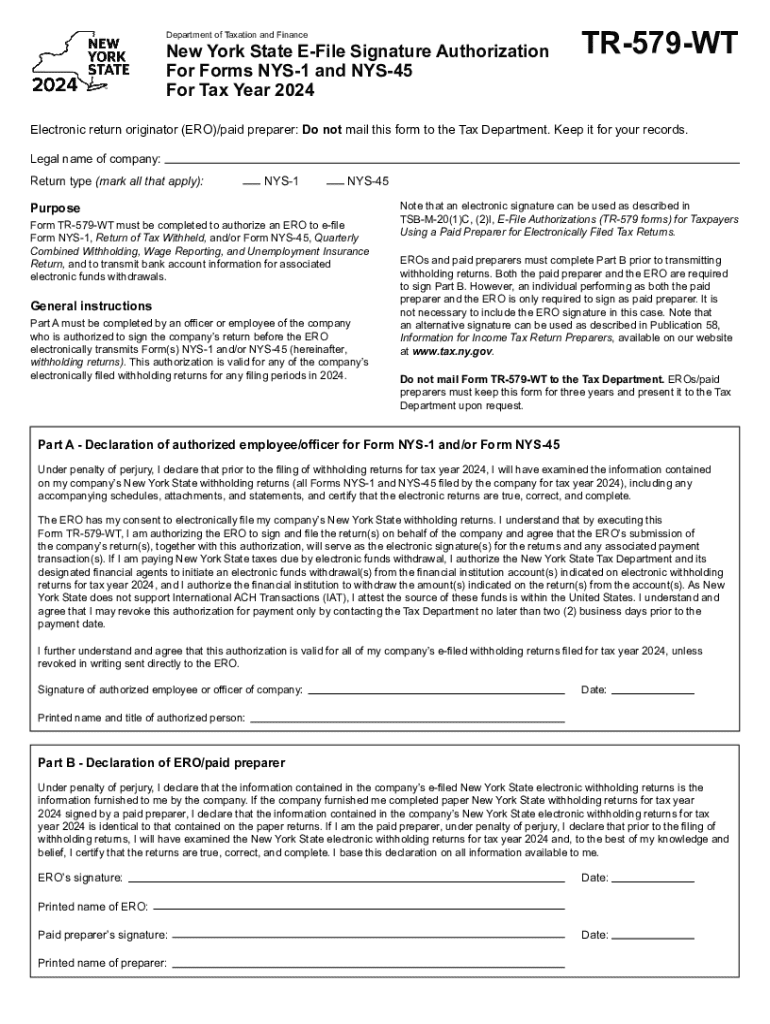

Department of Taxation and FinanceNew York State EFile Signature Authorization For Forms NYS1 and NYS45 For Tax Year 2024TR579WTElectronic return originator (ERO)/paid preparer: Do not mail this form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tr 579 wt form

Edit your e file signature authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york e file form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new york e file online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new york e file. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TR-579-WT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out new york e file

How to fill out NY TR-579-WT

01

Obtain a copy of the NY TR-579-WT form from the official New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions provided with the form carefully to understand the purpose and requirements.

03

Fill in your personal information including your name, address, and identifying numbers as requested on the form.

04

Provide details about the transactions or events that require reporting on NY TR-579-WT.

05

Calculate the amounts as necessary and input them in the designated fields.

06

Review the completed form for accuracy to ensure all information is correct.

07

Sign and date the form where indicated.

08

Submit the completed form according to the instructions, either by mail or electronically, if applicable.

Who needs NY TR-579-WT?

01

Individuals or businesses in New York State that are required to report certain transactions involving the sale or transfer of tangible personal property or services.

02

Taxpayers who need to document adjustments related to sales tax.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file NY state taxes electronically?

You're required to electronically file your return if you meet all three of the following conditions: you use software to prepare your own personal income tax return; and. your software supports the electronic filing of your return; and. you have broadband Internet access.

Can I mail my NY return?

You have the following options: Pay all of your NY income taxes online at New York Tax Online Service. Complete Form IT-370 with your Check or Money Order and mail both to the address on Form IT-370. Even if you filed an extension, you will still need to file your NY tax return either via eFile or by paper by Oct.

Can I still file my tax return on paper?

You can file your tax return electronically or by mail. Before you file, determine your filing status.

What is TR 579 taxes?

Form TR-579-IT must be completed to authorize an ERO to e-file a personal income tax return and to transmit bank account information for the electronic funds withdrawal.

What is an IRS e-file signature authorization?

More In Forms and Instructions The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Can I paper file New York State tax return?

Electronic filing is the fastest, safest way to file—but if you must file a paper Resident Income Tax Return, use our enhanced fill-in Form IT-201 with 2D barcodes. Benefits include: no more handwriting—type your entries directly into our form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new york e file in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your new york e file as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out new york e file using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign new york e file and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit new york e file on an iOS device?

Create, edit, and share new york e file from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is NY TR-579-WT?

NY TR-579-WT is a form used in New York State for reporting Tax Credits related to various tax programs.

Who is required to file NY TR-579-WT?

Individuals, businesses, or organizations that are claiming certain tax credits or are subject to the specific tax related to the form are required to file NY TR-579-WT.

How to fill out NY TR-579-WT?

To fill out NY TR-579-WT, provide the required personal or business information, detail the credits being claimed, and follow the instructions provided on the form for any calculations needed.

What is the purpose of NY TR-579-WT?

The purpose of NY TR-579-WT is to enable taxpayers to report their eligibility and claim for tax credits established under New York State tax laws.

What information must be reported on NY TR-579-WT?

The information required includes taxpayer identification details, the type of tax credits being claimed, supporting calculations, and any relevant documentation as specified in the instructions.

Fill out your new york e file online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York E File is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.