Get the free P ,, Ties

Show details

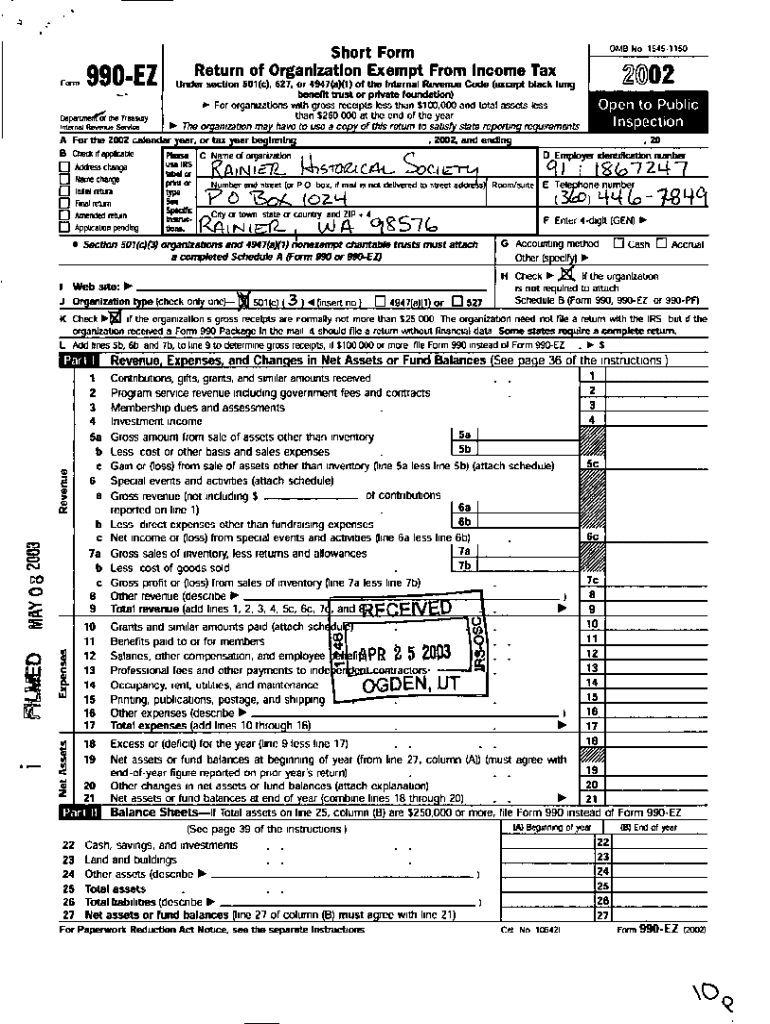

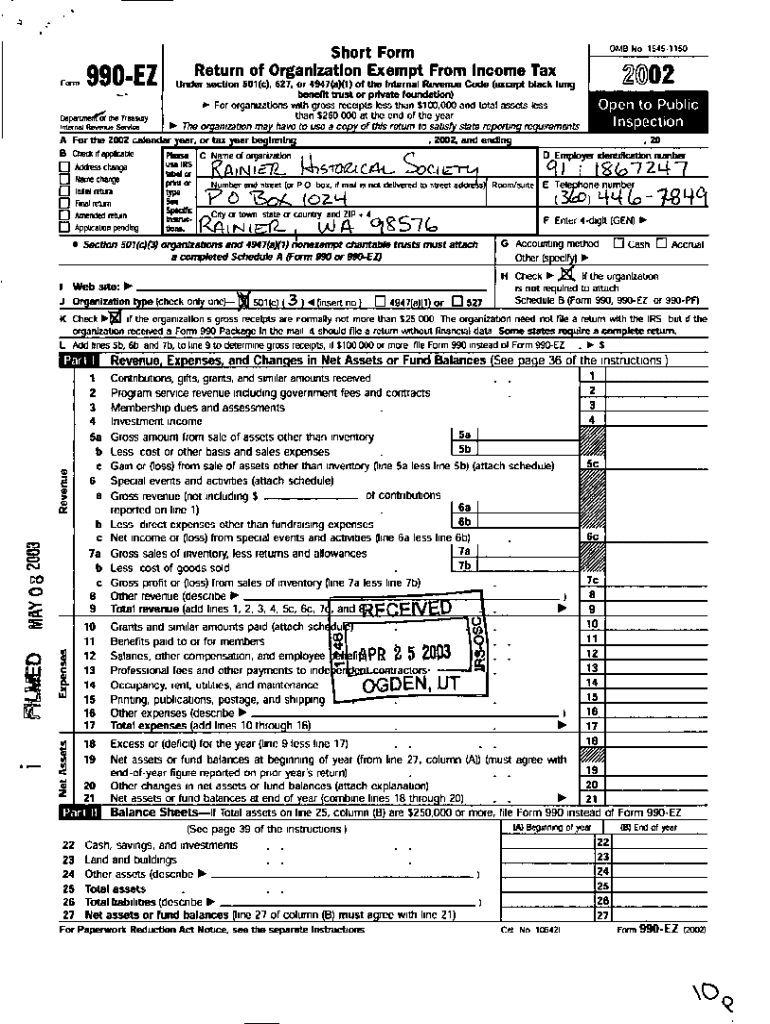

Short Form

Organization

Exempt From Income Tax

Return of990 EZ

P , Ties.\”

haw\” SVM \”\' C\”\”\'EEP, a fly\”\' a

t7pas.p Final

U, yre, eyO Application pending beg inn NGC Name d mpnizatbni

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign p ties

Edit your p ties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p ties form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit p ties online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit p ties. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out p ties

How to fill out p ties

01

Gather all necessary information such as name, address, contact details.

02

Select the appropriate type of tie (e.g. bow tie, necktie, bolo tie).

03

Place the tie around your neck with the wide end hanging lower than the narrow end.

04

Cross the wide end over the narrow end.

05

Loop the wide end under the narrow end and bring it back over the top.

06

Pull the wide end through the loop created at the front of the tie.

07

Adjust the knot by pulling on the wide end and narrow end to tighten and position it properly.

08

Tuck the narrow end of the tie behind the loop at the back to secure it.

Who needs p ties?

01

Individuals who need to dress professionally for work or formal events.

02

People attending special occasions such as weddings, parties, or galas.

03

Those who want to add a stylish accessory to their outfit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the p ties electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your p ties in minutes.

Can I edit p ties on an iOS device?

Use the pdfFiller mobile app to create, edit, and share p ties from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete p ties on an Android device?

Complete your p ties and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is p ties?

P ties refer to financial interests or business relationships that a government official or public figure may have that could potentially create a conflict of interest.

Who is required to file p ties?

Government officials and public figures are typically required to file p ties to disclose any potential conflicts of interest.

How to fill out p ties?

P ties forms are usually provided by the relevant government agency and must be completed with accurate and detailed information about financial interests and business relationships.

What is the purpose of p ties?

The purpose of p ties is to promote transparency and accountability by ensuring that government officials and public figures disclose any potential conflicts of interest.

What information must be reported on p ties?

Information such as sources of income, investments, debts, and gifts received must be reported on p ties.

Fill out your p ties online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

P Ties is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.