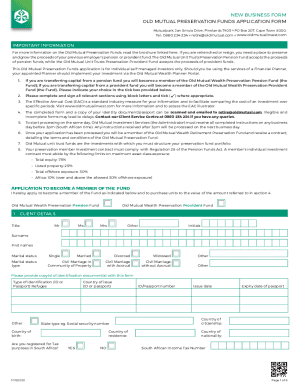

Who needs an MA 1 form?

MA 1 Form is needed for filing to all persons, who live and registered at Massachusetts State.

What is for MA 1 form?

MA 1 form is a regular tax declaration, which must be filed by all citizens of State. It contains all data about money incomes and expenses made by individual during previous year. Provided declaration allows get refunds and use social support from government.

Lot of other forms for individuals require previously filed MA 1 and data included there. Failure in this form may cause penalties.

Is MA 1 Form accompanied by other forms?

MA 1 form is accompanied by following forms:

- Schedules DI, X, Y, Z, RF, B, D, C, CB.

- Payment voucher

- Medical care forms.

When is MA 1 Form due?

MA 1 form must be filed to March 14. Completing and sending this form after noted date will cause a penalty.

How do I fill out MA 1 Form?

To fill out this form correctly, you must follow these steps:

- Insert your personal data by capital liters

- Mark one of checkboxes with filing status (only one option is available)

- Provide data about exemptions (calculate and place in required fields)

- Provide data about your money income. This information may be taken from W-2.

- Taxable pensions and annuities.

- Calculate and place result to the field 5. Don’t forget to subtract $200

- Money incomes from business\profession or farm

- Insert data about additional incomes

- Unemployment compensations

- State lottery winning

- Provide information in deduction section and calculate total deductions

- Information about loans and credits

- Income after credits. Contributions, taxes, HC penalties

- Total information

- Request of refund

Where do I send MA 1 Form?

Completed and signed form must be sent to the:

Massachusetts

Department of Revenue

PO Box 7011

Boston, MA 0