CFPB H-24(A) 2014-2025 free printable template

Show details

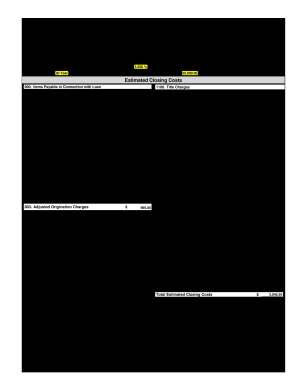

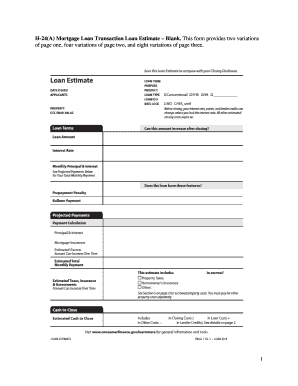

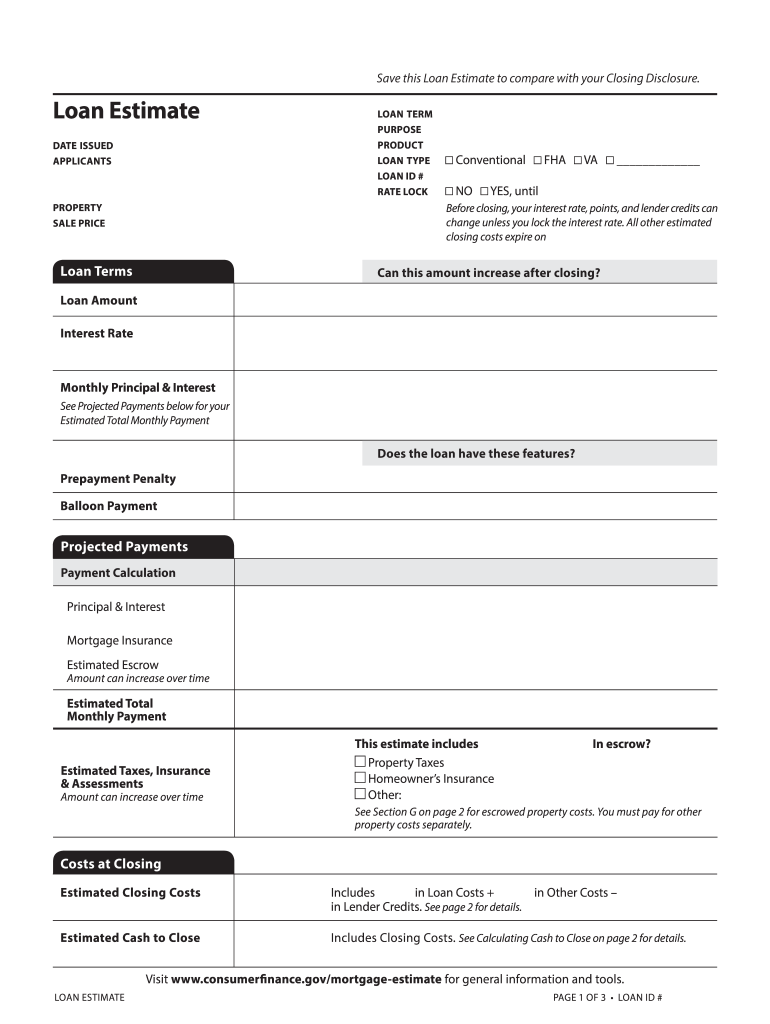

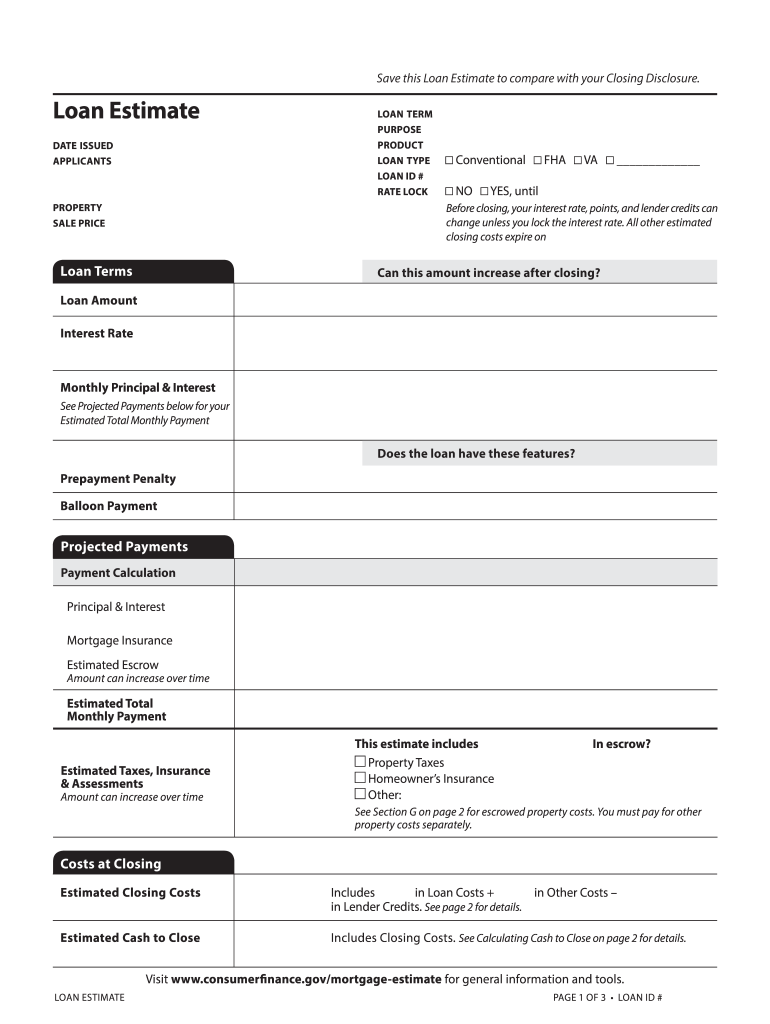

FEBRUARY 7 2014 TILA RESPA Integrated Disclosure H-24 A Mortgage Loan Transaction Loan Estimate Model Form This is a blank model Loan Estimate that illustrates the application of the content requirements in 12 CFR 1026. 37. Save this Loan Estimate to compare with your Closing Disclosure. Loan Estimate LOAN TERM PURPOSE PRODUCT LOAN TYPE LOAN ID RATE LOCK DATE ISSUED APPLICANTS PROPERTY SALE PRICE 30 years Purchase 5 Year Interest Only 5/3 Adjustable Rate Conventional FHA VA 1330172608 NO YES...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign loan estimate form

Edit your blank loan estimate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fillable loan estimate form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit editable loan estimate form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan estimate form pdf

How to fill out CFPB H-24(A)

01

Obtain a blank CFPB H-24(A) form from the official CFPB website or relevant agency.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide information about the financial institution or service provider in question.

05

Specify the type of complaint you are addressing, making sure to select the appropriate options.

06

Include any relevant details or documentation that supports your complaint.

07

Review the completed form for accuracy and completeness.

08

Submit the form according to the instructions provided, ensuring it is delivered to the correct address.

Who needs CFPB H-24(A)?

01

Consumers who have a complaint or issue with a financial product or service.

02

Individuals seeking a resolution to their dispute with a financial institution.

03

Anyone wanting to report potential violations of consumer financial protection laws.

Fill

printable loan estimate form

: Try Risk Free

People Also Ask about official loan estimate form

What are the 3 day rules for Trid?

Note: If a federal holiday falls in the three-day period, add a day for disclosure delivery. The three-day period is meas- ured by days, not hours. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing.

What is the 3 day loan estimate rule?

Generally, a creditor is responsible for ensuring that a Loan Estimate is delivered to a consumer or placed in the mail to the consumer no later than the third business day after receipt of the consumer's “application” for a mortgage loan subject to the TRID Rule.

How do you calculate cash to close on a loan estimate?

Your Estimated Cash to Close includes your down payment and closing costs, minus any deposit you have already paid to the seller, any amount the seller has agreed to pay toward your closing costs (seller credits), and other adjustments.

What is the 3 day period for a loan?

This waiting period gives you time to review all the documents to ensure that the terms you're agreeing to match the terms outlined at the beginning of the mortgage process when you received your loan estimate (which lenders are required to disclose no later than three days after receiving your completed application).

What is an example of a construction loan estimate?

The lender will loan you a percentage of the appraised value of the home. So, for instance, if the home is appraised to be worth $500,000, they will loan you $500,000 x (95% as an example) = $475,000. The down payment will be your construction costs less the loan amount.

What should a loan estimate include?

The form provides you with important information, including the estimated interest rate, monthly payment, and total closing costs for the loan. The Loan Estimate also gives you information about the estimated costs of taxes and insurance, and how the interest rate and payments may change in the future.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the fillable loan estimate template electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your loan estimate template and you'll be done in minutes.

Can I create an eSignature for the loan estimate pdf fillable in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your loan estimate pdf and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit loan estimate form excel straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing loan estimate example right away.

What is CFPB H-24(A)?

CFPB H-24(A) is a reporting form used by the Consumer Financial Protection Bureau (CFPB) that collectors must complete to provide specific information regarding mortgage loans, primarily focusing on certain data elements related to loan performance and servicing.

Who is required to file CFPB H-24(A)?

Entities such as mortgage servicers and lenders that service loans and meet the CFPB's criteria for reporting loan performance data are required to file CFPB H-24(A).

How to fill out CFPB H-24(A)?

To fill out CFPB H-24(A), entities should follow the form's guidelines, including accurately reporting data points such as loan status, payment history, and other relevant loan characteristics, ensuring all sections are completed in accordance with the CFPB's instructions.

What is the purpose of CFPB H-24(A)?

The purpose of CFPB H-24(A) is to collect standardized information about mortgage loans, which helps the CFPB monitor trends in the mortgage market, assess compliance with consumer protection laws, and support regulatory oversight.

What information must be reported on CFPB H-24(A)?

CFPB H-24(A) requires reporting information such as the loan's unique identifier, loan type, servicing history, borrower payment patterns, and current loan status among other relevant details.

Fill out your CFPB H-24A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Documentation is not the form you're looking for?Search for another form here.

Keywords relevant to loan estimate fillable form

Related to loan estimate example pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.