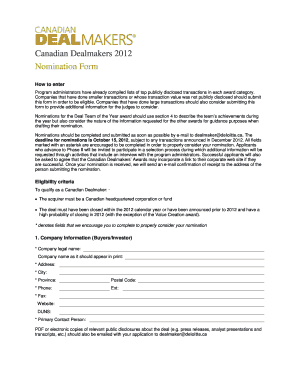

Get the free What are Acceptance Agents - irs

Show details

For IRS Individual Taxpayer Identification Number or ..... or downloaded from the IRS website at http://www. Ir's.gov.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what are acceptance agents

Edit your what are acceptance agents form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what are acceptance agents form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what are acceptance agents online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit what are acceptance agents. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

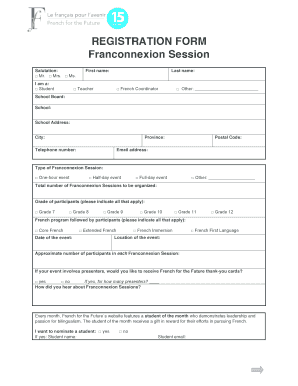

How to fill out what are acceptance agents

How to fill out what are acceptance agents:

01

Research and gather information on acceptance agents: Start by understanding what acceptance agents are and their role in the process. Look for reliable sources of information such as government websites or reputable organizations that provide guidance on this topic.

02

Understand the requirements and eligibility criteria: Familiarize yourself with the specific requirements and eligibility criteria for becoming an acceptance agent. This may vary depending on the country or jurisdiction you are in. Take note of any prerequisites, qualifications, or certifications that may be necessary.

03

Complete the necessary paperwork: Fill out any required application forms accurately and completely. Provide all requested information and documentation, such as identification documents, proof of certification if applicable, and any other supporting materials. Be sure to double-check the information entered to avoid any errors or discrepancies.

04

Submit your application: Once you have completed the necessary paperwork, submit your application to the relevant authority or organization responsible for accepting acceptance agent applications. Follow any instructions provided regarding submission methods, deadlines, or additional requirements, such as fees or supporting documents.

05

Await confirmation or feedback: After submitting your application, it may take some time for the processing and review to be completed. Be patient and await confirmation or feedback from the authority or organization. In some cases, you may be required to attend an interview or provide further information or clarification.

Who needs what are acceptance agents:

01

Individuals or organizations assisting with foreign tax reporting: Acceptance agents are often needed by individuals or organizations that provide assistance in the preparation and submission of foreign tax reporting forms. They help with the certification process and ensure the accuracy and completeness of the documentation.

02

Non-resident aliens or foreign entities: Non-resident aliens or foreign entities who have tax obligations in a particular country may require the services of acceptance agents. These agents help them navigate the complex tax reporting requirements, ensuring compliance with local regulations and avoiding any penalties or legal issues.

03

Professionals in the tax or accounting field: Tax professionals, accountants, or consultants who specialize in working with international clients or dealing with cross-border tax issues may benefit from becoming acceptance agents. This additional certification allows them to expand their services and assist their clients more effectively.

In summary, individuals or organizations involved in foreign tax reporting, non-resident aliens or foreign entities with tax obligations, and professionals in the tax or accounting field are among those who may need acceptance agents. The process of becoming an acceptance agent involves conducting research, understanding requirements, completing paperwork, submitting the application, and awaiting confirmation or feedback.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is what are acceptance agents?

Acceptance agents are individuals or entities authorized by the IRS to assist non-resident aliens with obtaining an Individual Taxpayer Identification Number (ITIN) for tax purposes.

Who is required to file what are acceptance agents?

Acceptance agents are required to file Form W-7 and assist non-resident aliens in applying for an ITIN.

How to fill out what are acceptance agents?

Acceptance agents must fill out Form W-7 with the help of the non-resident alien they are assisting and submit it to the IRS.

What is the purpose of what are acceptance agents?

The purpose of acceptance agents is to help non-resident aliens navigate the process of obtaining an ITIN for tax reporting purposes.

What information must be reported on what are acceptance agents?

Acceptance agents must report the personal information and documentation of the non-resident alien applying for an ITIN on Form W-7.

How can I send what are acceptance agents to be eSigned by others?

When your what are acceptance agents is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in what are acceptance agents without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your what are acceptance agents, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit what are acceptance agents on an Android device?

With the pdfFiller Android app, you can edit, sign, and share what are acceptance agents on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your what are acceptance agents online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Are Acceptance Agents is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.