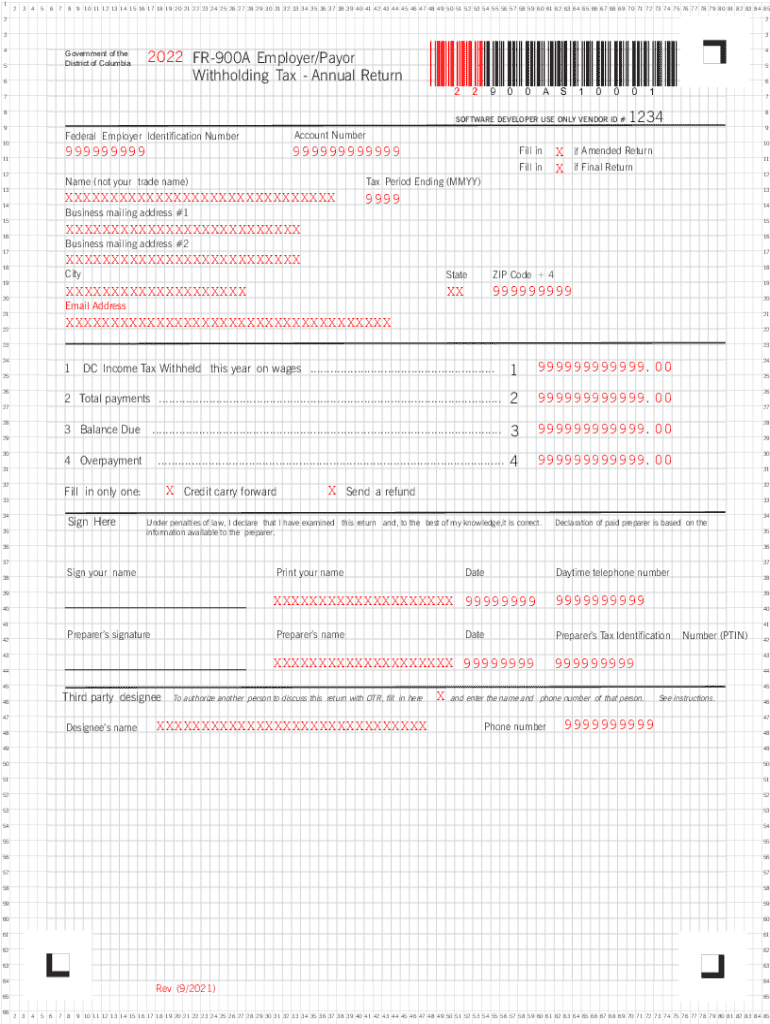

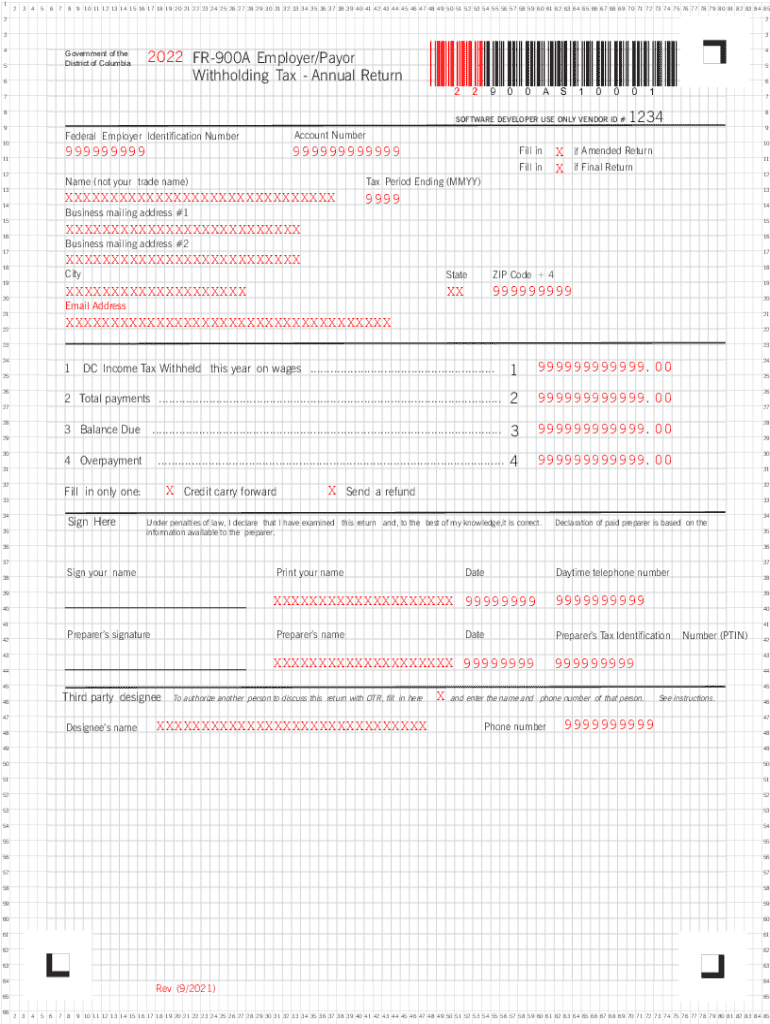

Get the free Withholding Tax - Annual Return

Show details

123456789 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

We are not affiliated with any brand or entity on this form

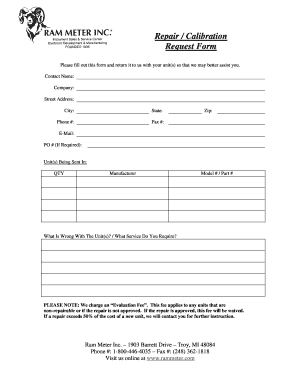

Get, Create, Make and Sign withholding tax - annual

Edit your withholding tax - annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withholding tax - annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing withholding tax - annual online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit withholding tax - annual. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

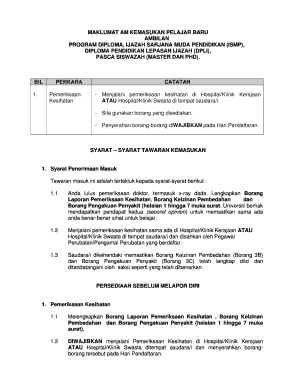

How to fill out withholding tax - annual

How to fill out withholding tax - annual

01

Obtain a copy of the W-4 form from your employer.

02

Fill out your personal information such as name, address, and social security number.

03

Review the instructions provided on the form to determine how many allowances you should claim.

04

If you have any additional income that is not subject to withholding, you may need to fill out additional forms or calculations.

05

Sign and date the form before submitting it to your employer.

Who needs withholding tax - annual?

01

Individuals who are employed and receive wages or salary from an employer need to fill out withholding tax - annual.

02

Self-employed individuals or those with other sources of income may also need to fill out withholding tax - annual to ensure proper tax withholdings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get withholding tax - annual?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the withholding tax - annual in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out withholding tax - annual using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign withholding tax - annual. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit withholding tax - annual on an iOS device?

Use the pdfFiller mobile app to create, edit, and share withholding tax - annual from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is withholding tax - annual?

Withholding tax - annual is a tax collected on income payments made to individuals and businesses, typically on a regular basis throughout the year.

Who is required to file withholding tax - annual?

Anyone who makes income payments subject to withholding tax is required to file withholding tax - annual, including employers, financial institutions, and individuals making payments to non-employees.

How to fill out withholding tax - annual?

To fill out withholding tax - annual, you will need to gather information on the income payments made, calculate the appropriate withholding amount, complete the relevant forms provided by the tax authorities, and submit the forms along with the payment by the deadline.

What is the purpose of withholding tax - annual?

The purpose of withholding tax - annual is to ensure that taxes are paid on income as it is earned, rather than waiting until the end of the year. It helps to distribute the tax liability throughout the year and prevent tax evasion.

What information must be reported on withholding tax - annual?

The information reported on withholding tax - annual typically includes details of the income payments made, the amount of tax withheld, the payee's identification information, and any other relevant details required by the tax authorities.

Fill out your withholding tax - annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Withholding Tax - Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.