IL Required Documents Chapter 13 2024-2025 free printable template

Show details

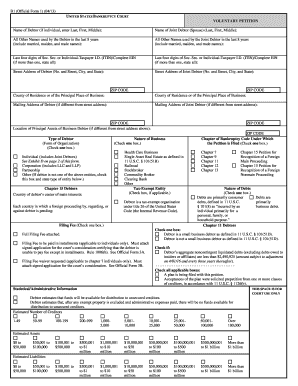

CHAPTER

13 INDIVIDUAL

RequirementsforDOCUMENTS

a Bare

REQUIRED

Bone

Petition

AT TIME OF FILING

Pro Se

(Minimum

Filing Requirements)

Chapter

7

U. S. Bankruptcy Court

Northern District of

Illinois

Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign chapter 13 - individual

Edit your chapter 13 - individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 - individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 13 - individual online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 13 - individual. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL Required Documents Chapter 13 Form Versions

Version

Form Popularity

Fillable & printabley

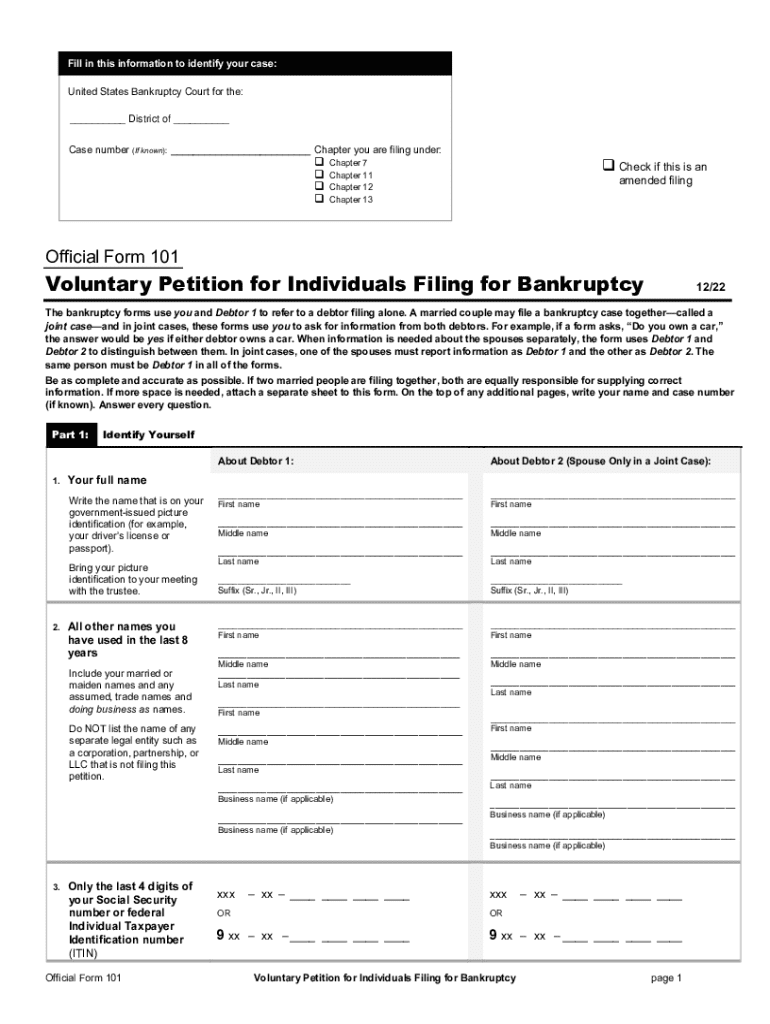

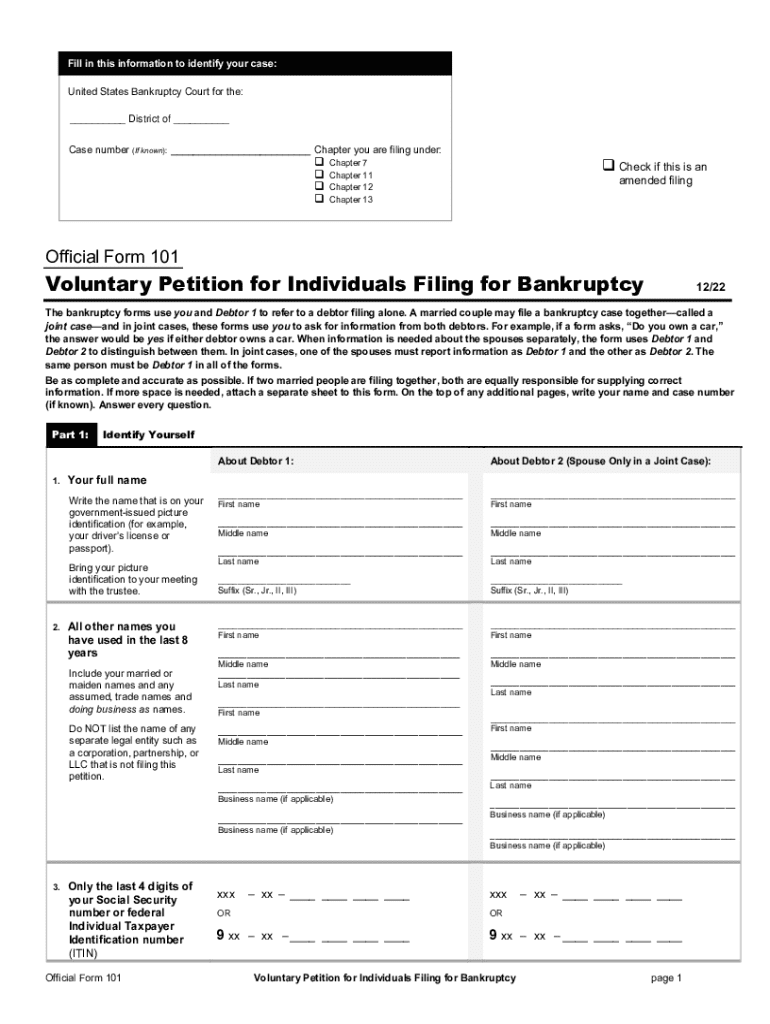

How to fill out chapter 13 - individual

How to fill out IL Required Documents Chapter 13

01

Gather all necessary financial documents including income statements, bank statements, and tax returns.

02

Complete the Chapter 13 bankruptcy petition form accurately.

03

List all your debts, assets, and income on the forms provided.

04

Complete the Chapter 13 plan, detailing how you will repay your debts over time.

05

File the completed forms with the bankruptcy court and pay the required filing fee.

06

Attend the creditors meeting to discuss your case with the trustee and creditors.

Who needs IL Required Documents Chapter 13?

01

Individuals or couples struggling with debt who wish to reorganize their finances and establish a repayment plan.

02

Those who have a regular income and can afford to make monthly payments toward their debts over a period of time under federal bankruptcy protection.

Fill

form

: Try Risk Free

People Also Ask about

Why does Chapter 13 fail?

In most cases, failure is due to one of several reasons: Life circumstances. Not having the guidance of an experienced bankruptcy attorney. Over-ambition.

What does petition for Chapter 13 mean?

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

Is filing Chapter 13 hard?

In many cases, Chapter 13 bankruptcy offers the most flexibility. Chapter 13 bankruptcy can offer several substantial benefits compared to the other types of bankruptcy options available in the US. However, navigating the filing process can be incredibly difficult, and Chapter 13 bankruptcy is not for everyone.

Why choose Chapter 13 over Chapter 7?

You may like to file Chapter 13 instead of a Chapter 7 bankruptcy, if you're behind on your mortgage payments and you're trying to save your home. Chapter 7 does not give you the opportunity to catch up mortgage payments or otherwise save your house. A Chapter 13 would be the appropriate chapter to file for that.

Which is better for credit Chapter 7 or 13?

Chapter 7 and Chapter 13 bankruptcy both affect your credit score the same – having a Chapter 13 bankruptcy on your credit report will not be any better for your score than a Chapter 7. However, the individual reviewing your report will look at more than your score.

What is the advantage of Chapter 13 over 7?

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chapter 13 - individual online?

With pdfFiller, it's easy to make changes. Open your chapter 13 - individual in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the chapter 13 - individual form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign chapter 13 - individual and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete chapter 13 - individual on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your chapter 13 - individual. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IL Required Documents Chapter 13?

IL Required Documents Chapter 13 refers to the specific forms and documentation that individuals must submit when filing for Chapter 13 bankruptcy in Illinois. These documents provide the court with necessary information about the debtor's financial situation.

Who is required to file IL Required Documents Chapter 13?

Individuals who are seeking debt relief under Chapter 13 bankruptcy in Illinois are required to file IL Required Documents Chapter 13. This typically includes individuals with a regular income who wish to develop a repayment plan for their debts.

How to fill out IL Required Documents Chapter 13?

To fill out IL Required Documents Chapter 13, debtors must provide accurate personal and financial information, including assets, liabilities, income, and expenses. It's important to carefully follow the guidelines provided by the court and seek legal assistance if necessary.

What is the purpose of IL Required Documents Chapter 13?

The purpose of IL Required Documents Chapter 13 is to ensure that the bankruptcy court has a comprehensive understanding of the debtor's financial condition. This information helps the court evaluate the repayment plan proposed by the debtor.

What information must be reported on IL Required Documents Chapter 13?

IL Required Documents Chapter 13 must include information such as the debtor's income, expenses, debts, assets, and a proposed repayment plan. Additionally, it may require documentation of recent tax returns and other financial statements.

Fill out your chapter 13 - individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 - Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.