Get the free Financial Audit Services - Hamilton County - hamiltoncountytx

Show details

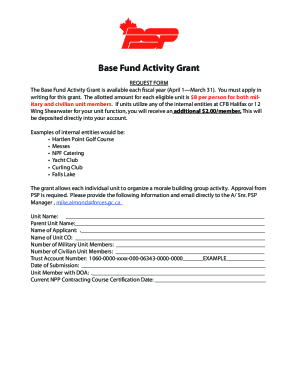

HAMILTON COUNTY, TEXAS REQUEST FOR QUALIFICATIONS FINANCIAL AUDIT SERVICES The Hamilton County Commissioners Court is requesting Qualification Statements from independent certified public accounting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial audit services

Edit your financial audit services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial audit services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial audit services online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial audit services. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial audit services

How to Fill out Financial Audit Services:

01

Identify and gather all relevant financial documents and records, such as income statements, balance sheets, cash flow statements, and tax returns.

02

Review and reconcile the financial statements to ensure accuracy and consistency.

03

Conduct a thorough examination of financial transactions and records to identify any irregularities or discrepancies.

04

Perform a risk assessment to determine areas that require additional scrutiny and focus.

05

Verify the completeness and validity of financial data by conducting interviews and requesting supporting documentation.

06

Evaluate internal controls and financial procedures to assess their effectiveness and identify any weaknesses or areas for improvement.

07

Analyze financial performance and trends to provide insights and recommendations for better financial management.

08

Prepare comprehensive audit reports detailing findings, observations, and recommendations for the organization's management.

09

Engage in open and constructive communication with the audited entity to address any concerns or inquiries regarding the financial audit process.

10

Follow all applicable auditing standards and regulations to ensure the quality and integrity of the financial audit services.

Who Needs Financial Audit Services:

01

Publicly traded companies: As required by law, publicly traded companies need to undergo rigorous financial audits to ensure compliance with accounting regulations and provide accurate financial information to investors and stakeholders.

02

Non-profit organizations: Non-profit organizations often rely on financial audits to demonstrate accountability and transparency to donors, members, and grant providers.

03

Government agencies: Government agencies utilize financial audit services to assess the use of public funds, manage financial risks, and maintain public trust.

04

Small and medium-sized enterprises (SMEs): SMEs may seek financial audit services to enhance their credibility and attract potential investors or lenders.

05

Banks and financial institutions: Financial auditors assist banks and financial institutions in assessing creditworthiness, internal controls, and regulatory compliance.

06

Insurance companies: Financial audits play a crucial role in assessing insurers' financial strength, solvency, and compliance with industry regulations.

07

Educational institutions: Universities, colleges, and schools may undergo financial audits to ensure proper financial management, track the usage of funds, and comply with grant requirements.

08

Healthcare organizations: Hospitals, clinics, and healthcare providers may require financial audits to demonstrate compliance with healthcare regulations, assess profitability, and manage financial risks.

09

Real estate companies: Financial audits help real estate companies assess the accuracy of financial statements, evaluate rental income, and monitor property management practices.

10

Internal and external stakeholders: Investors, shareholders, lenders, and other stakeholders often rely on financial audit services to gain confidence in an organization's financial affairs and decision-making processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial audit services?

Financial audit services involve examining a company's financial records and transactions to ensure they are accurate and in compliance with regulations.

Who is required to file financial audit services?

Companies, organizations, and entities that are required by law or regulation to have their financial statements audited are required to file financial audit services.

How to fill out financial audit services?

Financial audit services are typically filled out by professional auditors who have the necessary qualifications and experience in auditing financial statements.

What is the purpose of financial audit services?

The purpose of financial audit services is to provide assurance to stakeholders that a company's financial statements are accurate and reliable.

What information must be reported on financial audit services?

Financial audit services typically include detailed information about a company's financial position, performance, and cash flows.

How can I manage my financial audit services directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your financial audit services as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit financial audit services from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your financial audit services into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I edit financial audit services on an iOS device?

Use the pdfFiller mobile app to create, edit, and share financial audit services from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your financial audit services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Audit Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.