MN PS2511 2016 free printable template

Show details

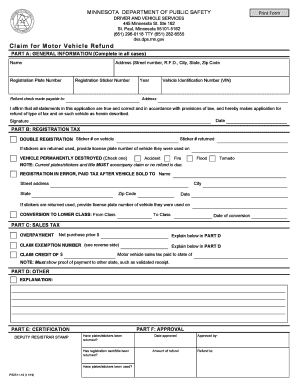

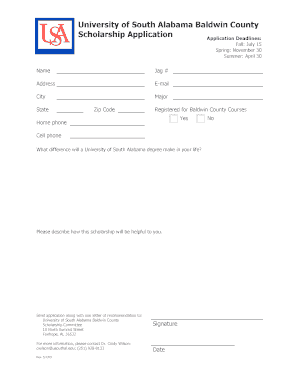

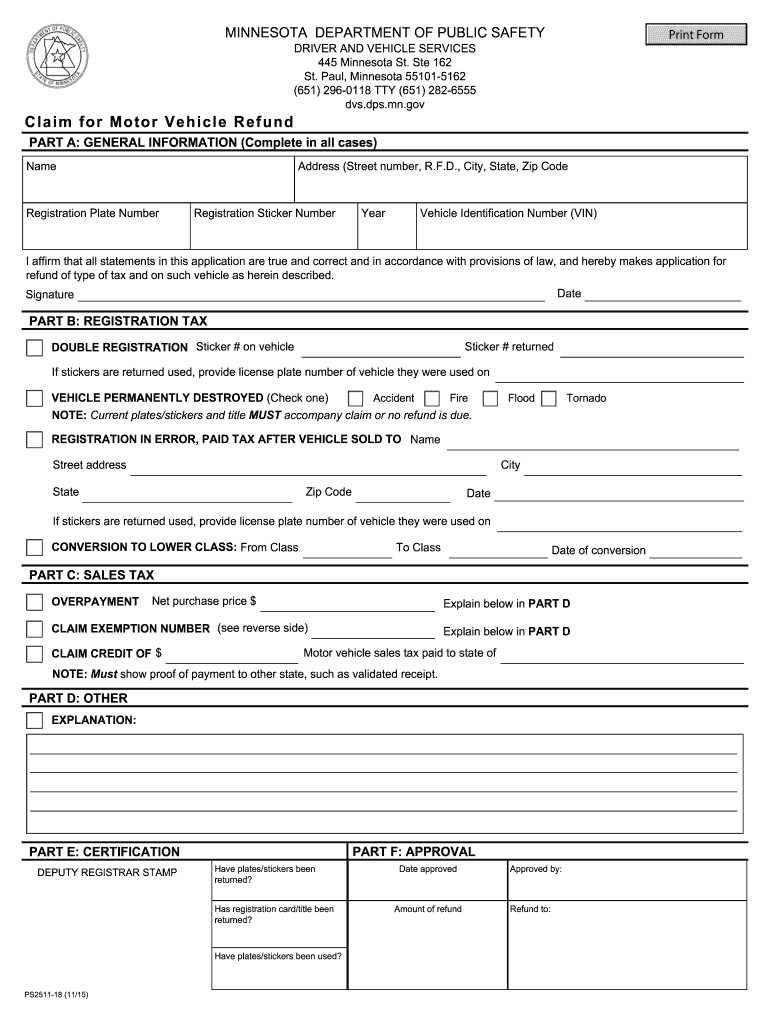

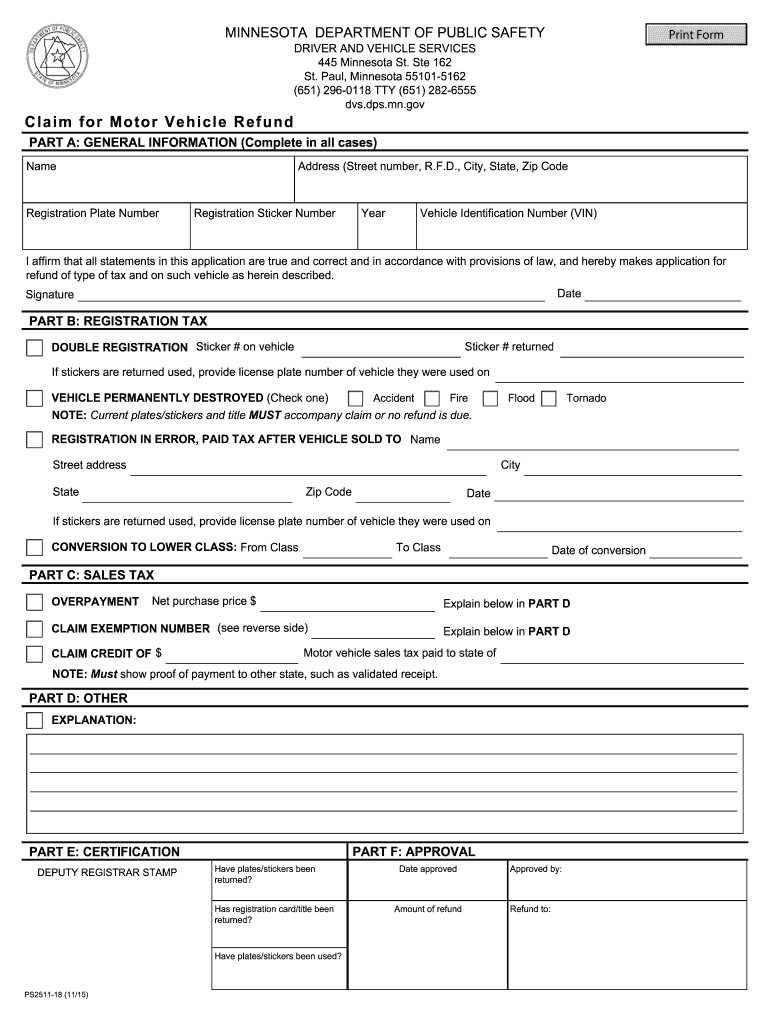

PS2511-16 CLAIM FOR MOTOR VEHICLE REFUND DRIVER AND VEHICLE SERVICES DIVISION 445 MINNESOTA STREET, SUITE 162 ST. PAUL, MINNESOTA 55101-5162 (651) 215-1270 TTY (651) 282-6555 www.mndriveinfo.org Read

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN PS2511

Edit your MN PS2511 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN PS2511 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN PS2511 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MN PS2511. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN PS2511 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN PS2511

How to fill out MN PS2511

01

Gather all necessary information, including your personal details and income statements.

02

Start with the top section of the MN PS2511 form and fill in your name, address, and Social Security number.

03

Proceed to the income section, where you'll provide details regarding your earnings, including wages, salaries, and any other sources of income.

04

Complete any additional sections that require disclosure of deductions or credits you may claim.

05

Review all entered information for accuracy to avoid errors that could delay processing.

06

Sign and date the form at the bottom to validate your submission.

07

Submit the form according to the provided instructions, either by mail or electronically if applicable.

Who needs MN PS2511?

01

Individuals who are required to report their income and file their taxes in Minnesota.

02

People applying for certain benefits or adjusting their tax obligations.

03

Those who need to comply with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do you need to return license plates in MN?

What do you do with old license plates? In the State of Minnesota, there is no requirement to return or recycle old license plates but there is a danger if you do not dispose of the license plates correctly. Most people add the license plates to a junk pile in their garage.

Can I get a refund on my car registration in Minnesota?

The Minnesota Department of Revenue does not issue refunds for motor vehicle sales tax paid in error.

Do I need to return my Minnesota license plates?

What do you do with old license plates? In the State of Minnesota, there is no requirement to return or recycle old license plates but there is a danger if you do not dispose of the license plates correctly. Most people add the license plates to a junk pile in their garage.

Does Minnesota refund car registration if you move?

Refunds. Minnesota does not issue registration refunds.

How do I return my license plates in Minnesota?

You will need to: Complete the Claim for Motor Vehicle Refund (Form PS2511). Gather your vehicle's registration card, license plates, and stickers. Mail or return the above to: Driver and Vehicle Services. 445 Minnesota St. Suite 162. St. Paul, MN 55101.

How do I fill out a title application in MN?

Fill the Minnesota certificate of title – including: Full legal name and address of buyer and current owner. Date of sale (month, day, and year) Vehicle price the buyer paid. An odometer recording (unless: 10 years and older and weighing over 16,000lbs) A damage disclosure if the vehicle is less than 6 years old.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MN PS2511 online?

The editing procedure is simple with pdfFiller. Open your MN PS2511 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the MN PS2511 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MN PS2511 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete MN PS2511 on an Android device?

Use the pdfFiller mobile app and complete your MN PS2511 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MN PS2511?

MN PS2511 is a tax form used in Minnesota for reporting the sale of tangible personal property or services that are subject to sales tax.

Who is required to file MN PS2511?

Any business or individual that conducts sales of taxable goods or services in Minnesota must file MN PS2511.

How to fill out MN PS2511?

To fill out MN PS2511, you need to provide your business information, the total sales made, the amount of sales tax collected, and any deductions that apply.

What is the purpose of MN PS2511?

The purpose of MN PS2511 is to report and remit the sales tax collected on sales of taxable goods and services to the state of Minnesota.

What information must be reported on MN PS2511?

The form requires information such as the total sales amount, sales tax collected, business identification details, and any exemptions or deductions claimed.

Fill out your MN PS2511 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN ps2511 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.