Get the free ITEMS SUBJECT TO VAT - auctionmart co

Show details

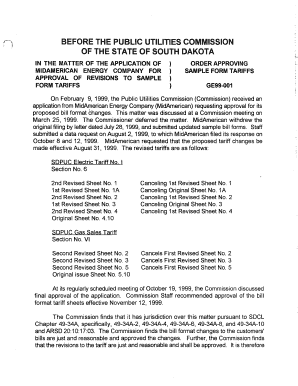

PLANT, MACHINERY & TOOL SALE ENTRY FORM SALE DATE SATURDAY 20TH SEPTEMBER 2014 NAME ADDRESS POST CODE PHONE NUMBER EMAIL ADDRESS ITEMS SUBJECT TO VAT? YES / NO VAT NUMBER (Delete as appropriate) Description

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign items subject to vat

Edit your items subject to vat form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your items subject to vat form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit items subject to vat online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit items subject to vat. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out items subject to vat

How to fill out items subject to VAT:

01

Identify the items subject to VAT: Start by determining which items in your business are subject to VAT. This can include products, services, and even certain types of transactions. Familiarize yourself with the VAT regulations in your country to understand what should be included.

02

Determine the correct VAT rate: Different items may attract different VAT rates. It is important to determine the correct VAT rate applicable to each item. Check the VAT laws and regulations or consult with a tax professional to ensure accurate classification.

03

Calculate the VAT amount: Once you have identified the items subject to VAT and the applicable VAT rate, you need to calculate the VAT amount for each item. This can be done by multiplying the item's selling price by the VAT rate. The result will be the VAT amount that needs to be included in the total price.

04

Include the VAT amount in invoices or receipts: Whenever you sell an item subject to VAT, you must provide a customer with an invoice or receipt that includes the VAT amount. Make sure to clearly state the VAT rate applied and the total price including VAT. This transparency is essential for both the business and the customer.

05

Keep accurate records: It is crucial to keep accurate records of all items subject to VAT, the VAT rates applied, and the VAT amounts collected. This will help you easily report and reconcile your VAT obligations, especially for tax reporting purposes. Utilize accounting software or seek assistance from an accountant to ensure accurate record-keeping.

Who needs items subject to VAT?

01

Businesses selling goods or services: Any business that sells goods or provides services may need to deal with items subject to VAT. This can range from retailers selling products to professionals offering specialized services.

02

Individuals importing goods: Individuals who import goods from abroad may also need to consider items subject to VAT. Customs duties and VAT are often applicable to imported goods, and individuals are responsible for including the VAT amount when declaring and paying for imported items.

03

Governments collecting taxes: VAT is an important source of revenue for governments. They need to ensure that businesses and individuals comply with VAT regulations and correctly report and pay the appropriate VAT amounts. Governments play a vital role in monitoring and overseeing VAT-related activities.

Overall, understanding how to fill out items subject to VAT and who needs to deal with them is essential for businesses, individuals, and governments to ensure compliance with tax regulations and maintain proper financial records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is items subject to vat?

Items subject to VAT are goods and services that are subject to value-added tax.

Who is required to file items subject to vat?

Businesses and individuals who sell goods or services that are subject to VAT are required to file items subject to VAT.

How to fill out items subject to vat?

Items subject to VAT can be usually filled out using a VAT return form provided by the tax authorities.

What is the purpose of items subject to vat?

The purpose of items subject to VAT is to collect tax revenue from the sale of goods and services at each stage of production and distribution.

What information must be reported on items subject to vat?

The information that must be reported on items subject to VAT usually includes details of the sales made, VAT charged, and any VAT paid on purchases.

Can I create an electronic signature for the items subject to vat in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your items subject to vat in minutes.

How do I fill out the items subject to vat form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign items subject to vat and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete items subject to vat on an Android device?

Complete your items subject to vat and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your items subject to vat online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Items Subject To Vat is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.