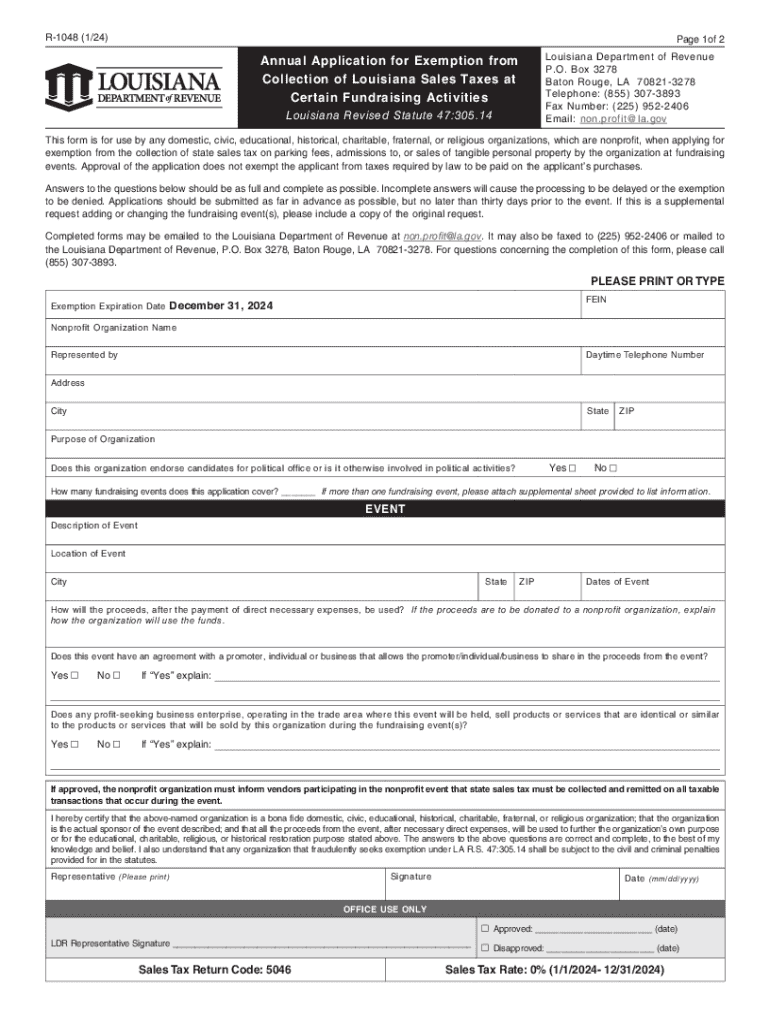

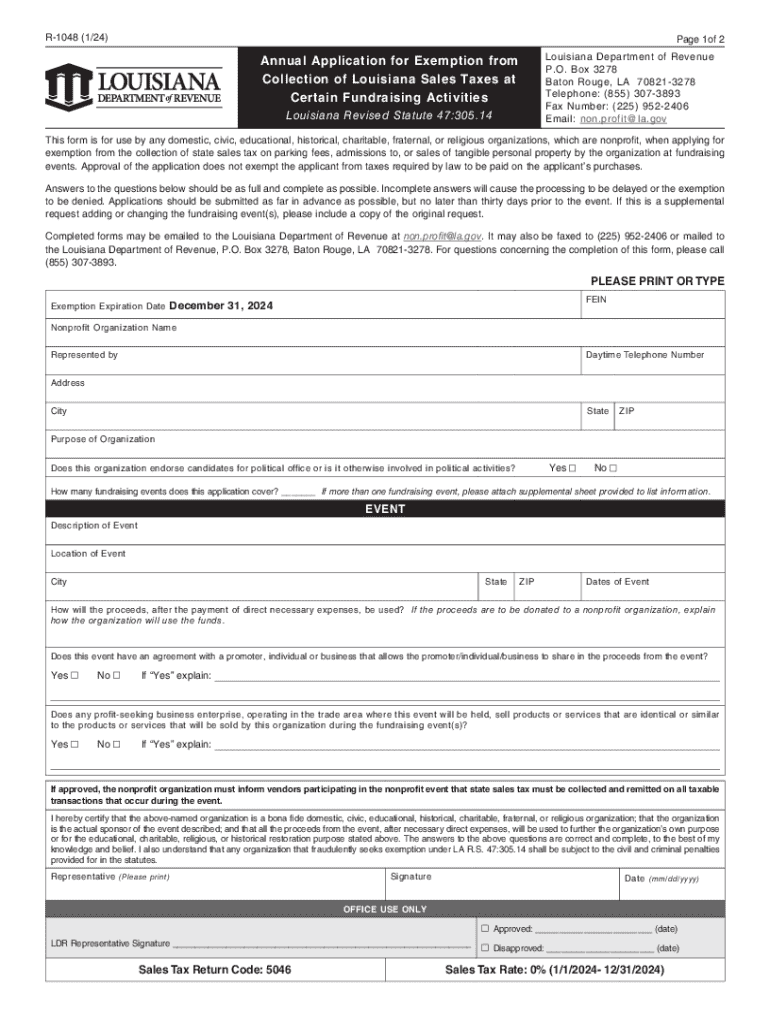

LA DoR R-1048 2024 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign annual application for exemption

Edit your annual application for exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual application for exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual application for exemption online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual application for exemption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA DoR R-1048 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out annual application for exemption

How to fill out LA DoR R-1048

01

Obtain LA DoR R-1048 form from the Louisiana Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and social security number.

03

Indicate the tax year for which you are filing the return.

04

Complete the income section by entering your total income from all sources.

05

Deduct allowable expenses from your total income to calculate your net taxable income.

06

Include any applicable credits or exemptions in the designated section.

07

Review your calculations for accuracy.

08

Sign and date the form at the bottom.

09

Submit the completed form to the appropriate office as instructed.

Who needs LA DoR R-1048?

01

Individuals or businesses in Louisiana who are required to report income or tax liability for the specified tax year.

02

Taxpayers seeking to claim deductions, exemptions, or credits applicable to their income.

Fill

form

: Try Risk Free

People Also Ask about

What items are exempt from sales tax in Louisiana?

Other tax-exempt items in Louisiana CategoryExemption StatusFood and MealsUtilities & FuelEXEMPT *Medical Goods and ServicesMedical DevicesEXEMPT *24 more rows

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What income is exempt from Louisiana income tax?

Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 1.85%. Public pension income is not taxed, and private pension income is partially taxed.

How much is a seller's permit in Louisiana?

How Much Does a Business License Cost in Louisiana? There is no cost to apply for a Louisiana resale certificate.

How to fill out Louisiana state tax form?

0:13 2:17 Form IT 540 Individual Income Return Resident - YouTube YouTube Start of suggested clip End of suggested clip Step 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on lineMoreStep 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on line 8b. Then subtract the ladder from the former enter the difference on line 8c.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annual application for exemption without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your annual application for exemption into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit annual application for exemption online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your annual application for exemption to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my annual application for exemption in Gmail?

Create your eSignature using pdfFiller and then eSign your annual application for exemption immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is LA DoR R-1048?

LA DoR R-1048 is a specific tax form used by the Louisiana Department of Revenue for reporting certain tax information.

Who is required to file LA DoR R-1048?

Entities and individuals who are subject to the applicable taxes in Louisiana are required to file LA DoR R-1048.

How to fill out LA DoR R-1048?

To fill out LA DoR R-1048, gather the necessary financial information, accurately complete each section of the form, and ensure compliance with any specific instructions provided by the Louisiana Department of Revenue.

What is the purpose of LA DoR R-1048?

The purpose of LA DoR R-1048 is to collect specific tax information to assist the Louisiana Department of Revenue in administering and enforcing state tax laws.

What information must be reported on LA DoR R-1048?

LA DoR R-1048 must report information such as income, deductions, credits, and other relevant data as required by Louisiana tax regulations.

Fill out your annual application for exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Application For Exemption is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.