Get the free Non Personal Account Opening Form.pdf - Commercial Bank

Show details

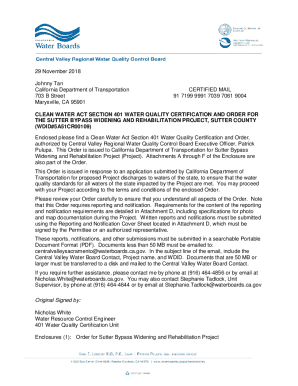

(Incorporated in Sri Lanka with Limited Liability) NON-PERSONAL ACCOUNT OPENING FORM Please complete all details in BLOCK letter The Manager Commercial Bank of Ceylon PLC Date ................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non personal account opening

Edit your non personal account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non personal account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non personal account opening online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non personal account opening. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non personal account opening

How to fill out non personal account opening:

01

Start by gathering all the necessary documents and information. This may include identification documents, proof of address, business registration documents, and relevant financial information.

02

Visit the bank or financial institution where you wish to open the non personal account. Alternatively, you might be able to complete the process online through their website or mobile application.

03

Upon arrival, inform the staff that you would like to open a non personal account. They will provide you with the required forms and assist you throughout the process.

04

Fill out the application form accurately and provide all the requested information. This may include personal details such as name, address, date of birth, and contact information. Additionally, you will need to provide business-related information if applicable, such as the name of the entity, registration number, and business activities.

05

Attach any necessary supporting documents such as photocopies of identification, business registration certificates, and financial statements. Make sure all these documents are valid and up to date.

06

Review the completed form and attached documents to ensure they are accurate and complete. Double-check for any missing or incorrect information that may cause delays in the account opening process.

07

Sign and date the application form and any other relevant documents as required. This validates your consent and agreement to the terms and conditions set by the bank or financial institution.

08

Submit the completed application form and supporting documents to the designated staff member or the relevant department. They will verify the information provided and may ask for any additional information if required.

09

After submission, inquire about the processing time for the non personal account opening. It may vary depending on the institution and the complexity of your application.

Who needs non personal account opening:

01

Businesses: Non personal account opening is necessary for businesses of all sizes, ranging from sole proprietorships to large corporations. It allows them to separate their personal finances from their business finances and facilitates efficient management of funds.

02

Non-profit organizations: Charities, associations, and other non-profit entities require non personal accounts to handle donations, grants, and other monetary transactions. This helps maintain transparency and accountability in managing funds.

03

Government agencies and institutions: Government entities also need non personal accounts to manage their financial operations and handle transactions related to public funds.

In conclusion, anyone who wants to conduct financial activities on behalf of an entity, such as a business or non-profit organization, needs to fill out a non personal account opening form. This ensures proper separation of personal and business finances and allows for efficient management of funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non personal account opening?

Non personal account opening refers to the process of opening a bank account for a business, organization or entity.

Who is required to file non personal account opening?

Any entity or organization that wishes to open a non personal account is required to file for non personal account opening.

How to fill out non personal account opening?

To fill out a non personal account opening, the entity must provide all necessary information and documentation required by the financial institution.

What is the purpose of non personal account opening?

The purpose of non personal account opening is to allow businesses, organizations or entities to conduct financial transactions and manage funds.

What information must be reported on non personal account opening?

Information such as the entity's legal name, address, tax identification number, purpose of the account, and authorized signatories must be reported on non personal account opening.

How do I make changes in non personal account opening?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your non personal account opening to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in non personal account opening without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit non personal account opening and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out non personal account opening on an Android device?

Complete non personal account opening and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your non personal account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Personal Account Opening is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.