Get the free acaw trust funds - acawtrustfunds

Show details

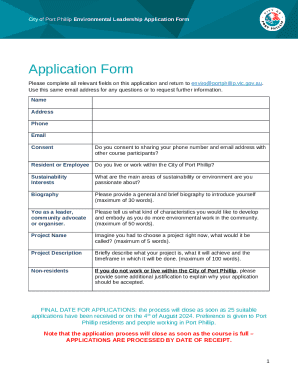

CONSENT FORM I, give the MACAW Trust Funds permission to (Please Print Name of Member) release my Health & Wellness reimbursement check to: (Please Print Name of Person picking up check*) *The person

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acaw trust funds

Edit your acaw trust funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acaw trust funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit acaw trust funds online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit acaw trust funds. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acaw trust funds

How to fill out ACaw trust funds:

01

Gather all necessary documents: Before filling out ACaw trust funds, make sure to gather all the necessary documents such as identification proofs, financial statements, and any relevant legal documents. These documents will be required during the process.

02

Understand the purpose and terms of the trust fund: It is important to have a clear understanding of why you are establishing the trust fund and its terms. ACaw trust funds can serve various purposes, such as asset protection, tax planning, or charitable giving. Familiarize yourself with the specific purpose and terms of your ACaw trust fund.

03

Consult with professionals: ACaw trust funds can be complex, so it is advisable to seek guidance from professionals such as estate planning attorneys or financial advisors. They can help you understand the legalities involved, provide necessary expertise, and ensure that everything is correctly structured according to your objectives.

04

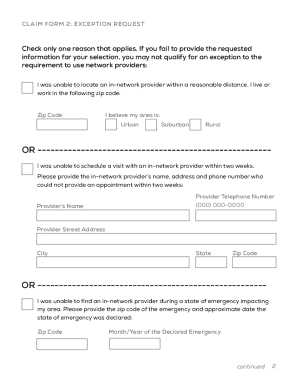

Complete the necessary paperwork: Based on your understanding of the purpose and terms of the trust fund, you will need to fill out the appropriate paperwork. This may include trust agreements, beneficiary designations, and any other required forms. It is important to be accurate and thorough while filling out these documents.

05

Fund the trust: Once the paperwork is complete, you will need to fund the trust. This involves transferring assets, such as cash, investments, or real estate, into the trust. It is essential to follow the proper procedures and document the transfer of assets to ensure the trust is properly funded.

06

Review and revisit the trust periodically: ACaw trust funds are not a one-time process; they require periodic reviews and updates. As life circumstances change, it is crucial to revisit the trust and make necessary adjustments. Keep track of any changes in your assets, beneficiaries, or objectives, and consult with professionals as needed.

Who needs ACaw trust funds?

01

Individuals with significant assets: ACaw trust funds are commonly utilized by individuals with substantial wealth. Trust funds can offer asset protection, tax planning benefits, and control over the distribution of assets for high net worth individuals.

02

Families with special needs members: Families with special needs members often establish ACaw trust funds to ensure their loved ones are cared for financially and receive the necessary support. Trust funds can provide a structure to manage assets without negatively impacting government benefits.

03

Business owners and entrepreneurs: ACaw trust funds can serve business owners and entrepreneurs by protecting their assets, enabling succession planning, and facilitating the transfer of wealth to future generations.

04

Charitable individuals: Those who are philanthropic and wish to support charitable causes often utilize ACaw trust funds. These trust funds can provide a way to make charitable contributions while potentially receiving tax benefits.

Remember, every individual's financial situation is unique, and it is essential to consult with professionals to determine if an ACaw trust fund is suitable for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify acaw trust funds without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including acaw trust funds, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the acaw trust funds in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your acaw trust funds in minutes.

How can I edit acaw trust funds on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing acaw trust funds.

What is acaw trust funds?

ACAW trust funds are tax-advantaged savings accounts designed to help individuals with disabilities save for qualified disability expenses.

Who is required to file acaw trust funds?

Individuals with disabilities or their legal representatives are required to file ACDAW trust funds.

How to fill out acaw trust funds?

To fill out ACDAW trust funds, individuals or their representatives must provide information about the account holder, contributions, and qualified disability expenses.

What is the purpose of acaw trust funds?

The purpose of ACAW trust funds is to provide tax-free savings for individuals with disabilities to use for qualified disability expenses.

What information must be reported on acaw trust funds?

Information such as account holder's details, contributions, withdrawals, and qualified disability expenses must be reported on ACAW trust funds.

Fill out your acaw trust funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acaw Trust Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.