Get the free Bank Lending outside CRA Assessment Areas

Show details

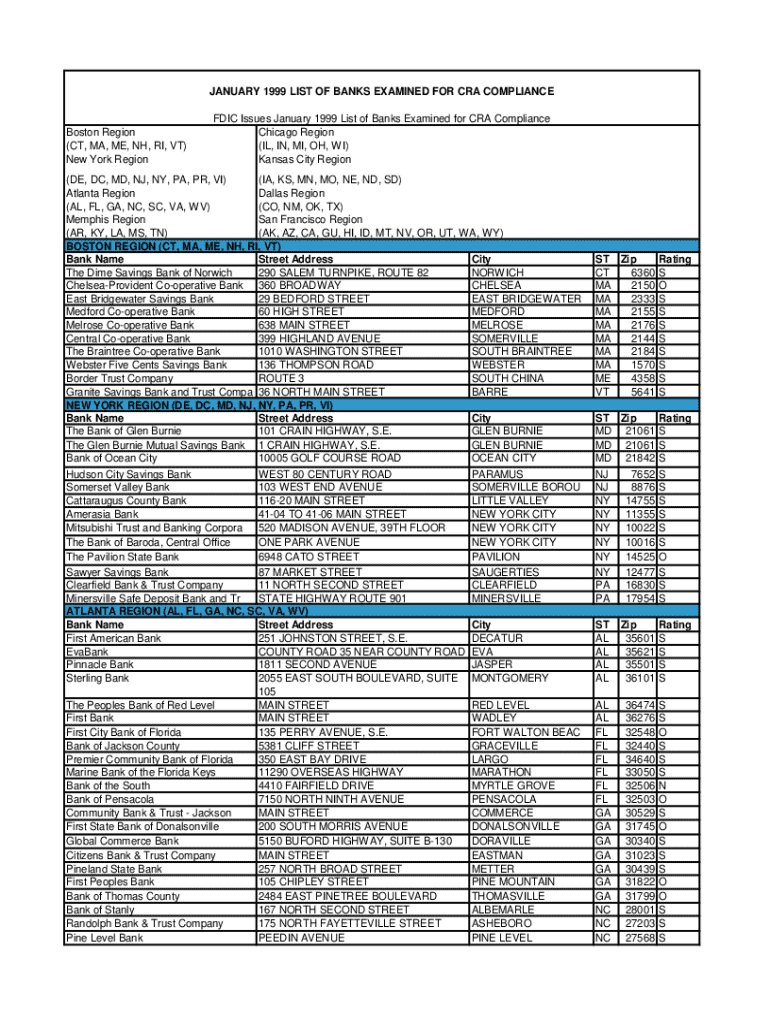

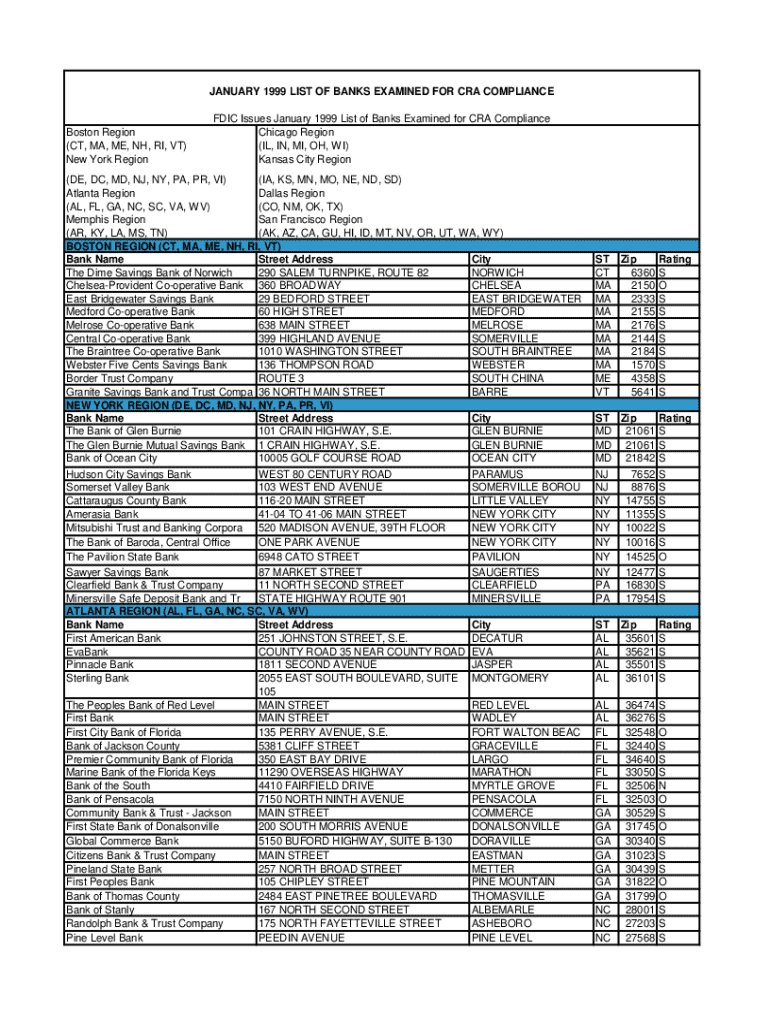

JANUARY 1999 LIST OF BANKS EXAMINED FOR CRA COMPLIANCE Boston Region (CT, MA, ME, NH, RI, VT) New York Region FDIC Issues January 1999 List of Banks Examined for CRA Compliance Chicago Region (IL,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank lending outside cra

Edit your bank lending outside cra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank lending outside cra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank lending outside cra online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank lending outside cra. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank lending outside cra

How to fill out bank lending outside cra

01

First, gather all necessary financial documents such as income statements, tax returns, and credit reports.

02

Research different banks and financial institutions that offer lending services outside of the Community Reinvestment Act (CRA).

03

Fill out the loan application form accurately and completely, providing all required information.

04

Submit the application along with the necessary documentation to the chosen bank or financial institution.

05

Wait for the review and approval process to be completed, and be prepared to negotiate terms and conditions of the loan if needed.

06

Once approved, carefully review the loan agreement and make sure you understand the terms before signing.

Who needs bank lending outside cra?

01

Individuals or businesses who do not qualify for a loan under the CRA guidelines

02

Individuals or businesses looking for alternative lending options with potentially different terms and conditions

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in bank lending outside cra?

The editing procedure is simple with pdfFiller. Open your bank lending outside cra in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the bank lending outside cra electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out bank lending outside cra using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign bank lending outside cra and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is bank lending outside cra?

Bank lending outside the Community Reinvestment Act (CRA) refers to loans made by banks that do not qualify under the provisions of the CRA, often because they are made outside of the assessment areas or are not subject to the CRA's requirements.

Who is required to file bank lending outside cra?

Generally, banks that originate loans outside of the CRA requirements are required to report this lending activity to regulatory authorities, including large banks and some smaller banks depending on their lending practices.

How to fill out bank lending outside cra?

To fill out the bank lending outside CRA report, institutions must compile data on loans made outside the CRA assessment areas, including the type of loan, amount, borrower details, and geographic location. This data must be formatted according to regulatory guidelines.

What is the purpose of bank lending outside cra?

The purpose of bank lending outside CRA is to provide transparency regarding lending practices and to ensure that banks are reporting all lending activities, particularly those that may not benefit low and moderate-income communities.

What information must be reported on bank lending outside cra?

Information that must be reported includes the loan amount, type of loan, borrower's income level, the geographic location of the loan, and any other relevant details that support the lending activity outside of CRA regulations.

Fill out your bank lending outside cra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Lending Outside Cra is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.