Get the free Rite Aid Corporation, 3:23-bk-18993, No. 18 (Bankr.D.N.J. Oct ... - oag ca

Get, Create, Make and Sign rite aid corporation 323-bk-18993

Editing rite aid corporation 323-bk-18993 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rite aid corporation 323-bk-18993

How to fill out rite aid corporation 323-bk-18993

Who needs rite aid corporation 323-bk-18993?

Understanding the Rite Aid Corporation 323-BK-18993 Form: A Comprehensive Guide

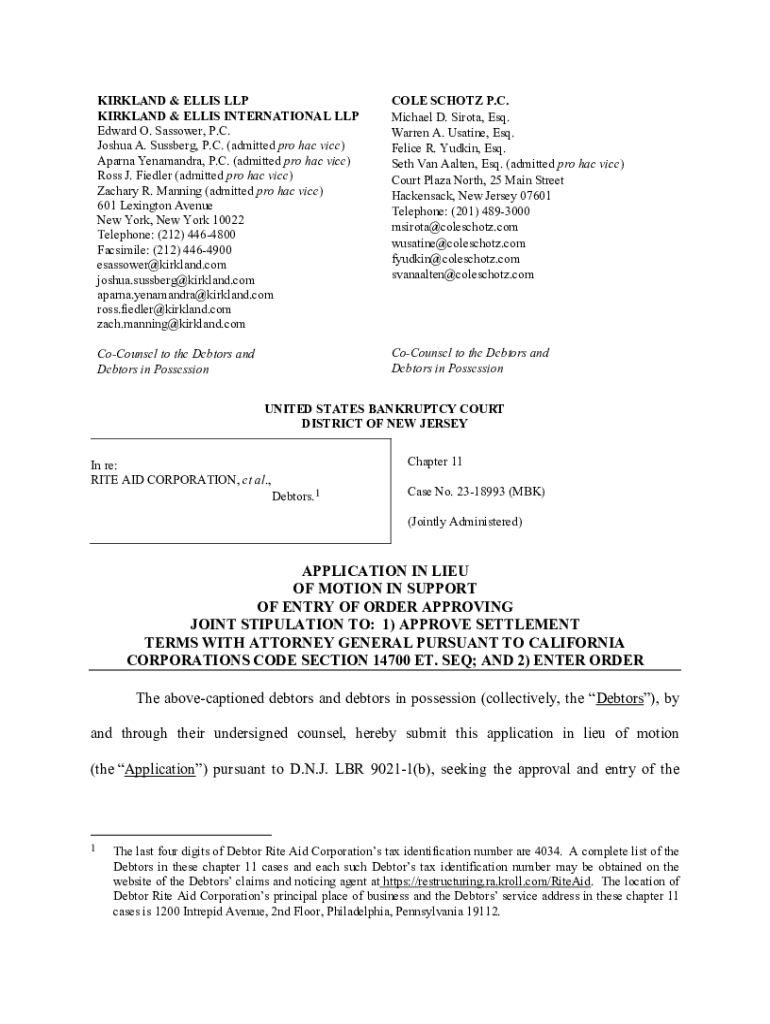

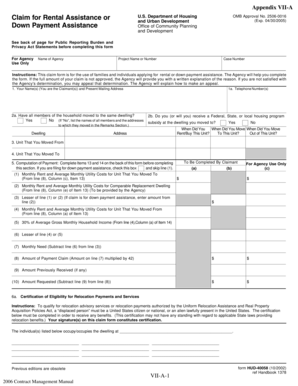

Overview of the Rite Aid Corporation 323-BK-18993 Form

The Rite Aid Corporation 323-BK-18993 Form is a critical document utilized within various operational contexts at Rite Aid. This form serves to document specific transactions or alterations within the corporation, ensuring all processes comply with regulatory standards and internal practices.

Understanding and utilizing the 323-BK-18993 Form effectively is essential for maintaining operational integrity and transparency. Its proper completion reflects adherence to company protocols, making it vital for employees.

Who needs the 323-BK-18993 Form?

The target audience for the Rite Aid Corporation 323-BK-18993 Form primarily includes employees involved in operational and administrative functions. Various departments, such as finance, legal, and operations, frequently use this form to document significant changes and transactions.

Specific roles that often handle this form include finance associates, compliance officers, and operations managers. Situationally, the form can be required during audits, financial reporting, and whenever a formal record of changes is requested.

How to access the 323-BK-18993 Form

Accessing the Rite Aid Corporation 323-BK-18993 Form is simple. The most straightforward option is through Rite Aid’s official website, where forms are regularly updated and organized for employee ease. Additionally, users can navigate to pdfFiller for an enhanced document handling experience.

To download the form, proceed as follows: visit the relevant section on the Rite Aid website or utilize the pdfFiller platform. This dual-access strategy ensures you can always find the most up-to-date version of the form.

Fill out the 323-BK-18993 Form: A step-by-step guide

Before starting to fill out the 323-BK-18993 Form, ensure all required information and supporting documents are available. Commonly needed details include transaction particulars or dates related to changes being recorded. Familiarizing yourself with the form's sections is crucial for clarity.

When completing the form, follow these steps: begin with your personal and department information, followed by specific transaction details, then review all entries for accuracy to prevent errors that could lead to processing delays.

Editing the 323-BK-18993 Form

Editing the Rite Aid 323-BK-18993 Form can be efficiently done using pdfFiller. This platform provides a user-friendly interface with various features that facilitate form modifications without hassle. To edit the form, upload your completed version to pdfFiller and access editing tools.

For collaborative editing, teams can invite members to co-edit the form. This feature enhances accuracy, allowing for real-time changes and comments, which can streamline the review process considerably.

Signing the 323-BK-18993 Form

Ensuring the 323-BK-18993 Form is signed correctly is crucial for its validity. Understanding e-signature requirements is essential. Electronic signatures are legally binding, providing they comply with the appropriate regulations. This feature enables convenient signing without physical presence.

To eSign the 323-BK-18993 Form with pdfFiller, follow these steps: upload your completed form, select the eSignature option, and draw or upload your signature as needed. This process is straightforward and highly secure.

Submitting the 323-BK-18993 Form

Submitting the completed 323-BK-18993 Form requires adherence to specific guidelines. After ensuring all information is accurately filled and signed, submit the form according to Rite Aid's protocol. This may entail forwarding it electronically or via traditional mail, depending on the context.

If submitting electronically via pdfFiller, simply follow the prompts for digital submission. Be mindful of any deadlines associated with submissions to ensure timely processing.

FAQs about the 323-BK-18993 Form

Many employees may have questions about the Rite Aid Corporation 323-BK-18993 Form. Common inquiries include how to rectify mistakes, file time-sensitive submissions, or understand the form’s nuances. Addressing these queries quickly can enhance workflow efficiency.

For those new to this form, it’s advisable to review example forms or consult with colleagues who have experience in completing it. Additional resources can provide clarity on specific sections or terminology.

Conclusion

Mastering the Rite Aid Corporation 323-BK-18993 Form is a vital part of maintaining seamless operations within the organization. By leveraging tools like pdfFiller, users can enhance their document handling experience, making the filling, editing, and submission process not only easier but efficient.

The importance of this form within the Rite Aid operational landscape cannot be overstated. By complying with document management best practices, you can contribute to a legacy of effective governance and accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the rite aid corporation 323-bk-18993 in Chrome?

Can I create an eSignature for the rite aid corporation 323-bk-18993 in Gmail?

How do I complete rite aid corporation 323-bk-18993 on an Android device?

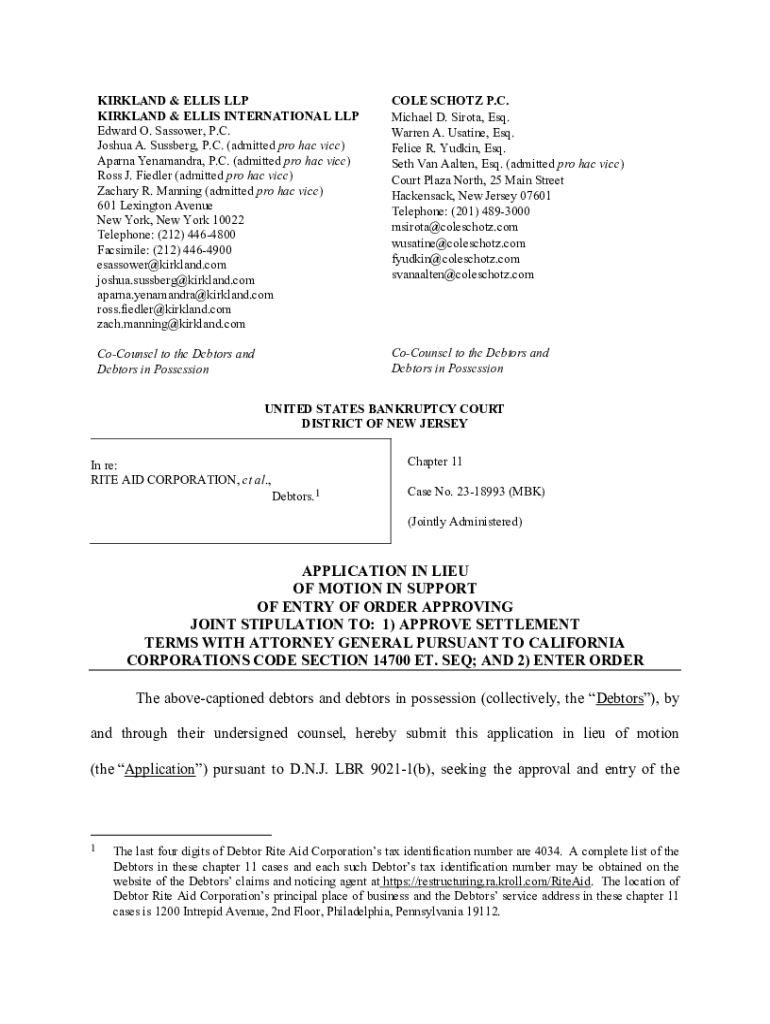

What is rite aid corporation 323-bk-18993?

Who is required to file rite aid corporation 323-bk-18993?

How to fill out rite aid corporation 323-bk-18993?

What is the purpose of rite aid corporation 323-bk-18993?

What information must be reported on rite aid corporation 323-bk-18993?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.