Get the free 1031 UpdateAdvanced Exchange Strategies for Attorneys

Show details

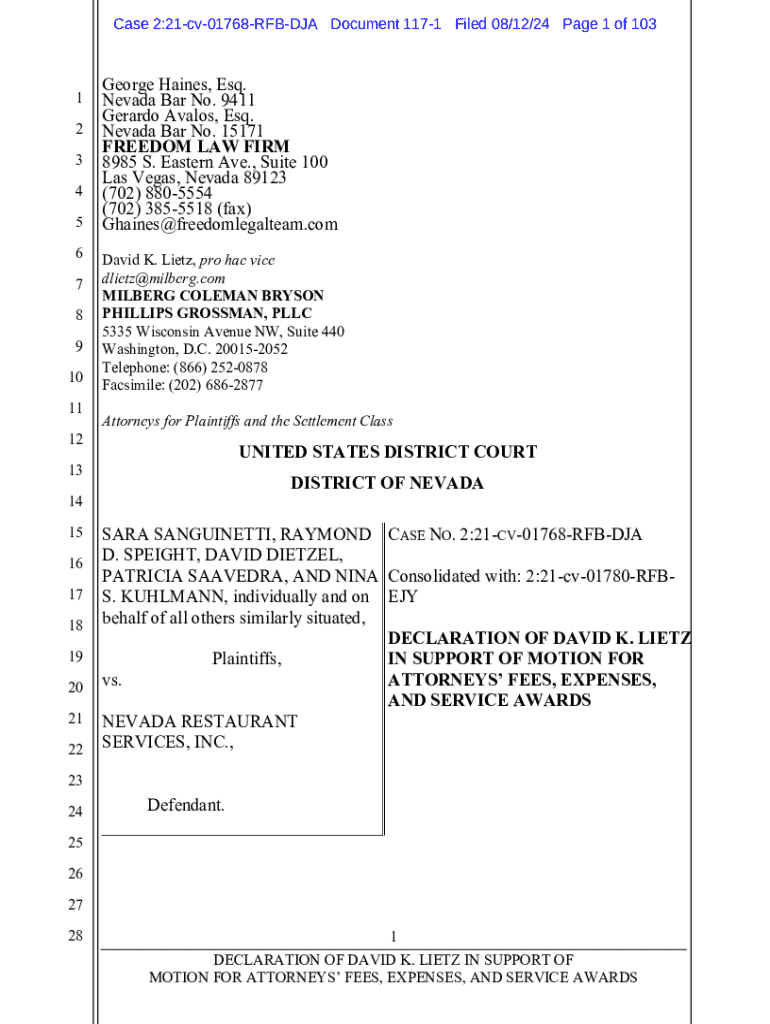

Case 2:21cv01768RFBDJA Document 1171 Filed 08/12/24 Page 1 of 1031 2 3 4 5 6 7 8 9 10 11 12George Haines, Esq. Nevada Bar No. 9411 Gerardo Avalos, Esq. Nevada Bar No. 15171 FREEDOM LAW FIRM 8985 S.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1031 updateadvanced exchange strategies

Edit your 1031 updateadvanced exchange strategies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1031 updateadvanced exchange strategies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1031 updateadvanced exchange strategies online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1031 updateadvanced exchange strategies. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1031 updateadvanced exchange strategies

How to fill out 1031 updateadvanced exchange strategies

01

Identify a qualified intermediary to facilitate the 1031 exchange process.

02

Locate a replacement property within 45 days of selling your current property.

03

Make sure the replacement property is of equal or greater value and adheres to 1031 exchange guidelines.

04

Close on the replacement property within 180 days of selling your current property.

05

Consult with a tax professional to ensure compliance with IRS regulations and maximize tax benefits.

Who needs 1031 updateadvanced exchange strategies?

01

Real estate investors looking to defer capital gains taxes.

02

Business owners looking to reinvest profits from a sale into a new property.

03

Anyone seeking to preserve and grow their wealth through strategic real estate investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1031 updateadvanced exchange strategies in Gmail?

1031 updateadvanced exchange strategies and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send 1031 updateadvanced exchange strategies for eSignature?

To distribute your 1031 updateadvanced exchange strategies, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit 1031 updateadvanced exchange strategies on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 1031 updateadvanced exchange strategies right away.

What is 1031 updateadvanced exchange strategies?

The 1031 updateadvanced exchange strategies refer to methods used in real estate investment, allowing investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property.

Who is required to file 1031 updateadvanced exchange strategies?

Individuals or entities that engage in a 1031 exchange, which involves selling and purchasing properties to defer taxes, are required to complete specific tax forms to report the transaction.

How to fill out 1031 updateadvanced exchange strategies?

To fill out 1031 updateadvanced exchange strategies, you must provide details about the properties involved, timelines of the exchange, and the qualified intermediary used, typically on IRS Form 8824.

What is the purpose of 1031 updateadvanced exchange strategies?

The purpose of 1031 updateadvanced exchange strategies is to allow investors to defer paying capital gains taxes on the sale of a property, thereby enabling them to reinvest more of their profits into new real estate ventures.

What information must be reported on 1031 updateadvanced exchange strategies?

Information that must be reported includes the identification of the relinquished and replacement properties, the dates of the transactions, and the role of any qualified intermediaries involved.

Fill out your 1031 updateadvanced exchange strategies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1031 Updateadvanced Exchange Strategies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.