Get the free Capital reserve Account

Get, Create, Make and Sign capital reserve account

How to edit capital reserve account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out capital reserve account

How to fill out capital reserve account

Who needs capital reserve account?

Comprehensive Guide to Capital Reserve Account Form

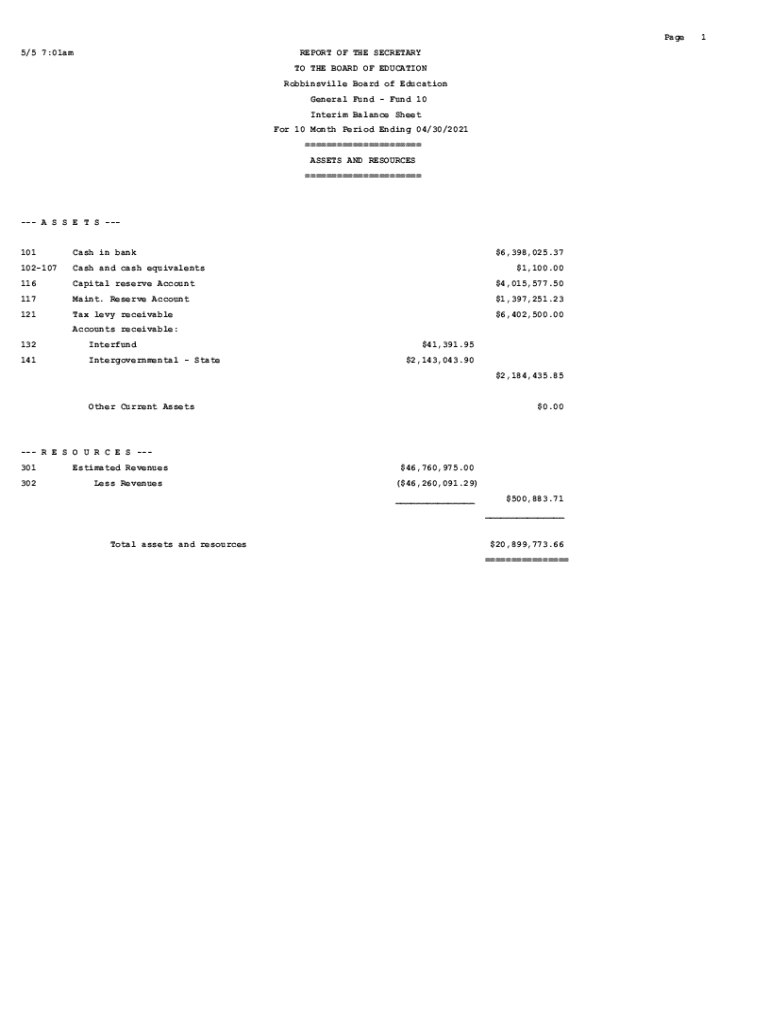

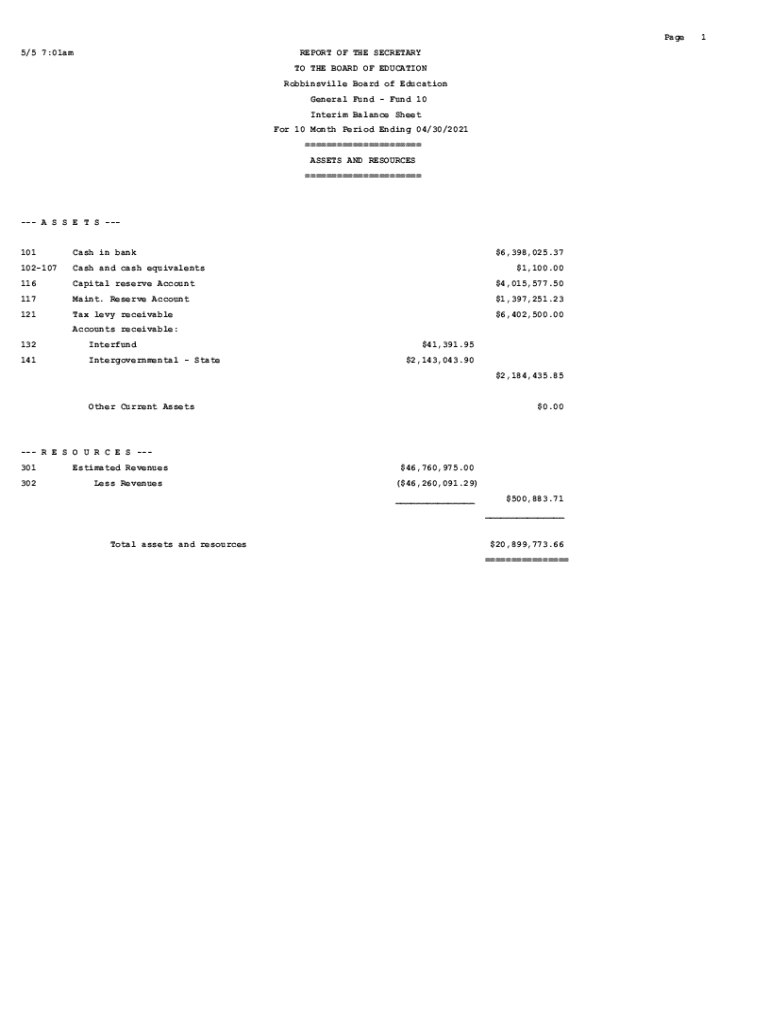

Understanding capital reserve accounts

A capital reserve account is a fund set aside specifically for future capital expenditures or major repairs. This type of account serves as a financial safety net, ensuring that individuals or organizations have the necessary resources to address significant expenses without compromising their regular cash flow. Establishing a capital reserve account is an essential strategy in financial planning as it helps manage unexpected financial challenges effectively.

Having a capital reserve account is crucial for both individuals and organizations as it enhances financial security. By earmarking funds for unexpected costs, it alleviates the pressure on day-to-day budgets and allows for more strategic planning. For instance, owners of rental properties often contribute to a capital reserve to cover potential replacements like roofs or HVAC systems, ensuring that property stays well-maintained and in demand.

Key components of a capital reserve account form

To successfully create a capital reserve account, understanding the capital reserve account form is critical. The form acts as the first touchpoint in defining the parameters of how the fund will operate. Each element of the form gathers important information about the account and its intended use. Essential information typically includes the account holder's name, contact details, and their current financial status.

The form comprises several sections that clarify the fund's purpose and operational strategies. One significant area is the account type selection, which may vary depending on individual or organizational needs. Furthermore, stipulating the specific purpose of the capital reserves, such as preparation for renovations or equipment upgrades, can provide clarity for future planning.

Additionally, it is valuable to include supporting documentation, such as maintenance plans or budget forecasts, which can demonstrate the rationale behind the reserve and help in securing stakeholder approval if necessary.

Filling out the capital reserve account form

Filling out the capital reserve account form may seem daunting at first, but following a structured approach can simplify the process. Start by gathering all financial data, including income statements, balance sheets, and any ongoing financial obligations. Accurate data ensures that all future projections you make will be sound. Next, complete personal or organizational information sections meticulously, cross-referencing as needed to ensure accuracy.

In detailing the account purposes and projected uses, it's important to be as specific as possible. Identify which upcoming projects or surprise expenses the reserve will support and provide realistic timelines for anticipated expenditures. This lucidity helps establish a clear financial roadmap and aids in monitoring the account moving forward.

Common mistakes to avoid include providing incomplete information or overlooking critical details. A thorough review before submission is essential to catching these errors, which can lead to future complications with fund management.

Managing your capital reserve account

Once the capital reserve account is established, ongoing management becomes fundamental to its success. Keeping track of contributions regularly ensures that the fund remains adequately financed as financial circumstances change over time. Moreover, it is essential to monitor fund utilization and keep records of any withdrawals, ensuring that each expense aligns with the initial goals set forth in the capital reserve account form.

Best practices also involve revisiting the reserve account periodically to adjust contributions based on current budgetary outcomes and future projections. Utilizing tools like pdfFiller can significantly streamline the document management process, aiding in not just the creation but also the ongoing adjustments of the capital reserve account documentation.

Collaboration and sharing the form

Sharing the capital reserve account form with relevant stakeholders is vital for transparency and collaborative financial planning. You can make this easier through e-signing options available on platforms like pdfFiller, which allows teams to access the document, provide their input, and finalize agreements quickly. By sending the completed input securely via email or shared drives, you maintain control of the document flow.

However, it’s crucial to ensure that any shared documents containing sensitive financial data are handled securely. Make use of encrypted sharing options and remind all parties involved of the importance of confidentiality when it comes to financial documents. This direct approach helps in maintaining trust and adherence to privacy standards.

Frequently asked questions (FAQs)

When considering a capital reserve account, you'll likely have questions. A common inquiry is regarding the typical timeline required to establish a capital reserve account. The process may vary but generally involves a few weeks to gather documentation and finalize the form with the relevant financial institution. It’s crucial to be patient during this period to ensure all necessary steps are followed with precision.

Another common query relates to the flexibility of the goals outlined in the account. Yes, individuals and organizations can adjust these goals over time, especially as financial situations evolve. Continuous evaluation is encouraged to ensure the account serves its intended purpose. The management of these accounts is often overseen by a financial officer or the property manager, maintaining a balance between responsible management and alignment with the overall financial strategy.

Additional considerations

Successfully integrating your capital reserve account into your broader financial strategy is essential. Make certain that your reserves complement existing savings strategies, ensuring that all parts of your financial ecosystem work in harmony. You may find that as you plan for future expenses, reevaluating other financial commitments becomes necessary to shore up savings where needed.

Several external factors may influence your capital reserve needs. Economic fluctuations can impact asset prices, maintenance costs, and even rental income. Therefore, staying attuned to market trends and adjusting your capital reserve contributions accordingly can keep your financial plans robust and adaptable, ensuring you remain proactive rather than reactive to changes.

Interactive tools available on pdfFiller

pdfFiller offers a wide array of interactive tools designed to make the management and tracking of your capital reserve account simpler and more efficient. Using template options allows users to customize the capital reserve account form to fit unique needs. By defining specific fields and categories, you empower all stakeholders to monitor contributions meaningfully.

Features aimed at collaborative planning are also offered within pdfFiller. Team members have access to input budgets and comment on potential funding needs. Tools that facilitate shared feedback streamlines the process of adjusting future contributions and budget allocations, making fund management much more dynamic and inclusive.

Quick links

To help you navigate the capital reserve account management process swiftly, pdfFiller provides easy access to a suite of tools. Users can find direct links to create and manage capital reserve account forms within the platform for further assistance with document creation. Video tutorials are also available to provide visual demonstrations of filling out and managing your account forms seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit capital reserve account online?

How do I complete capital reserve account on an iOS device?

How do I edit capital reserve account on an Android device?

What is capital reserve account?

Who is required to file capital reserve account?

How to fill out capital reserve account?

What is the purpose of capital reserve account?

What information must be reported on capital reserve account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.